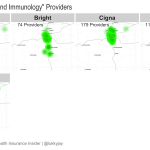

Last week, I shared charts showing how many total providers are in each individual market insurer’s network, and compared that with total enrollment for each insurer. But the total number of providers doesn’t tell the whole story. Network adequacy issues still arise for specific consumers when an insurance plan might have many primary care providers, but… Read more about 2018 Colorado Individual/Family Market Specialist Maps

Providers

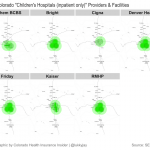

2018 Essential Community Provider Maps

Network coverage is an important part of picking a health insurance policy. And while the insurers and the exchange have tools that will let you check to see if your doctor is in-network with the plan you’re considering, those tools aren’t as helpful if you don’t have a specific provider in mind and just want… Read more about 2018 Essential Community Provider Maps

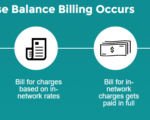

We should eliminate balance billing at in-network hospitals

Earlier this month, lawmakers in Florida passed House Bill 221 in an effort to prevent surprise balance billing when patients are treated by out-of-network providers at in-network facilities. Governor Scott hasn’t yet signed HB221 into law, but details about how the law would work are outlined here. HB221 is being called a model for other states… Read more about We should eliminate balance billing at in-network hospitals

Do Not Assume Your Provider Network Will Be The Same As It Was Last Year

A description of PPO, HMO, EPO and a search tools for all carriers is available here. EDIT 2/18/14: Connect for Health Colorado updates the provider directory once per month. It is possible therefore that the list may not be up-to-date at all times. If you have questions, you can call your carrier directly, or contact… Read more about Do Not Assume Your Provider Network Will Be The Same As It Was Last Year

Risk Management, Step One: Identify the Actual Risk, Not The Perceived One

Julie Ferguson hosted the 191st edition of the Cavalcade of Risk this week – be sure to check it out! She opens with a link to a particularly good article about how we tend to worry about all the wrong things. We worry about being eaten by a shark if we swim in the ocean, but don’t think much about the risk of biking/walking/driving to the ocean in the first place. Even though most people die in rather mundane ways, it’s the dramatic, high-profile  dangers that grab our attention. If we’re really paying attention to risk, we’ll focus more on making the ho-hum aspects of our daily routine safer, and not worry so much about being attacked by a bear while hiking. Pretty much sums up what risk-management is all about: first you have to understand the risks!

dangers that grab our attention. If we’re really paying attention to risk, we’ll focus more on making the ho-hum aspects of our daily routine safer, and not worry so much about being attacked by a bear while hiking. Pretty much sums up what risk-management is all about: first you have to understand the risks!

I liked David Williams’ post about an unintended consequence of the oral chemotherapy parity law in Mass. In his case, he’s getting a refund of previously paid copays because someone on his plan is using an oral medication that can be prescribed for cancer, although in this case it’s used to treat something else. But since his plan covers infused chemo with no cost-sharing, the oral medication must also be covered with no cost-sharing.

Colorado is among the 26 states that have oral chemotherapy laws on the books (I would image that all of the rest will within the next few years), and overall, the concept makes perfect sense: Chemo is chemo, and patients should have access to whatever type of chemo they and their doctors feel will be most successful, without having to consider whether oral chemo will be more expensive. Oral chemo parity laws might end up saving money in the long run, since they avoid the hospital or clinic fees associated with a traditional multi-hour chemo infusion. And oral chemo also makes it easier for the patient to carry on with day to day life. But it would also make sense to have a clause in the law that requires the parity only if the oral medication is actually being used to treat cancer, as opposed to some other use.

A Midsummer Wonk’s Dream

Welcome to the Midsummer Health Wonk Review! It’s always a pleasure to host, and this edition actually isn’t a Shakespeare theme, but it is jam-packed with excellent articles from some of the best writers in the healthcare blog world. The HWR had a break before this edition and will have a hiatus after this one too. We’re starting things off with a few articles that help to shed light on some aspects of health care reform that should be straight-forward but sometimes get a bit convoluted with political rhetoric. Then we’ve got several posts about corruption in healthcare and healthcare policy, and lots of posts that provide contrasting and well-reasoned viewpoints on healthcare reform and healthcare in general. We’ll keep things cool with some winter and spring pictures we took around us here in Northern Colorado. Enjoy!

