there is also an option to offer “expanded” bronze plans that can have higher AV than regular bronze plans. In order to be considered expanded bronze, a plan must

Anthem Blue Cross

What is Silver Loading in the Connect for Health Colorado ACA Exchange?

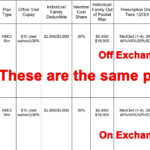

On exchange with Silver Loading (no Cost Sharing Reduction) vs Off Exchange

2017 Rate Increases for Colorado Individual Health Insurance Market

EDIT, 9/25/2016: Rates were approved recently by the Colorado Division of Insurance. The following average rate changes (actual changes will vary by plan) will take effect January 1, 2017 for the seven carriers that will offer individual market coverage through the exchange. They will also apply off-exchange, as all of these carriers offer their plans both… Read more about 2017 Rate Increases for Colorado Individual Health Insurance Market

Commission cuts aren’t the same in states with state-run exchanges

EDIT, March 29, 2016: In addition to having state-run exchanges, there’s another factor involved here, which is much more likely to be the correct explanation. California, Colorado, Connecticut, and Kentucky are the four states that have taken regulatory action to prevent health insurance carriers from cutting commissions. Although my initial hypothesis wasn’t bad, direct action… Read more about Commission cuts aren’t the same in states with state-run exchanges

Carrier Contact Information And Updates For People Who Need To Pay January’s Premium

Today, January 10th, is the payment deadline for most Connect for Health Colorado policies with January 1 effective dates. A few carriers have pushed the deadline out a little bit: Updated Anthem Blue Cross and Blue Shield is moving the payment deadline to 1/31 for 1/1 effective dates. Delta Dental: January 15. Premier Access Dental… Read more about Carrier Contact Information And Updates For People Who Need To Pay January’s Premium

Do Not Assume Your Provider Network Will Be The Same As It Was Last Year

A description of PPO, HMO, EPO and a search tools for all carriers is available here. EDIT 2/18/14: Connect for Health Colorado updates the provider directory once per month. It is possible therefore that the list may not be up-to-date at all times. If you have questions, you can call your carrier directly, or contact… Read more about Do Not Assume Your Provider Network Will Be The Same As It Was Last Year

Pediatric Dental on 2014 Individual Health Insurance Policies in Colorado

If you’re confused by the new pediatric dental requirements, you’re not alone. Here’s a rundown of how the ACA and HHS regulations impact pediatric dental coverage, with Colorado-specific details: The ACA defines pediatric dental coverage as one of the ten essential health benefits (EHBs) that must be covered on all new individual and small group… Read more about Pediatric Dental on 2014 Individual Health Insurance Policies in Colorado

How Does Obama’s Policy Continuation Announcement Impact Colorado’s Individual Market?

By now you’ve probably heard about the Obama Administration’s compromise over the policy cancellation uproar. The fix that Obama has offered is that health insurance companies can extend existing plans for one more year, allowing them to continue to exist in 2014. This has been incorrectly reported in some media outlets as allowing carriers to continue… Read more about How Does Obama’s Policy Continuation Announcement Impact Colorado’s Individual Market?

Colorado Senator Udall Introduces Bill To Allow Individual Policies To Continue For Two More Years

Colorado Senator Mark Udall introduced legislation today that would allow people with individual health insurance to keep their existing policies for two more years – through the end of 2015 – regardless of any cancellation notices that have already been sent out. Udall’s Continuous Coverage Act is designed to smooth the transition to ACA-compliant plans…. Read more about Colorado Senator Udall Introduces Bill To Allow Individual Policies To Continue For Two More Years

Getting Past The Health Insurance Plan Cancellation Hysteria

Much has been said recently about how the ACA is causing a tidal wave of policy cancellations, and resulting in people losing coverage that they would prefer to keep. The frustrating part about this – as has generally been the case with every big uproar about the ACA – is that we’re not really getting… Read more about Getting Past The Health Insurance Plan Cancellation Hysteria

