EDIT, 9/25/2016: Rates were approved recently by the Colorado Division of Insurance. The following average rate changes (actual changes will vary by plan) will take effect January 1, 2017 for the seven carriers that will offer individual market coverage through the exchange. They will also apply off-exchange, as all of these carriers offer their plans both… Read more about 2017 Rate Increases for Colorado Individual Health Insurance Market

Rocky Mountain

Proposed rate increases in Colorado: CO-OP up 21%, Kaiser up 2%

The back-story Last September, when we wrote about the fact that the average individual rates increase in Colorado was less than one percent for 2015, we noted that the overall rate increase was astoundingly low – far lower than anything we’d seen during our time in this industry. And although it will be several more weeks… Read more about Proposed rate increases in Colorado: CO-OP up 21%, Kaiser up 2%

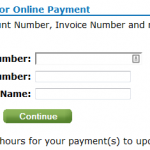

Carrier Contact Information And Updates For People Who Need To Pay January’s Premium

Today, January 10th, is the payment deadline for most Connect for Health Colorado policies with January 1 effective dates. A few carriers have pushed the deadline out a little bit: Updated Anthem Blue Cross and Blue Shield is moving the payment deadline to 1/31 for 1/1 effective dates. Delta Dental: January 15. Premier Access Dental… Read more about Carrier Contact Information And Updates For People Who Need To Pay January’s Premium

Pediatric Dental on 2014 Individual Health Insurance Policies in Colorado

If you’re confused by the new pediatric dental requirements, you’re not alone. Here’s a rundown of how the ACA and HHS regulations impact pediatric dental coverage, with Colorado-specific details: The ACA defines pediatric dental coverage as one of the ten essential health benefits (EHBs) that must be covered on all new individual and small group… Read more about Pediatric Dental on 2014 Individual Health Insurance Policies in Colorado

How Does Obama’s Policy Continuation Announcement Impact Colorado’s Individual Market?

By now you’ve probably heard about the Obama Administration’s compromise over the policy cancellation uproar. The fix that Obama has offered is that health insurance companies can extend existing plans for one more year, allowing them to continue to exist in 2014. This has been incorrectly reported in some media outlets as allowing carriers to continue… Read more about How Does Obama’s Policy Continuation Announcement Impact Colorado’s Individual Market?

Fewer Plans Available In Exchanges In 2013, But Maybe That’s A Good Thing

At the end of September, just as the exchanges were about to open for business, HealthPocket created a comparison of the number of individual and family health insurance policies available in each state in 2013 and compared that with the number of policies that would be available in each state’s exchange in 2014. It’s an… Read more about Fewer Plans Available In Exchanges In 2013, But Maybe That’s A Good Thing

Renewal Options for Each Individual Health Insurance Carrier in Colorado

Last week I explained how early renewal at the end of 2013 might be a good option for some people who have individual health insurance. If you’re happy with your coverage and aren’t going to qualify for a subsidy in the Colorado exchange, keeping your existing plan for most of 2014 might be a good way to save some money on premiums. This is especially true for people who prefer very high deductibles, as those plans are generally not ACA compliant and thus will not be available for purchase after the end of 2013. But if your carrier allows it, you can keep your current policy until it renews in 2014, and switch to an ACA compliant plan at that time. For people with plans that renew late in the year, this could mean keeping a lower-cost, higher deductible policy for most of 2014. If you’ll be eligible for a premium subsidy, it’s definitely worth your time to compare a subsidized exchange plan with what you have now. But if you’re happy with your coverage and you’re going to be paying full price for an ACA compliant plan, check with your carrier to see about keeping your current plan in 2014.

Keep in mind that each Colorado health insurance carrier is doing things a little differently in terms of 2013 renewals heading into 2014. It’s important to check with your carrier to make sure you’re aware of what steps you need to take – don’t assume that  your plan will automatically renew – or automatically not renew. The Colorado Division of Insurance has left a lot of leeway for carriers to determine their own protocol for renewals going into 2014. There is no state requirement that existing policies be cancelled as of the end of 2013, although some carriers have opted for that as a default. All plans must be ACA-compliant by January 1, 2015. So when your policy renews in 2014, you will have to transition to an ACA compliant plan. But the date of that renewal can be anytime from January to December.

your plan will automatically renew – or automatically not renew. The Colorado Division of Insurance has left a lot of leeway for carriers to determine their own protocol for renewals going into 2014. There is no state requirement that existing policies be cancelled as of the end of 2013, although some carriers have opted for that as a default. All plans must be ACA-compliant by January 1, 2015. So when your policy renews in 2014, you will have to transition to an ACA compliant plan. But the date of that renewal can be anytime from January to December.