In an excellent piece debunking popular “wisdom” regarding immigrants and healthcare, Joe Paduda of Managed Care Matters explains that when it comes to the Medicare Trust Fund, immigrants put in a lot more than they take out: In 2009, immigrants paid in 14.7% of trust fund contributions but only accounted for 7.9% of its spending, with a net surplus of almost $14 billion. US-born people accounted for a deficit of almost $31 billion in the Medicare Trust Fund that same year. This appears to be a long-term trend: From 2002 to 2009, immigrants contributed $115.2 billion more to the Medicare Trust Fund than they received in Medicare benefits. Joe goes on to explain the details and warn those who rally behind strict immigration reform that they may want to rethink their position. Our Medicare Trust Fund would be in a lot worse shape without the immigrant population.

In an excellent piece debunking popular “wisdom” regarding immigrants and healthcare, Joe Paduda of Managed Care Matters explains that when it comes to the Medicare Trust Fund, immigrants put in a lot more than they take out: In 2009, immigrants paid in 14.7% of trust fund contributions but only accounted for 7.9% of its spending, with a net surplus of almost $14 billion. US-born people accounted for a deficit of almost $31 billion in the Medicare Trust Fund that same year. This appears to be a long-term trend: From 2002 to 2009, immigrants contributed $115.2 billion more to the Medicare Trust Fund than they received in Medicare benefits. Joe goes on to explain the details and warn those who rally behind strict immigration reform that they may want to rethink their position. Our Medicare Trust Fund would be in a lot worse shape without the immigrant population.

And if you’re curious about the implementation track for the ACA (and understandably confused by the constant talk of repeal, delay, replace, etc. that we keep hearing from some politicians) Linda Bergthold has what I consider to be a straight-forward and factual review of the situation. To sum it up, she’s predicting that the employer mandate will go into effect in 2015, as currently scheduled (following a one-year delay, but not a repeal), and that the individual mandate will be implemented in 2014, as planned. And while some states that delayed the creation of an exchange marketplace will likely have a tougher time getting everything up and running by 2014, the exchanges will be operational next year. I imagine there will be some bumps in the road as the ACA is fully implemented over the next few years. But we can work on ironing those out as we go – there’s no need to start from scratch.

Although the exchanges are likely to be successful in the long run, it won’t be without significant effort on the part of the people running them. At Health Affairs Blog, Barbara Markham Smith and Jack Meyer explain their recommendations for strategies that can help the exchanges be successful both out of the gates and for the long haul. They discuss pricing (don’t make it too high!) as well as communication/advertising programs that need to be unified, clear, concise and nation-wide in order to generate awareness and interest in as many people as possible.  (Unfortunately, there’s a significant portion of the country’s leadership who seem to want the exchanges to fail – even to the detriment of the American people – and are content to spread mis-information about the entire law. This is a considerable hurdle that the exchanges will have to overcome.) Barbara and Jack recommend a temporary respite from the tax reconciliation that will be done to determine whether a person or family that received a subsidy is required to pay back a portion of it due to increased income compared with the prior year. And they also call for fostering increased competition and CO-OP creation in the states have not yet done so. All in all, pretty solid ideas for success in the exchanges and policy-makers would be wise to take heed.

(Unfortunately, there’s a significant portion of the country’s leadership who seem to want the exchanges to fail – even to the detriment of the American people – and are content to spread mis-information about the entire law. This is a considerable hurdle that the exchanges will have to overcome.) Barbara and Jack recommend a temporary respite from the tax reconciliation that will be done to determine whether a person or family that received a subsidy is required to pay back a portion of it due to increased income compared with the prior year. And they also call for fostering increased competition and CO-OP creation in the states have not yet done so. All in all, pretty solid ideas for success in the exchanges and policy-makers would be wise to take heed.

I think of Dr. Roy Poses as the healthcare blog world whistleblower – he can always be counted on to expose nefarious acts in the healthcare industry, and Health Care Renewal is a must-read blog. Here is his take on the recent Transparency International poll that found 43% of US respondents believe that the US healthcare system is corrupt, and that 64% believe that the government is run by big money and special interests. Roy notes that unfortunately, most of the media coverage of the Transparency International poll has focused on world-wide data and/or specifics from far-away lands. Instead of focusing on our own serious problems with corruption in healthcare, it seems that a lot of media outlets (keep in mind that media is sometimes beholden to special interests too…) prefer to present the problem as something that happens in other countries as opposed to something that we need to work on here in the US.