Fewer Plans Available In Exchanges In 2013, But Maybe That’s A Good Thing

At the end of September, just as the exchanges were about to open for business, HealthPocket created a comparison of the number of individual and family health insurance policies available in each state in 2013 and compared that with the number of policies that would be available in each state’s exchange in 2014. It’s an… Read more about Fewer Plans Available In Exchanges In 2013, But Maybe That’s A Good Thing

Early Renewal Does Not Mean You’re Taking Advantage of a Loophole

A few weeks ago, I wrote a post about our family’s health insurance policy and the changes coming in 2014. To make a long story short, our premiums are going to go up significantly and we don’t qualify for subsidies. We’re not complaining… we know that the ACA makes healthcare more accessible for a lot… Read more about Early Renewal Does Not Mean You’re Taking Advantage of a Loophole

Renewal Options for Each Individual Health Insurance Carrier in Colorado

Last week I explained how early renewal at the end of 2013 might be a good option for some people who have individual health insurance. If you’re happy with your coverage and aren’t going to qualify for a subsidy in the Colorado exchange, keeping your existing plan for most of 2014 might be a good way to save some money on premiums. This is especially true for people who prefer very high deductibles, as those plans are generally not ACA compliant and thus will not be available for purchase after the end of 2013. But if your carrier allows it, you can keep your current policy until it renews in 2014, and switch to an ACA compliant plan at that time. For people with plans that renew late in the year, this could mean keeping a lower-cost, higher deductible policy for most of 2014. If you’ll be eligible for a premium subsidy, it’s definitely worth your time to compare a subsidized exchange plan with what you have now. But if you’re happy with your coverage and you’re going to be paying full price for an ACA compliant plan, check with your carrier to see about keeping your current plan in 2014.

Keep in mind that each Colorado health insurance carrier is doing things a little differently in terms of 2013 renewals heading into 2014. It’s important to check with your carrier to make sure you’re aware of what steps you need to take – don’t assume that  your plan will automatically renew – or automatically not renew. The Colorado Division of Insurance has left a lot of leeway for carriers to determine their own protocol for renewals going into 2014. There is no state requirement that existing policies be cancelled as of the end of 2013, although some carriers have opted for that as a default. All plans must be ACA-compliant by January 1, 2015. So when your policy renews in 2014, you will have to transition to an ACA compliant plan. But the date of that renewal can be anytime from January to December.

your plan will automatically renew – or automatically not renew. The Colorado Division of Insurance has left a lot of leeway for carriers to determine their own protocol for renewals going into 2014. There is no state requirement that existing policies be cancelled as of the end of 2013, although some carriers have opted for that as a default. All plans must be ACA-compliant by January 1, 2015. So when your policy renews in 2014, you will have to transition to an ACA compliant plan. But the date of that renewal can be anytime from January to December.

Here’s a brief summary of what we have heard so far from some of the main carriers in Colorado. This is subject to change, so check with us or your carrier before you make a decision.

Anthem Blue Cross Blue Shield: The default is for your plan to just keep its current renewal date and continue unchanged until that date in 2014. But Anthem is also offering insureds an option […]

Early Renewal Provides A Good Alternative For 2014

Over the last few years, opponents of health care reform have often exaggerated – and sometime outright lied about – the potential negative aspects of the reform law. This has resulted in a public that is often woefully misinformed about what the law does and does not do. But the spin is not limited to just opponents of the law. Sometimes ACA supporters spin things too. This Huffington Post article from a few months ago is a good example. The title, “Aetna seeks to avoid Obamacare rules next year” is designed to play on the general unpopularity (and over-estimation of perceived profits) of insurance companies. When you read a little further, you find that Aetna is reaching out to brokers and insureds to let them know that Aetna will be allowing members to opt for an early renewal in December of this year – if they want to keep their current policy until December 2014.

Why is this being portrayed as a bad thing?