Here’s a brief summary of what we have heard so far from some of the main carriers in Colorado. This is subject to change, so check with us or your carrier before you make a decision.

Anthem Blue Cross Blue Shield: The default is for your plan to just keep its current renewal date and continue unchanged until that date in 2014. But Anthem is also offering insureds an option […]

Early Renewal Provides A Good Alternative For 2014

Over the last few years, opponents of health care reform have often exaggerated – and sometime outright lied about – the potential negative aspects of the reform law. This has resulted in a public that is often woefully misinformed about what the law does and does not do. But the spin is not limited to just opponents of the law. Sometimes ACA supporters spin things too. This Huffington Post article from a few months ago is a good example. The title, “Aetna seeks to avoid Obamacare rules next year” is designed to play on the general unpopularity (and over-estimation of perceived profits) of insurance companies. When you read a little further, you find that Aetna is reaching out to brokers and insureds to let them know that Aetna will be allowing members to opt for an early renewal in December of this year – if they want to keep their current policy until December 2014.

Why is this being portrayed as a bad thing?

It is indisputable that people who are healthy, buy their own health insurance, won’t qualify for subsidies and prefer high deductible health plans are going to have higher premiums for ACA-compliant plans than they have now. Some of these people don’t mind high deductibles. They don’t consider their policy to be skimpy or junk insurance just because it isn’t ACA compliant. You might have seen headlines about how only a tiny fraction of existing individual health plans meet the requirements that the ACA will impose next year, but that doesn’t mean that the existing  plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

There are absolutely some bad health insurance plans on the market, with skimpy coverage, limited networks and lots of fine print. But there are also lots of good quality health insurance plans and reputable carriers. And there are plenty of people who are not going to qualify for subsidies next year (roughly half of the people who currently buy individual health insurance). If those people currently have – and are happy with – a high deductible plan that is less expensive than what they would have to pay for an ACA-compliant plan, there’s no reason that they shouldn’t be able to keep their plan as long as possible in 2014. The law requires coverage to be ACA-compliant when a policy renews in 2014. Carriers that are offering early renewals in December are providing good customer service, especially for insureds who […]

Colorado Health Insurance Options On the Exchange in 2014

Although we’re still at least a week away from knowing the specific details on rates and plan designs for policies that will be sold in the Connect for Health Colorado exchange, the Division of Insurance has approved 242 plans that will be available in the exchange from 13 Colorado health insurance carriers. In late May, the number of carriers stood at 11 and the number of plans was 250+. But as we noted last week, there was still a lot going on behind the scenes over the summer, and some carriers had to resubmit plan information that was not accepted in the spring. The final count is 150 plans that will be available to individuals and 92 for small groups (keep in mind that this is just for plans within the exchange. There will be lots of other ACA-compliant plans available outside the exchange).

The plans for individuals will be available from ten different carriers (All Savers, Cigna, Colorado Choice, Colorado Health Insurance Cooperative,  Denver Health Medical Plan, HMO Colorado (Anthem), Humana, Kaiser, New Health Ventures and Rocky Mountain HMO). Although there are some new names in this list, there are also plenty of familiar ones (All Savers is a UnitedHealth company, which means that the main carriers that currently sell policies in the individual market in Colorado will all be represented in the exchange). Although we haven’t yet seen the final premium and plan details, it appears that Colorado will continue to have a robust individual health insurance market in 2014, both in and out of the exchange.

Denver Health Medical Plan, HMO Colorado (Anthem), Humana, Kaiser, New Health Ventures and Rocky Mountain HMO). Although there are some new names in this list, there are also plenty of familiar ones (All Savers is a UnitedHealth company, which means that the main carriers that currently sell policies in the individual market in Colorado will all be represented in the exchange). Although we haven’t yet seen the final premium and plan details, it appears that Colorado will continue to have a robust individual health insurance market in 2014, both in and out of the exchange.