Continuing with the corruption theme, Eric Turkewitz of the NY Personal Injury Law Blog shares a multi-part series about Dr. Katz, who has been rebuked for lying on the stand in a personal injury trial that resulted in a mistrial because of the doctor’s actions. Central to the issue is the practice of independent medical exams (with the word “independent” being very loosely used in this case) conducted by doctors who are hired by insurance companies when they are defending personal injury cases. In the case that Eric is writing about, the doctor makes a 7 figure income  from his medical-legal practice, but in one case that has been made public, he grossly over-stated the amount of time he spent with a patient (he claimed it was 10 – 20 minutes, but a secretly-made video recording of the visit showed that it was under two minutes). Eric has looked at additional data and found that the average length of Dr. Katz’s exams was around 4 minutes. Additional details on this story are here. Wow. The doctor was obviously concerned first and foremost with money, but the insurance companies who hired him were likely not doing due diligence to make sure that he was providing accurate data. They may have been more concerned with finding a doctor who would tell them what they wanted to hear rather than the actual details of the patients’ medical cases. Sad all around, but sadder still is the fact that it’s probably not all that unusual.

from his medical-legal practice, but in one case that has been made public, he grossly over-stated the amount of time he spent with a patient (he claimed it was 10 – 20 minutes, but a secretly-made video recording of the visit showed that it was under two minutes). Eric has looked at additional data and found that the average length of Dr. Katz’s exams was around 4 minutes. Additional details on this story are here. Wow. The doctor was obviously concerned first and foremost with money, but the insurance companies who hired him were likely not doing due diligence to make sure that he was providing accurate data. They may have been more concerned with finding a doctor who would tell them what they wanted to hear rather than the actual details of the patients’ medical cases. Sad all around, but sadder still is the fact that it’s probably not all that unusual.

And for a little more on the cronyism/corruption topic (maybe those corruption figures Roy mentioned from the Transparency International poll were skewed a bit too low?), Hank Stern of InsureBlog writes about agencies and individuals who have been involved with the Obama Administration for some time, and are now finding themselves in lucrative financial and/or influential positions as the ACA gets implemented. In other words, business as usual in the government. Government appointments, grants, etc. are often awarded this way (ie, appearing to be rewards for donations and/or loyalty), in every administration, regardless of which party is in power. There’s ample room for opponents to cry foul, but it also has to be pointed out that presidents and secretaries and others in power have to be able to select people they trust for top leadership positions. And trust is earned over time. There’s a fine line between selecting the right candidate for the job, having that person be someone trusted by the top officials, and avoiding cronyism. I don’t know what the right answer is, but it’s easy to see how the appointments and grants and leadership roles being handed out with the ACA could be construed as rewards for political support and loyalty.

At Health Beat, Maggie Mahar writes a thoughtful and thorough review of Miriam Zoll’s Cracked Open: Liberty, Fertility and the Pursuit of High Tech Babies. After reading Maggie’s article, I’m eager to read the book itself (Maggie leaves a bit of a cliff hanger at the end…). Assisted reproductive technology is certainly a blessing to many families. But it can also be fraught with problems that stem from both overly-optimistic expectations on the part of patients (and society in general), over-promising on the part of providers, and a medical field that is largely unregulated and often not covered by health insurance policies.

At Health Business Blog, David Williams explains his skepticism about DealWell, a new Priceline-style website for healthcare services. I am very much in favor of increasing transparency in healthcare pricing and moving away from the proprietary pricing system we have now, where even the most dedicated patient “shoppers” can find it impossible to obtain real healthcare prices before having a procedure. And to that end, I love the idea of a website where people can bid on the care they need and providers can accept or decline the offer depending on their current workload and the payment offered. But David makes some excellent points about the downsides: not being integrated with health insurance is a big one, especially since nearly everyone will have to have health insurance starting in 2014 (even if a procedure is lower than your deductible, it makes sense to stay in network and have the amount you pay be credited towards your deductible, in case you need additional care later in the year). Although DealWell might be a good option for people looking for one-time services that aren’t covered by health insurance (such a LASIK or a dental implant, for example), it’s probably not going to be the next big thing in healthcare price transparency.

idea of a website where people can bid on the care they need and providers can accept or decline the offer depending on their current workload and the payment offered. But David makes some excellent points about the downsides: not being integrated with health insurance is a big one, especially since nearly everyone will have to have health insurance starting in 2014 (even if a procedure is lower than your deductible, it makes sense to stay in network and have the amount you pay be credited towards your deductible, in case you need additional care later in the year). Although DealWell might be a good option for people looking for one-time services that aren’t covered by health insurance (such a LASIK or a dental implant, for example), it’s probably not going to be the next big thing in healthcare price transparency.