It is indisputable that people who are healthy, buy their own health insurance, won’t qualify for subsidies and prefer high deductible health plans are going to have higher premiums for ACA-compliant plans than they have now. Some of these people don’t mind high deductibles. They don’t consider their policy to be skimpy or junk insurance just because it isn’t ACA compliant. You might have seen headlines about how only a tiny fraction of existing individual health plans meet the requirements that the ACA will impose next year, but that doesn’t mean that the existing  plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

There are absolutely some bad health insurance plans on the market, with skimpy coverage, limited networks and lots of fine print. But there are also lots of good quality health insurance plans and reputable carriers. And there are plenty of people who are not going to qualify for subsidies next year (roughly half of the people who currently buy individual health insurance). If those people currently have – and are happy with – a high deductible plan that is less expensive than what they would have to pay for an ACA-compliant plan, there’s no reason that they shouldn’t be able to keep their plan as long as possible in 2014. The law requires coverage to be ACA-compliant when a policy renews in 2014. Carriers that are offering early renewals in December are providing good customer service, especially for insureds who […]

Your Health Insurance Will Probably Change in 2014

I frequently come across FAQs on various websites with a question along the lines of: “Do I have to switch to a new health insurance plan if I like my existing one?” And almost always, the answer is something like this: “No. The ACA allows grandfathered health insurance plans to continue unchanged, so if your plan was in effect when the ACA was signed into law on March 23, 2010 and has not been significantly changed since then, it will be considered “qualified coverage” and you can keep it”.

This is frustrating to read, because I’m sure that people who aren’t familiar with the details of health care reform might just see that first word – no – and not pay attention to the significant caveat that follows it. Adding to the confusion is the partially true statement President Obama made in 2009, saying “If you like your health care plan, you will be able to keep your health care plan. Period. No one will take it away. No matter what.”

The problem is that people who currently have health insurance might think that they can keep their plan – even if they’re not on a grandfathered plan – because there’s a lot of confusion about what exactly a grandfathered plan is. In 2012, just under half of people who get their health insurance from an employer were on a grandfathered plan, but that number is dropping and will continue to do so as plans change. There’s no way to know whether your health plan is grandfathered without calling your carrier and asking. A plan that was grandfathered as of 2011 might not be so today, since changes to the plan can happen at any time and can cause a plan to lose its grandfathered status.

The really bad health insurance plan that I wrote about earlier this year might be a grandfathered plan that was in effect when the ACA was signed into law. Insureds may have joined after that date and still be on a grandfathered plan. (although that still doesn’t explain the $5 million lifetime max that was being marketed on that plan as of this year – even grandfathered plans are not allowed to have lifetime maximums).

But especially in the individual market, health plans are constantly being redesigned. The way the process works in Colorado – and in many other states – is that existing plans are retired, or “sunset” and new ones are introduced. In most cases, insureds are allowed to remain on the sunset plan. If the carrier does away with the plan completely, they have to offer the plan’s insureds the option to  purchase any of the other plans the company offers, guaranteed issue. So most carriers have traditionally let insureds remain on sunset plans, but the plan becomes a closed block, which means that no new insureds are being added to the pool. The result is usually that over time, premiums within a closed block start to rise faster than premiums in other plans that are enrolling new members (keep in mind that in the individual market, medical underwriting has long been used to make sure that new members are relatively healthy. So for individual plans, members who have been on the plan the longest tend to have higher claims expenses than new members). This leads healthy insureds who are on sunset plans to seek coverage in another plan in order to lower their rates.

purchase any of the other plans the company offers, guaranteed issue. So most carriers have traditionally let insureds remain on sunset plans, but the plan becomes a closed block, which means that no new insureds are being added to the pool. The result is usually that over time, premiums within a closed block start to rise faster than premiums in other plans that are enrolling new members (keep in mind that in the individual market, medical underwriting has long been used to make sure that new members are relatively healthy. So for individual plans, members who have been on the plan the longest tend to have higher claims expenses than new members). This leads healthy insureds who are on sunset plans to seek coverage in another plan in order to lower their rates.