For consumers who will qualify for a subsidy, the exchange is definitely the place to be – subsidies are only available in the exchange. Consumers who do not qualify for a subsidy (either because their income is too high or because they have access to an employer group plan that is technically “affordable” but might actually be outside of their budget) can shop within the exchange (via an approved broker or directly through the exchange) or they can […]

Clearing Up Confusion Around The Health Insurance Provider Fee

One of the funding mechanisms for the health insurance exchanges is the implementation of the health insurer fee that will go into effect in 2014. I’ve seen this referred to as a health insurance provider fee (a bit confusing as it might lead people to believe that the fee is imposed on medical providers rather than insurers), a health insurance industry fee, and an ACA health insurance carrier fee, among others. But whatever you want to  call it, the fee is an amount that will be collected from health insurance carriers starting next year, and the funds will be used to help pay for the state and federal health insurance exchanges.

call it, the fee is an amount that will be collected from health insurance carriers starting next year, and the funds will be used to help pay for the state and federal health insurance exchanges.

The fee will generate $8 billion in 2014, and will increase each year up to $14.3 billion in 2018. After that, it will increase annually in line with health insurance premiums. Insurance carriers will be responsible for remitting their share of the fee, which is calculated based on the insurer’s total collected premiums from the prior year.

As is generally the case with any new fees or mandates that increase costs for insurance companies, this fee will be passed on to companies and individuals who purchase policies. However, it won’t necessarily be easy to determine how much the fee is impacting your health insurance premiums, since many carriers are expected to just roll the fee into their total premiums.

In Colorado, Rocky Mountain Health Plans has stated that they will be adding the health insurance provider fee as a separate line item on their bills in an effort to be as transparent as possible. They will begin collecting the fee next month (July 2013) in order to spread the fee over a longer time horizon and thus lessen the impact on next year’s premiums. Carriers can choose to wait to begin collecting the fee, but the total amount collected will be the same regardless: Roughly 2% – 2.5% of total premiums in 2014, and 3% – 4% of total premiums in future years. In the individual market, RMHP will be  collecting $4.12 per member per month, for the rest of 2013. If you have a SOLO plan with RMHP and notice a line item on your bill labeled “Health Insurance Providers Fee”, now you’ll know what it is (be aware that the total collected is per member per month, so if you have a family of five on a RMHP policy, your bill will reflect a charge of $20.60/month starting in July). If you have coverage with another carrier, you’ll still be paying the fee (some carriers […]

collecting $4.12 per member per month, for the rest of 2013. If you have a SOLO plan with RMHP and notice a line item on your bill labeled “Health Insurance Providers Fee”, now you’ll know what it is (be aware that the total collected is per member per month, so if you have a family of five on a RMHP policy, your bill will reflect a charge of $20.60/month starting in July). If you have coverage with another carrier, you’ll still be paying the fee (some carriers […]

Are Marketplaces Duplicating Existing Health Insurance Comparison Sites?

[…] So although I agree with Senator Lundberg when it comes to what’s available in Colorado, I don’t think we can necessarily extend that generalization to all states. And the subsidies (only available in the health insurance marketplaces, aka exchanges) have to be taken into consideration too, since those are the overwhelming “carrot” that officials are hoping to use to entice millions of currently uninsured middle-income Americans onto the health insurance rosters. In a state like Colorado, we probably could have done just fine by adding subsidies to our current system. We already had a solid high risk pool (not all states did) and we’ve already been making progress in terms of general reform and access to care. So the changes brought by the introduction of the ACA and the health insurance marketplace in Colorado might not be as significant as they will be in other states. That perspective – as well as the idea that we’re all in this together as a country rather than a bunch of isolated states – is helpful in terms of understanding “why all the fuss” about setting up marketplaces that might seem to duplicate a lot of existing services. In some places, yes. In others, definitely not.

Rocky Mountain Health Plans 2013 Rate Increase Announced

Rocky Mountain Health Plans announces the 2013 new business rate increase for the “SOLO” individual/family health insurance plans in Colorado is 18%. As with all carriers, for existing clients on open plans, rate changes may be different due to age attainment and trend. Carriers may adjust rates differently for closed plans effective January 1, 2013.