Over at Disease Management Care Blog, Jaan Sidorov takes a closer look at the glowing picture painted by CMS regarding ACO pilot programs, digs a little deeper, and gives us a slightly less rosy view of the results. And there’s even a T-Rex analogy, to keep things even more interesting. Jaan points out that the ACOs that didn’t meet the pilot program goals are likely feeling the sting of losing millions of dollars, since the initial investment costs are not cheap. Although 9 of the 32 pilot ACO providers have said that they want to leave the program, I wonder if results will be better as time goes by, mitigating the initial investment costs somewhat? Stay tuned.

Julie Ferguson of Workers’ Comp Insider writes about the July 6th 777 crash at SFO, detailing how the flight attendants did an excellent job of putting their emergency training into practice, saving lives in the process. Julie notes that while it’s easy to shrug off emergency plans simply because we rarely come face-to-face with an emergency, such preparedness can mean the difference between life and death. Does your business have a solid plan in place to deal with emergencies? Has everyone at the business been trained on it? How fast can your building be evacuated if necessary? All good things to think about.

Writing at Health Access Blog, Anthony Wright discusses the one-year delay of the employer mandate portion of the ACA that will require employers with more than 50 employees to provide health insurance to eligible full-time workers. Anthony makes some very important points: the delay doesn’t impact anyone’s eligibility for health insurance and/or subsidies. People who would have been offered health insurance from an  employer with the employer mandate in place will still be able to get coverage through their state’s exchange – and if they make up to 400% of the federal poverty level, they’ll qualify for subsidies to help pay for it. In addition, the vast majority of large employers in the US already offer health insurance to their employees and have historically done so without a mandate requiring it. It’s unlikely that a large amount of those employers will suddenly drop their coverage in 2014. But Anthony goes on to note that if the delay were extended for additional years, it could begin to destabilize the financial foundation of the ACA and employers might begin to shift more workers onto exchange plans, relying on tax-funded subsidies to foot a portion of the bill.

employer with the employer mandate in place will still be able to get coverage through their state’s exchange – and if they make up to 400% of the federal poverty level, they’ll qualify for subsidies to help pay for it. In addition, the vast majority of large employers in the US already offer health insurance to their employees and have historically done so without a mandate requiring it. It’s unlikely that a large amount of those employers will suddenly drop their coverage in 2014. But Anthony goes on to note that if the delay were extended for additional years, it could begin to destabilize the financial foundation of the ACA and employers might begin to shift more workers onto exchange plans, relying on tax-funded subsidies to foot a portion of the bill.

The Healthcare Economist, aka Jason Shafrin, brings us a great summary of health insurance in China over the past half century. Until the end of the 1970s, there were three main health insurance systems in China that covered nearly everyone. But the wheels started to come off after that; by 1998 almost half of the urban population had no health insurance, and by 2003, 95% of the rural population in China was uninsured. In the last ten years, China has tackled health care reform in order to try to remedy the problem. While plenty of progress has been made, there is still a long way to go.

Jared Rhoads has written a review of The Autistic Brain by Temple Grandin. His review is a good read, and the book looks like it is as well. Professor Grandin teaches at Colorado State University – my alma mater – and consults for the livestock industry as well as being a bestselling author. She’s an inspiring and accomplished person even without taking into account her own autism. Her book combines her personal  experiences with the latest that science has to offer us with regards to autism. If you’re interested in autism, Jared’s summary is that this book is a good place to start learning more. I’m adding it to my list of books to read, so thanks for the tip Jared!

experiences with the latest that science has to offer us with regards to autism. If you’re interested in autism, Jared’s summary is that this book is a good place to start learning more. I’m adding it to my list of books to read, so thanks for the tip Jared!

John Goodman lays out some of the results of the ACA thus far (fair enough, but keep in mind that most of the law hasn’t been implemented yet). He details some positives and negatives, both expected and unintended, although his overall take is that the ACA is not a great solution. Strongly worded opinions about the ACA will likely meet with a round of applause from one side of the political spectrum, and boos from the other side. But regardless of your position, I would say that it’s tough to argue with John’s point about high deductible, consumer-driven health plans. I think he’s correct in saying that they’re probably going to be quite popular starting in 2014, when they will be among the least-expensive plans available. This is probably particularly true among people who won’t qualify for subsidies.