There are lots of reasons for new plan designs: It’s a way for carriers to create product differentiation (especially true in robust markets like we have in Colorado). New plan designs also allow carriers to create products with lower premiums, as they’re well aware that price is one of the most important factors when consumers are shopping for coverage (a good example is the trend over the past decade towards health plans with separate prescription deductibles instead of integrated Rx deductibles or Rx coverage with traditional copays). New plan designs also […]

Colorado Health Insurance Options On the Exchange in 2014

Although we’re still at least a week away from knowing the specific details on rates and plan designs for policies that will be sold in the Connect for Health Colorado exchange, the Division of Insurance has approved 242 plans that will be available in the exchange from 13 Colorado health insurance carriers. In late May, the number of carriers stood at 11 and the number of plans was 250+. But as we noted last week, there was still a lot going on behind the scenes over the summer, and some carriers had to resubmit plan information that was not accepted in the spring. The final count is 150 plans that will be available to individuals and 92 for small groups (keep in mind that this is just for plans within the exchange. There will be lots of other ACA-compliant plans available outside the exchange).

The plans for individuals will be available from ten different carriers (All Savers, Cigna, Colorado Choice, Colorado Health Insurance Cooperative,  Denver Health Medical Plan, HMO Colorado (Anthem), Humana, Kaiser, New Health Ventures and Rocky Mountain HMO). Although there are some new names in this list, there are also plenty of familiar ones (All Savers is a UnitedHealth company, which means that the main carriers that currently sell policies in the individual market in Colorado will all be represented in the exchange). Although we haven’t yet seen the final premium and plan details, it appears that Colorado will continue to have a robust individual health insurance market in 2014, both in and out of the exchange.

Denver Health Medical Plan, HMO Colorado (Anthem), Humana, Kaiser, New Health Ventures and Rocky Mountain HMO). Although there are some new names in this list, there are also plenty of familiar ones (All Savers is a UnitedHealth company, which means that the main carriers that currently sell policies in the individual market in Colorado will all be represented in the exchange). Although we haven’t yet seen the final premium and plan details, it appears that Colorado will continue to have a robust individual health insurance market in 2014, both in and out of the exchange.

For consumers who will qualify for a subsidy, the exchange is definitely the place to be – subsidies are only available in the exchange. Consumers who do not qualify for a subsidy (either because their income is too high or because they have access to an employer group plan that is technically “affordable” but might actually be outside of their budget) can shop within the exchange (via an approved broker or directly through the exchange) or they can […]

Many Traditional Plans Are Currently Less Expensive Than HDHPs

We used to be just as impressed with HDHPs and HSAs, but – at least in Colorado – they have lost some of their appeal over the last few years because HDHPs aren’t as price competitive as they once were. Our own family had an HDHP and HSA for several years, but we switched a couple years ago to a new  plan that is not HSA-qualified (we’re still allowed to have our HSA, and we are able to withdraw money from it if we need to pay medical expenses. But we can’t contribute any additional money to it unless we switch back to an HSA-qualified HDHP). The reason we switched was the premium. Our HSA-qualified plan was going up to $570/month, and the new plan we chose was $311/month (it’s now right around $400). HSA-qualified plans have one joint deductible for the whole family, and expenses like prescriptions are rolled into that unified deductible. That’s in contrast to the type of plan we have now, with a maximum out of pocket that allows for two family members to meet individual deductible and coinsurance limits (basically doubling the potential – although unlikely – out of pocket exposure). Our current plan also follows the recent trend of incorporating a separate prescription deductible that must be met before prescriptions are covered with a traditional copay. This type of plan has lesser benefits than an HDHP, and thus the premiums tend to be lower as well.

plan that is not HSA-qualified (we’re still allowed to have our HSA, and we are able to withdraw money from it if we need to pay medical expenses. But we can’t contribute any additional money to it unless we switch back to an HSA-qualified HDHP). The reason we switched was the premium. Our HSA-qualified plan was going up to $570/month, and the new plan we chose was $311/month (it’s now right around $400). HSA-qualified plans have one joint deductible for the whole family, and expenses like prescriptions are rolled into that unified deductible. That’s in contrast to the type of plan we have now, with a maximum out of pocket that allows for two family members to meet individual deductible and coinsurance limits (basically doubling the potential – although unlikely – out of pocket exposure). Our current plan also follows the recent trend of incorporating a separate prescription deductible that must be met before prescriptions are covered with a traditional copay. This type of plan has lesser benefits than an HDHP, and thus the premiums tend to be lower as well.