RMHP posted the disclosure of the increase for new and renewing business on healthcare.gov.

For clients who pay monthly:

- January renewals were mailed Friday, November 30, 2012.

- February renewals will be mailed the end of December.

- March renewals will be mailed the end of January.

No 2013 CoverColorado Assessment

CoverColorado announced that there will be no assessment in 2013 on Colorado health insurance carriers. The 2012 assessment was roughly $3.79/month/contract for individual/family insureds.

Anthem Blue Cross of Colorado has also announced that their membership this year was higher than expected this year. They were making up for a shortfall by charging $4.36/month/contract in 2012. Due to the higher enrollment, Anthem BCBS has enough funding to satisfy December without billing subscribers a CoverColorado assessment.

Primary Care Practices In Colorado Chosen As Part Of CMS Pilot Program

The Centers for Medicare & Medicaid Services (CMS) announced this week the start of a pilot program to enhance primary care via collaboration among CMS, private health insurance carriers and 500 primary care practices in seven regions across the US. 73 of those practices are in Colorado, with 335 participating physicians, and several of the top health insurance carriers in Colorado are participating too: Anthem Blue Cross Blue Shield, Cigna, Humana, Rocky Mountain Health Plans, and United Healthcare, in addition to Colorado Medicaid, Colorado Choice Health Plans, and Colorado Access (a health plan specifically designed for underserved populations).

CMS will be paying participating providers a “care management fee” which is estimated to be about $20 per month per beneficiary, in addition to the usual fee-for-service reimbursements. The private health insurance carriers that are participating have worked out their own reimbursement schedules, but one would assume that the setup will be similar to the one that CMS has devised. […]

Program Encourages Rural Students To Pursue Careers In Medicine

[…] I’ve written before about the PCP shortage, which exists even though many patients in well-served areas (and those with good private health insurance) may be unaware of it. Compounding the problem is the often lower median income in many rural communities. There are some exceptions of course, but in general the metropolitan areas of the state have higher average incomes than the rural areas. That means that it’s likely that a higher percentage of rural families – living in areas that are already underserved in terms of healthcare providers – qualify for state and federal health insurance programs that might further limit the options in terms of healthcare providers they can see.

All of this serves to highlight the importance of programs like CREATE Health Scholars. The program is relatively new and its first group of students is now moving on to post-graduate studies in medicine, pharmacy, dentistry and research. It will be interesting to look at the distribution of healthcare providers in rural areas of Colorado a decade from now. Hopefully the CREATE Health Scholars and other programs like it will have helped to close the gap between medically well-served and under-served areas of the state.

Best Health Insurance Companies In Colorado

We recently got a call from a client who mentioned that he had done a Google search for the “best health insurance companies in Colorado” and his concern was that Anthem Blue Cross Blue Shield was not on the top ten list that he said came up as the first search result. We were a… Read more about Best Health Insurance Companies In Colorado

Replicating Grand Junction’s Healthcare System

[…] This is a scenario that I could see being implemented even without a monopoly by one health insurance carrier. Grand Junction aside, if we look at the whole state of Colorado, the top 70% of the health insurance market is comprised of ten carriers. I wonder if it would be possible for medical offices to set up agreements whereby they pool money received from those ten carriers and from Medicare, Medicaid, and CHP+. Then instead of paying physicians directly from the health insurer depending on the insurance coverage of each specific patient, the doctors could simply be paid either a salary or an average reimbursement for each patient, regardless of which insurance that patient had. This would require some restructuring in terms of how medical billing is done, but it would allow medical offices to continue to negotiate competitive contracts with private health insurers (and the higher the contracted rate, the more total dollars the medical practice would have to put into their payment pool).