That’s it for this mid-summer edition of the Health Wonk Review. Many thanks to Julie and Joe for keeping such a great blog carnival going all these years! The HWR now has a summer hiatus. Don’t miss the next edition on August 15th, which will be hosted by David Williams at Health Business Blog.

Clearing Up Confusion Around The Health Insurance Provider Fee

One of the funding mechanisms for the health insurance exchanges is the implementation of the health insurer fee that will go into effect in 2014. I’ve seen this referred to as a health insurance provider fee (a bit confusing as it might lead people to believe that the fee is imposed on medical providers rather than insurers), a health insurance industry fee, and an ACA health insurance carrier fee, among others. But whatever you want to  call it, the fee is an amount that will be collected from health insurance carriers starting next year, and the funds will be used to help pay for the state and federal health insurance exchanges.

call it, the fee is an amount that will be collected from health insurance carriers starting next year, and the funds will be used to help pay for the state and federal health insurance exchanges.

The fee will generate $8 billion in 2014, and will increase each year up to $14.3 billion in 2018. After that, it will increase annually in line with health insurance premiums. Insurance carriers will be responsible for remitting their share of the fee, which is calculated based on the insurer’s total collected premiums from the prior year.

As is generally the case with any new fees or mandates that increase costs for insurance companies, this fee will be passed on to companies and individuals who purchase policies. However, it won’t necessarily be easy to determine how much the fee is impacting your health insurance premiums, since many carriers are expected to just roll the fee into their total premiums.

In Colorado, Rocky Mountain Health Plans has stated that they will be adding the health insurance provider fee as a separate line item on their bills in an effort to be as transparent as possible. They will begin collecting the fee next month (July 2013) in order to spread the fee over a longer time horizon and thus lessen the impact on next year’s premiums. Carriers can choose to wait to begin collecting the fee, but the total amount collected will be the same regardless: Roughly 2% – 2.5% of total premiums in 2014, and 3% – 4% of total premiums in future years. In the individual market, RMHP will be  collecting $4.12 per member per month, for the rest of 2013. If you have a SOLO plan with RMHP and notice a line item on your bill labeled “Health Insurance Providers Fee”, now you’ll know what it is (be aware that the total collected is per member per month, so if you have a family of five on a RMHP policy, your bill will reflect a charge of $20.60/month starting in July). If you have coverage with another carrier, you’ll still be paying the fee (some carriers […]

collecting $4.12 per member per month, for the rest of 2013. If you have a SOLO plan with RMHP and notice a line item on your bill labeled “Health Insurance Providers Fee”, now you’ll know what it is (be aware that the total collected is per member per month, so if you have a family of five on a RMHP policy, your bill will reflect a charge of $20.60/month starting in July). If you have coverage with another carrier, you’ll still be paying the fee (some carriers […]

Doctors Moving Away From Independent Practice – What That Means For Patients

A recent thought-provoking article in the Fort Collins Coloradoan delves into the future of independent medical practices and the pros and cons of hospital mergers and “closed” healthcare systems like Kaiser Permanente (Kaiser opened for business in northern Colorado last fall) moving into the area. The article notes that the split between employed physicians and… Read more about Doctors Moving Away From Independent Practice – What That Means For Patients

Comparing CEO Compensation in Various Healthcare Industries

Joe Paduda of Managed Care Matters did an excellent job with the most recent Health Wonk Review – be sure to stop by his blog and check it out. I thought this article from Dr. Roy Poses was especially interesting. Writing at Health Care Renewal, Dr. Poses shines the spotlight on UnitedHealth Group’s CEO Stephen Hemsley’s oversized compensation. Roy notes that while the increase in CEO compensation does mirror the company’s overall financial success of late, it must also be considered in light of the fact that the company has made some missteps in terms of fulfilling its stated mission to provide health care “at an affordable price” and “expand access to quality health care.” Roy’s article cites several examples of allegedly unethical behavior, and concludes by noting that “Real health care reform needs to make health care leaders accountable, and especially accountable for the bad behavior that helped make them rich.”