Several years ago, HDHPs were very popular among our clients in Colorado. But over the last few years, they’ve become much less popular, mainly because there are so many less-expensive health insurance options on the market now. HDHPs haven’t really changed in terms of design, but their premiums have climbed to reflect the rising cost of health care. In order to provide more affordable options, health insurance carriers have designed new plans with increased out-of-pocket exposure and lower premiums. Because HDHPs are relatively constrained by regulations regarding their structure, they haven’t been able to remain at the low end of the price scale in the health insurance market. In fact, many HDHP plan designs are now […]

Do You Need Critical Illness Insurance?

When my father was 54, he was diagnosed with an auto immune disease that struck quickly and in a devastating fashion. He lost his kidneys to the disease, and spent the next 11 years on dialysis until he received a kidney transplant last summer. Thankfully, he had long-term disability insurance through his employer, along with… Read more about Do You Need Critical Illness Insurance?

Networks And Carriers Are Part Of The Big Picture With Exchanges

[…] Aetna, United and Cigna are all absent from the CA exchange, and Dan looks into several reasons why some of the bigger carriers might have opted not to sell in the exchange on day one, and why some large provider networks are not going to be covered by plans sold in that state’s exchange.

Here in Colorado, Aetna stopped selling individual policies a couple years ago, so we weren’t expecting them to be in the state’s exchange, Connect for Health Colorado. United Healthcare has been a mainstay in the Colorado individual market, and while they submitted numerous plans to the DOI for small group products, they are all to be sold outside of the exchange and there don’t appear to be any individual plans in their new lineup. Cigna, however, will be selling individual plans both inside and outside of the exchange in Colorado.

Here in Colorado, Aetna stopped selling individual policies a couple years ago, so we weren’t expecting them to be in the state’s exchange, Connect for Health Colorado. United Healthcare has been a mainstay in the Colorado individual market, and while they submitted numerous plans to the DOI for small group products, they are all to be sold outside of the exchange and there don’t appear to be any individual plans in their new lineup. Cigna, however, will be selling individual plans both inside and outside of the exchange in Colorado.

We’ve heard from carrier representatives – who are familiar with multiple state exchanges – that Connect for Health Colorado has been particularly great to work with, and that is no doubt part of the reason Colorado will have a large number of carriers and policy options available within the exchange. We’re happy to be in a state that has been actively working on healthcare reform for several years, and that moved quickly to begin building an exchange and implementing the ACA as soon as it was passed.

No Colorado Health Insurance Rate Information Yet

May 15th was the deadline for health insurance carriers in Colorado to submit rates for new plans that will be sold in the individual and small group markets in Colorado, both in and outside of the exchange/marketplace (Connect for Health Colorado). Much has been said about today – May 22nd – being the date when those rates are available to the public, and there has been a lot of anticipation about getting to find out what health insurance premiums are going to look like next year in Colorado. We know that in the Pacific Northwest, rates have come in lower than expected, attributed partially to the “heavy competition” in the WA and OR marketplaces (9 and 12 insurers, respectively). Colorado has even more competition than that, with 19 different carriers submitting rates for plans to be sold through Connect for Health Colorado and on the open market (I’ve seen other reports that say 17 carriers, but either way, it will be a robustly competitive market – just as we’ve always had in Colorado).