One of the major factors that contributes to the success of the system in Grand Junction is that doctors there are ok with receiving lower total incomes than they would in other areas that don’t function the way Grand Junction does. When you pool Medicare and Medicaid payments together with private health insurance payments, the public health insurance reimbursements drag down the average payment. In order to make sure that people with public health insurance are receiving equal access to healthcare (which they currently do not, especially those with Medicaid), the per-patient average reimbursement for physicians would have to decrease, since it would mean that more lower-paying patients would be treated. The caveat that doctors would have to be willing to work for a little less money is especially true of specialists, which is where the highest incomes are. […]

Emergency Room Overcrowding Expected To Worsen In The Coming Decade

[…] The results of these studies are a convincing argument in favor of the model that has been used in Grand Junction, Colorado since the 70’s. Instead of being reimbursed on an individual basis by each patient’s health insurance carrier, doctors in Grand Junction agreed long ago to simply pool the reimbursements from private health insurance, Medicare, and Medicaid. From that pool of money, the doctors are paid equally for every patient they see, regardless of whether that patient has private health insurance or Medicaid. Medicaid reimbursements are lower than those of private health insurance, so it’s understandable that many doctors prefer to see patients with private health insurance. But the system in Grand Junction focuses on what’s best for the community and does away with the financial incentive to see privately insured patients rather than those with Medicaid.

Perhaps implementation of a similar model in other cities could help to improve Medicaid patients’ access to primary care and cut down on ER overcrowding.

New T.R. Reid Documentary Highlights Greatness In Our Healthcare System

[…] Overutilization – driven by supply rather than demand – was another common theme in the program. Basically, that the more healthcare supply we have (eg, scanning machines), the more utilization we have. This accounts for a large part of the huge variation in healthcare costs from one city to another. And in all of the hospitals and medical practices featured on the program, curbing over-utilization has been a high priority. One hospital figured out that blood transfusions during surgery aren’t nearly as necessary as they once thought (and indeed, the patients often do better without them). Given that the total cost of blood transfusions is about $1000/pint (!), that’s quite a cost-saving discovery. In another large clinic, pharmaceutical reps were no longer allowed to visit and they also removed the samples of brand name drugs that once filled their drawers. This was a controversial move, but they analyzed a lot of data provided by their local Blue Cross insurance carrier and found that they could optimize pharmaceutical care for a lot less money – patients had better outcomes and the clinic reduced overall Rx spending by $88/million a year compared with the state average.

The Program also showed and example of how patient-centered medical homes work in the real world. PCMHs are a huge buzz word these days, but the PBS documentary shows one in action, and they did a great job of making it easy for patients to visualize how such a program would work and how it would benefit us – including things like much more face time with doctors, and a reduction in the number of hospitalizations and ER visits. In addition to PCMHs, shared decision making between doctors and patients (another buzz word in healthcare reform) was highlighted as having a positive impact on both utilization and patient satisfaction. […]

Claims Expenses In New Colorado High Risk Pool Are Double The National Average

[…] I realize that premiums cover a very small portion of the claims expenses incurred by the high risk pools, so perhaps it’s a better move from a financial standpoint to limit enrollment in the high risk pool. But expanding eligibility and increasing enrollment numbers have been discussed numerous times since the pools started operating in 2010. I haven’t seen any specific details explaining why Colorado’s per-member claims expenses are so much higher than they are in other states with similar programs. It could be that it’s random, but if that’s the case we should expect to see Colorado’s numbers even out with other states as time goes by. If we don’t, we can assume that there’s something specific to Colorado that is causing the difference – either healthcare is far more expensive here, or our federally funded high risk pool is enrolling applicants who are – on average – far sicker than applicants in other states. Once the program has had another year of claims data, it will be interesting to revisit the numbers and see whether Colorado is still spending significantly more than other states, or whether the numbers have started to equalize.

Division of Insurance Website Receives Praise From HHS

A few months ago, I wrote about the new website that the Colorado Division of Insurance has created to improve transparency in the health insurance market. I particularly liked the features of the site that allow consumers to see how the rate filing process works and track a health insurance carrier’s rate increase history. Colorado used money from a $1 million grant from HHS last year (a provision of the PPACA) to create the website, and it’s obvious that the Division of Insurance is taking the goal of transparency seriously.

I’m a bit late to this party, but I just read a news release from the Division of Insurance from back in September noting that the HHS Regional Director, Marguerite Salazar, commended the Colorado Division of Insurance for the website, calling it a “shining example of consumer-friendly and transparent information…” […]

Colorado Child-Only Open Enrollment Details For January 2012

The next open enrollment for child-only policies is almost here, so I thought it might be helpful to provide some specific details in terms of what policies are available and what parents should expect when submitting child-only applications next month.