I definitely do not disagree with Dr. Poses, and we’ve noted in the past that UnitedHealth Group has had issues with large executive compensation and backdating stock options (that was with a previous CEO, however). But I do want to use this as an opportunity to remind our readers and clients that most health insurance companies have CEO compensation packages that are far lower. Forbes compiled a list of the 498 highest-paid CEOs in 2012, and I scrolled through the first 150 on the list. UnitedHealth Group is there on the first page, ranked number 8 (they’re also ranked number 31 in Fortune 500 total profits, so as Roy said, the CEO salary is at least in the same ballpark with the company’s financial performance).

I definitely do not disagree with Dr. Poses, and we’ve noted in the past that UnitedHealth Group has had issues with large executive compensation and backdating stock options (that was with a previous CEO, however). But I do want to use this as an opportunity to remind our readers and clients that most health insurance companies have CEO compensation packages that are far lower. Forbes compiled a list of the 498 highest-paid CEOs in 2012, and I scrolled through the first 150 on the list. UnitedHealth Group is there on the first page, ranked number 8 (they’re also ranked number 31 in Fortune 500 total profits, so as Roy said, the CEO salary is at least in the same ballpark with the company’s financial performance).

But you have to click through several pages of the CEO compensation list to get to the next health insurance carrier. Humana was the next one I found, ranked at […]

Balance Billing From Non-Network Providers Who Work At In-Network Facilities

We recently heard from one of our clients who is dealing with a balance billing issue resulting from a NICU stay. For her baby’s birth, she chose a large hospital in Denver that was on her Humana health insurance network. Her OB/GYN was also on the Humana plan, and she figured she had all of her ducks in a row. But complications necessitated an emergency transfer to the NICU, where her new baby was cared for by doctors who are contracted with the hospital, but are not part of the Humana network.

When patients are treated by out-of network providers, there’s no contractual obligation between the doctors and the health insurance carrier. The patient will usually be responsible for a higher deductible when using a non-network provider (although this is not typically enforced for  emergency care), but even after the deductible is met, the provider is not obligated to accept the “reasonable and customary” payment from the health insurance carrier. The provider can choose to bill the patient the shortfall between what was originally billed and what was paid by insurance.

emergency care), but even after the deductible is met, the provider is not obligated to accept the “reasonable and customary” payment from the health insurance carrier. The provider can choose to bill the patient the shortfall between what was originally billed and what was paid by insurance.

Our client has been balance billed over $5,000 by the NICU doctors. Humana paid the doctors their in-network amounts for the NICU stay and counted it as an in-network expense (ie, no additional out-of-network deductible was charged) because it was an emergency situation. But the doctors refused to accept the insurance reimbursement as payment in full, and billed the family for an additional $5,000+. I suppose it could be worse – this family ended up with a $50,000 balance bill from their baby’s NICU stay.

But it could also be better. People who are recovering from an illness or injury don’t need to also be finding out that an in-network facility where they were treated also has providers who are not […]

Healthcare Social Media Review: Which Tools Work Best For Your Patients?

Welcome to the HealthCare Social Media Review, where you’ll find all sorts of articles on the intersection of healthcare and social media. Over the years, we’ve found social media to be an excellent way to interact with our peers, colleagues, and clients – first with our blog, and now increasingly through Google + (Jay, Louise), Twitter (Jay, Louise), and Facebook. I relied heavily on Twitter when I was looking for articles to include in this HCSM Review, and all of the social media platforms we use are excellent resources when we’re looking for like-minded people or relevant, timely information on a particular topic. We’re honored to be hosting this edition of the HCSM Review. The blog posts included here are all written by people who have a strong social media presence, and we’ve included links to their Twitter, Facebook or Google+ pages so that you can follow them too.

To start things off, we have an excellent article from Nina Dunn (@Spector_health), explaining that we need to get back to basics with social media use in healthcare. Rather than focusing on the negatives (it changes too fast! There are no clear guidelines for how to use it! HIPAA!, etc.), Nina encourages healthcare providers to focus instead on the ways that social media can be beneficial. She notes that just because a platform exists doesn’t mean that you have to use it (ie, you don’t need to be on every social media channel all at once), and that it’s important to know your audience and target your social media presence accordingly. Good content is king (that rule never changes), and social media marketing might require a different mindset when it comes to measuring success – but that’s not a reason to avoid it. All in all, a great read, and a perfect tone for the Healthcare Social Media Review…