There has been much speculation about what the new rates will look like. 9News did a piece last week that highlighted the concerns that rates – particularly in the individual market – could be much higher next year. Over the last year or so, in talking with knowledgeable representatives from the various health insurance carriers (who are themselves talking with knowledgeable actuaries), we’ve heard predictions that range from rate decreases for older policy-holders to rates more than doubling for younger insureds… and just about everything in between. So we are very curious to see how things look once the DOI releases rates.

There has been much speculation about what the new rates will look like. 9News did a piece last week that highlighted the concerns that rates – particularly in the individual market – could be much higher next year. Over the last year or so, in talking with knowledgeable representatives from the various health insurance carriers (who are themselves talking with knowledgeable actuaries), we’ve heard predictions that range from rate decreases for older policy-holders to rates more than doubling for younger insureds… and just about everything in between. So we are very curious to see how things look once the DOI releases rates.

Today’s the day that those rates are scheduled to be made public, but I doubt that things will be particularly clear anytime soon […]

Comparing CEO Compensation in Various Healthcare Industries

Joe Paduda of Managed Care Matters did an excellent job with the most recent Health Wonk Review – be sure to stop by his blog and check it out. I thought this article from Dr. Roy Poses was especially interesting. Writing at Health Care Renewal, Dr. Poses shines the spotlight on UnitedHealth Group’s CEO Stephen Hemsley’s oversized compensation. Roy notes that while the increase in CEO compensation does mirror the company’s overall financial success of late, it must also be considered in light of the fact that the company has made some missteps in terms of fulfilling its stated mission to provide health care “at an affordable price” and “expand access to quality health care.” Roy’s article cites several examples of allegedly unethical behavior, and concludes by noting that “Real health care reform needs to make health care leaders accountable, and especially accountable for the bad behavior that helped make them rich.”

I definitely do not disagree with Dr. Poses, and we’ve noted in the past that UnitedHealth Group has had issues with large executive compensation and backdating stock options (that was with a previous CEO, however). But I do want to use this as an opportunity to remind our readers and clients that most health insurance companies have CEO compensation packages that are far lower. Forbes compiled a list of the 498 highest-paid CEOs in 2012, and I scrolled through the first 150 on the list. UnitedHealth Group is there on the first page, ranked number 8 (they’re also ranked number 31 in Fortune 500 total profits, so as Roy said, the CEO salary is at least in the same ballpark with the company’s financial performance).

I definitely do not disagree with Dr. Poses, and we’ve noted in the past that UnitedHealth Group has had issues with large executive compensation and backdating stock options (that was with a previous CEO, however). But I do want to use this as an opportunity to remind our readers and clients that most health insurance companies have CEO compensation packages that are far lower. Forbes compiled a list of the 498 highest-paid CEOs in 2012, and I scrolled through the first 150 on the list. UnitedHealth Group is there on the first page, ranked number 8 (they’re also ranked number 31 in Fortune 500 total profits, so as Roy said, the CEO salary is at least in the same ballpark with the company’s financial performance).

But you have to click through several pages of the CEO compensation list to get to the next health insurance carrier. Humana was the next one I found, ranked at […]

Most Americans Might Not See Big Premium Hikes, But The Individual Market Is Different

One of our all-time favorite bloggers, Julie Ferguson of Workers’ Comp Insider, hosted the most recent Health Wonk Review – the “why hasn’t spring sprung?” edition. Maybe Julie just needs to move to Colorado… here on the Front Range, we’re definitely starting to see signs of spring – today was a beautiful sunny day,… Read more about Most Americans Might Not See Big Premium Hikes, But The Individual Market Is Different

You Have To Have An HSA Qualified Health Plan In Order To Set Up An HSA

It’s tax season, and that always correlates with an increase in questions about HSAs. We always get several calls at this time of year from people who want to set up just an HSA by itself and are wondering how to go about that, and we’ve even had people call and tell us that their accountant told them to go set up an HSA because it would be an excellent way to get an additional tax deduction.