The first open enrollment window in 2012 will be the month of January. Applications for child-only policies have to be submitted between January 1 and January 31. Application not submitted by the end of January will have to wait and re-submit in July, which is the second open-enrollment period of the year. For most carriers, each child in a family will have to have a separate application.

All eligible child-only applications submitted during the open enrollment period are guaranteed issue, so the child cannot be refused coverage. However, the applications are still medically underwritten and the rate can be increased by up to 200% based on the child’s medical history (so if the standard price is $100, the policy could actually be assigned a rate of $300, which is equal to a 200% rate increase).

Colorado Senate Bill 128 requires all Colorado health insurance carriers that offer coverage for adults to also offer child-only plans during the two annual open enrollment windows. But the bill does not require carriers to provide guaranteed issue coverage for children who are eligible for health insurance from another source (other than a high risk pool like CoverColorado or GettingUSCovered – see the bottom of page 4).

Most Colorado carriers have selected one or two plan designs that will be available for child-only applications next month. To give you an idea of what is available in Colorado for child-only coverage, we’re providing information here regarding child-only options from six of the top individual health insurance carriers in the state. […]

CoverColorado Assessment For 2012

[…] As the cost of healthcare continues to rise, CoverColorado – just like every other insurer – needs more and more money to cover the cost of claims. Their website shows the fees that have been assessed over the past few years, and the increased fee that will go into effect next month for 2012.

Because the CoverColorado assessment is collected by health insurance carriers and passed on to CoverColorado, the fee is added to each policy’s premium every month. The end result is that we all pay a few dollars more per month than the actual cost of our policy. This can be confusing, especially if people are new to individual health insurance and haven’t had experience with paying their own health insurance premiums in the past. The amount that is going to be drafted from your bank account or billed to you will be a few dollars higher than your stated premiums because it includes the CoverColorado assessment. […]

Consumer-Driven Healthcare Debate

[…]prior to reading Ungar’s article I wasn’t aware of the agreement between the Independent Physicians Association and Rocky Mountain Health Plans with regard to Medicare and Medicaid reimbursement. The doctors in the IPA were so determined to treat every patient equally that they worked out an arrangement with RMHP to have the insurance carrier accept payment directly from Medicare and Medicaid and then pool that money together with premiums collected from RMHP insureds.

[…] Hixon argues that patients with more financial responsibility for their own care do indeed make better decisions regarding efficient use of healthcare dollars. Furthermore, he cites a study that found that patients with high deductible health insurance policies (eg, HSA qualified plans) had more preventive care, lower rates of hospitalization, and were more compliant in terms of following their doctors’ recommendations. They were also more likely to question their medical bills and had overall lower medical costs than people with traditional low-deductible policies.

[…] In addition to probably being above average in terms of financial savvy, I would assume that the demographic that opts for high deductible health insurance is also probably healthier than average. It makes sense that the more health problems a person has, the more likely he’ll be to choose a lower-deductible policy, since he knows he’s likely to be using the policy at least somewhat regularly. On the other hand, a person with no health conditions at all is probably making a good gamble to select a high deductible policy, since there’s a decent chance he’ll be able to go for several years without having a major claim. So the fact that people with HDHPs have lower medical costs isn’t really surprising. It’s largely a self-selected group (employers who offer an HDHP usually offer another plan as well, and everyone shopping for individual health insurance who picks an HDHP has other options from which to choose). I’m not sure that medical costs would still be lower for people with HDHPs if they policy designs were assigned randomly across the entire population.

Comparative Effectiveness Research Fee To Be Added To Premiums In 2012

[…] This fee is similar to the one that is assessed to pay for CoverColorado (except that it’s a much smaller amount). Basically, carriers will collect the fee from members and then pass the money on to the Patient-Centered Outcomes Research Institute, much the way carriers pass on the CoverColorado fee. The fee will not be counted as premiums for the purpose of calculating medical loss ratio numbers, and should not be confused as being part of the premium that we pay for our health insurance.