David Harlow of HealthBlawg gives us a perfect example of how social media can be very useful in terms of gathering information and engaging people in real time to solve problems. The Office of the National Coordinator (ONC) for Health IT issued a request for information (RFI) on interoperability, asking “What specific HHS policy changes would significantly increase standards based electronic exchange of laboratory results?” The problem appears to basically hinge on the fact that labs receive no financial incentives to make their reports interoperable and compliant with EHR meaningful use standards (medical offices do have a financial incentive to do so). Keith Boone (@motorcycle_guy) blogged about the question, and then the power of social media took over thanks to retweets and […]

You Have To Have An HSA Qualified Health Plan In Order To Set Up An HSA

It’s tax season, and that always correlates with an increase in questions about HSAs. We always get several calls at this time of year from people who want to set up just an HSA by itself and are wondering how to go about that, and we’ve even had people call and tell us that their accountant told them to go set up an HSA because it would be an excellent way to get an additional tax deduction.

HSAs (health savings accounts) are indeed a great way to get an above-the-line tax deduction. They’re also a great way to save for future medical expenses and/or retirement. But it’s not as simple as just setting one up and contributing money. You have to have an HSA qualified high deductible health plan in place in order to be able to contribute money to an HSA. Not all high deductible health insurance policies are HSA qualified. The IRS has very specific guidelines in terms of how HSA qualified HDHPs have to be structured, and if a plan meets those guidelines, it will be labeled as such in the marketing materials.

Look at the picture below:

“PPO (0) – HMO (0)” ??? That’s confusing too! PPO and HMO are network types and HSA qualified has nothing to do with networks. HSA qualified plans can be PPO or HMO. In Colorado, all individual health insurance is PPO, except for Kaiser Permanente. They’re the only individual/family HMO.

To give an example, our family had an HSA qualified HDHP for several years, and we contributed to our HSA during those years. But in 2011, we switched to a Core Share plan from Anthem Blue Cross and Blue Shield. It’s less expensive than Anthem’s HSA qualified plans (and less expensive than most of the other plans we looked at as well), and even though it’s a high deductible plan, it doesn’t meet the requirements for being HSA qualified. The maximum allowable out-of-pocket expense limit for a family on an HSA qualified plan is $12,500 in 2013, and our plan has a $15,000 maximum out-of-pocket exposure for a family. So even though the policy has a high deductible, covers preventive care before the deductible, doesn’t have copays, and generally meets all of the other requirements, the higher out-of-pocket limit means that we cannot contribute money to our HSA unless we switch back to an HSA qualified health plan in the future.

That same IRS link also explains how you can switch to an HSA qualified health plan anytime up until […]

Will Marketplace Customer Service Be On A Par With Private Industry?

One of our clients recently told us about a health insurance plan that was being marketed to him, and we were curious enough to want to look into the situation further. In a nutshell, it’s not a discount plan, not a mini-med, and not a traditional limited-benefit indemnity plan. All of those plans should be avoided in general, and the ACA has sort of skirted around them a bit: numerous mini-meds have been granted temporary waivers in order to continue to operate, discount plans aren’t addressed by the ACA at all (and aren’t regulated by most state Division of Insurance departments either, since they aren’t actually insurance), and limited benefit indemnity plans are exempted from ACA rules (although people who have them will likely have to pay a penalty for not meeting minimum benefit requirements).

Anyway, the plan that was marketed to our client resembled traditional health insurance, but was very convoluted and sold with numerous riders to cover all sorts of different scenarios. The brochure was 27 pages long and included numerous detailed examples showing how awesome the marketed coverage was when compared with “traditional major medical.” It noted that the plan isn’t subject to ACA mandates, and the policy is still being marketed with a $5 million lifetime maximum. When I spoke with an agent for the plan (a captive agent, of course – plans like that are never marketed by brokers who have access to other policies), he told me that the policy will not be guaranteed issue next year, and that they aren’t concerned about the potential penalties that their clients will have to pay starting in 2014 for not having ACA-compliant coverage. His reasoning (and the marketing pitch that they’re making to their clients) is that their premiums will be so much lower than ACA-compliant plans that their clients will save enough money to more than make up for the penalty (currently their premiums were roughly the same as those of reputable health insurance policies).

In short, everything about this policy sounded sketchy.

A rather lengthy Google search didn’t bring up much in the way of regulations pertaining to this sort of issue. I remembered my efforts in the fall of 2011 to get specific details about regulations regarding mini-meds… and I wasn’t encouraged. At the time, the Colorado Division of Insurance wasn’t aware of a solution to the problem our client was facing (although to give them credit, I was able to speak with someone as soon as I called them). They referred me to HHS, where I had to leave a voice mail. The outgoing message said that someone would get back to me within five business days, but that was a year and a half ago and I’m not holding my breath for a reply. I also left a message for the National Association of Insurance Commissioners (NAIC) about the issue and never heard back from anyone there. We ended up getting the client onto an Anthem Blue Cross Blue Shield plan, but we never heard back from any of the government agencies we contacted regarding his mini-med situation.