HSAs (health savings accounts) are indeed a great way to get an above-the-line tax deduction. They’re also a great way to save for future medical expenses and/or retirement. But it’s not as simple as just setting one up and contributing money. You have to have an HSA qualified high deductible health plan in place in order to be able to contribute money to an HSA. Not all high deductible health insurance policies are HSA qualified. The IRS has very specific guidelines in terms of how HSA qualified HDHPs have to be structured, and if a plan meets those guidelines, it will be labeled as such in the marketing materials.

Look at the picture below:

“PPO (0) – HMO (0)” ??? That’s confusing too! PPO and HMO are network types and HSA qualified has nothing to do with networks. HSA qualified plans can be PPO or HMO. In Colorado, all individual health insurance is PPO, except for Kaiser Permanente. They’re the only individual/family HMO.

To give an example, our family had an HSA qualified HDHP for several years, and we contributed to our HSA during those years. But in 2011, we switched to a Core Share plan from Anthem Blue Cross and Blue Shield. It’s less expensive than Anthem’s HSA qualified plans (and less expensive than most of the other plans we looked at as well), and even though it’s a high deductible plan, it doesn’t meet the requirements for being HSA qualified. The maximum allowable out-of-pocket expense limit for a family on an HSA qualified plan is $12,500 in 2013, and our plan has a $15,000 maximum out-of-pocket exposure for a family. So even though the policy has a high deductible, covers preventive care before the deductible, doesn’t have copays, and generally meets all of the other requirements, the higher out-of-pocket limit means that we cannot contribute money to our HSA unless we switch back to an HSA qualified health plan in the future.

That same IRS link also explains how you can switch to an HSA qualified health plan anytime up until […]

Let Medicare Negotiate Drug Prices And The Government Can Afford Subsidies

Right in the middle of the sequestration mess seems like a good time to discuss the subsidies that are going to be a major part of the ACA starting next year. As of 2014, nearly everyone in the US will be required to have health insurance, and all individual health insurance will become guaranteed issue. There are concerns that premiums in the individual market might increase significantly, but for many families the subsidies enacted by the ACA will help to make coverage more affordable. The subsidies will be available to families earning up to 400% of the federal poverty level; the premium assistance will be awarded on a sliding scale, with the families on the upper edge of that income threshold receiving the smallest subsidies.

Right in the middle of the sequestration mess seems like a good time to discuss the subsidies that are going to be a major part of the ACA starting next year. As of 2014, nearly everyone in the US will be required to have health insurance, and all individual health insurance will become guaranteed issue. There are concerns that premiums in the individual market might increase significantly, but for many families the subsidies enacted by the ACA will help to make coverage more affordable. The subsidies will be available to families earning up to 400% of the federal poverty level; the premium assistance will be awarded on a sliding scale, with the families on the upper edge of that income threshold receiving the smallest subsidies.

But how much will those subsidies cost the taxpayers? How will a government that is so cash-strapped that it’s curbing spending on programs like Head Start and special education be able to fund the subsidies called for in the ACA?

Last summer, the CBO estimated that the exchange subsidies will cost $1,017 billion over the next ten years. Undoubtedly a large sum, but probably necessary in order to make guaranteed issue health insurance affordable for low- and middle-income families.

That sum is partially offset by the CBO’s projections of $515 billion (over the next ten years) in revenue from individual mandate penalties (fines imposed on non-exempt people who opt to go without health insurance starting in 2014), excise tax on “Cadillac” group health insurance policies, and “other budgetary effects” enacted by the healthcare reform law.

That leaves us with $502 billion. Not an insignificant sum of money even when […]

Will Marketplace Customer Service Be On A Par With Private Industry?

One of our clients recently told us about a health insurance plan that was being marketed to him, and we were curious enough to want to look into the situation further. In a nutshell, it’s not a discount plan, not a mini-med, and not a traditional limited-benefit indemnity plan. All of those plans should be avoided in general, and the ACA has sort of skirted around them a bit: numerous mini-meds have been granted temporary waivers in order to continue to operate, discount plans aren’t addressed by the ACA at all (and aren’t regulated by most state Division of Insurance departments either, since they aren’t actually insurance), and limited benefit indemnity plans are exempted from ACA rules (although people who have them will likely have to pay a penalty for not meeting minimum benefit requirements).

Anyway, the plan that was marketed to our client resembled traditional health insurance, but was very convoluted and sold with numerous riders to cover all sorts of different scenarios. The brochure was 27 pages long and included numerous detailed examples showing how awesome the marketed coverage was when compared with “traditional major medical.” It noted that the plan isn’t subject to ACA mandates, and the policy is still being marketed with a $5 million lifetime maximum. When I spoke with an agent for the plan (a captive agent, of course – plans like that are never marketed by brokers who have access to other policies), he told me that the policy will not be guaranteed issue next year, and that they aren’t concerned about the potential penalties that their clients will have to pay starting in 2014 for not having ACA-compliant coverage. His reasoning (and the marketing pitch that they’re making to their clients) is that their premiums will be so much lower than ACA-compliant plans that their clients will save enough money to more than make up for the penalty (currently their premiums were roughly the same as those of reputable health insurance policies).

In short, everything about this policy sounded sketchy.

A rather lengthy Google search didn’t bring up much in the way of regulations pertaining to this sort of issue. I remembered my efforts in the fall of 2011 to get specific details about regulations regarding mini-meds… and I wasn’t encouraged. At the time, the Colorado Division of Insurance wasn’t aware of a solution to the problem our client was facing (although to give them credit, I was able to speak with someone as soon as I called them). They referred me to HHS, where I had to leave a voice mail. The outgoing message said that someone would get back to me within five business days, but that was a year and a half ago and I’m not holding my breath for a reply. I also left a message for the National Association of Insurance Commissioners (NAIC) about the issue and never heard back from anyone there. We ended up getting the client onto an Anthem Blue Cross Blue Shield plan, but we never heard back from any of the government agencies we contacted regarding his mini-med situation.

A rather lengthy Google search didn’t bring up much in the way of regulations pertaining to this sort of issue. I remembered my efforts in the fall of 2011 to get specific details about regulations regarding mini-meds… and I wasn’t encouraged. At the time, the Colorado Division of Insurance wasn’t aware of a solution to the problem our client was facing (although to give them credit, I was able to speak with someone as soon as I called them). They referred me to HHS, where I had to leave a voice mail. The outgoing message said that someone would get back to me within five business days, but that was a year and a half ago and I’m not holding my breath for a reply. I also left a message for the National Association of Insurance Commissioners (NAIC) about the issue and never heard back from anyone there. We ended up getting the client onto an Anthem Blue Cross Blue Shield plan, but we never heard back from any of the government agencies we contacted regarding his mini-med situation.

So back to our current questions about the sketchy-sounding health insurance being marketed to our client. I contacted HealthCare.gov via Twitter but got no response. I called the Colorado Division of Insurance and was told that I should send in an email with the specifics. I did that on Wednesday and haven’t heard anything back from them yet. I called them this morning to follow up, and they told me that they had received my email but didn’t know to whom it had been assigned yet – this is two days after I sent it, so I would assume that perhaps the employees there are overworked and understaffed. I didn’t contact the national HHS office again, because I didn’t feel like wasting my time any further. However, I did send an email on Friday morning to the regional HHS office in Denver, so hopefully I’ll hear back from them sometime soon.

I’m also hopeful that I’ll hear back from the Colorado DOI sometime next week. They usually end up being a helpful – and local – resource, even if we have to wait a few days. Once we get some more information, I’ll write a follow-up post about how an individual carrier is apparently able to operate entirely outside the regulations of the ACA.

But for now, I’m struck by how difficult it can be to obtain information from a government agency, or even speak with a real person as opposed to just leaving a message or sending an email that may or may not ever get read. I know that private companies aren’t always shining examples of customer service, but I can’t imagine calling the claims or customer service number on the back of our Anthem Blue Cross Blue Shield card and being told […]