A rather lengthy Google search didn’t bring up much in the way of regulations pertaining to this sort of issue. I remembered my efforts in the fall of 2011 to get specific details about regulations regarding mini-meds… and I wasn’t encouraged. At the time, the Colorado Division of Insurance wasn’t aware of a solution to the problem our client was facing (although to give them credit, I was able to speak with someone as soon as I called them). They referred me to HHS, where I had to leave a voice mail. The outgoing message said that someone would get back to me within five business days, but that was a year and a half ago and I’m not holding my breath for a reply. I also left a message for the National Association of Insurance Commissioners (NAIC) about the issue and never heard back from anyone there. We ended up getting the client onto an Anthem Blue Cross Blue Shield plan, but we never heard back from any of the government agencies we contacted regarding his mini-med situation.

So back to our current questions about the sketchy-sounding health insurance being marketed to our client. I contacted HealthCare.gov via Twitter but got no response. I called the Colorado Division of Insurance and was told that I should send in an email with the specifics. I did that on Wednesday and haven’t heard anything back from them yet. I called them this morning to follow up, and they told me that they had received my email but didn’t know to whom it had been assigned yet – this is two days after I sent it, so I would assume that perhaps the employees there are overworked and understaffed. I didn’t contact the national HHS office again, because I didn’t feel like wasting my time any further. However, I did send an email on Friday morning to the regional HHS office in Denver, so hopefully I’ll hear back from them sometime soon.

I’m also hopeful that I’ll hear back from the Colorado DOI sometime next week. They usually end up being a helpful – and local – resource, even if we have to wait a few days. Once we get some more information, I’ll write a follow-up post about how an individual carrier is apparently able to operate entirely outside the regulations of the ACA.

But for now, I’m struck by how difficult it can be to obtain information from a government agency, or even speak with a real person as opposed to just leaving a message or sending an email that may or may not ever get read. I know that private companies aren’t always shining examples of customer service, but I can’t imagine calling the claims or customer service number on the back of our Anthem Blue Cross Blue Shield card and being told […]

The Driving Factors Behind Inpatient Cost Increases

[…] it may not be what you’d guess. The study he references looked at inpatient costs from 2001 to 2006 (admittedly a bit out of date now, but still relevant and interesting data) and found that the biggest increases were in “supplies and devices”, ICU, and hospital room and board – all three of those areas had double digit percentage increases in costs from 2001 to 2006. I would be very curious to see another column on that chart with 2012 numbers and the corresponding percentage increases… are those three areas still the culprits, or have others (like pharmacy?) surpassed them?

Patients Want More Electronic Communication With Doctors

For the past few years, healthcare information technology has been one of the major players in healthcare reform efforts. All six hospitals in Northern Colorado are now linked with a medical information sharing program, and medical offices all over the country are getting on board with electronic medical records. The rise of electronic media in healthcare is not without controversy, but I think that we can all agree that it was – and is – inevitable. Each year brings newer and better technology, and people (patients and healthcare providers alike) have ever-increasing expectations in terms of the availability of information and communication.

Thus it’s no surprise that a recent survey found that patients want more digital interaction with their doctors. Half of respondents in the study felt that a past medical problem could have been avoided if their doctor had sent text messages or emails with encouragement, tips and reminders. Of course, whether electronic communication with doctors would actually have averted the problem is unknown. What’s important however, are the patients’ perceptions. 68% of the survey respondents said […]

Thus it’s no surprise that a recent survey found that patients want more digital interaction with their doctors. Half of respondents in the study felt that a past medical problem could have been avoided if their doctor had sent text messages or emails with encouragement, tips and reminders. Of course, whether electronic communication with doctors would actually have averted the problem is unknown. What’s important however, are the patients’ perceptions. 68% of the survey respondents said […]

How To Better Serve Emergency Room “Frequent Flyers”

The American College of Emergency Physicians had their annual meeting in Denver, Colorado this week, and presentations involved several new studies pertaining to people who are the most frequent users of emergency room care. I found that article to be fascinating, in part because it dispels so many myths about emergency room “frequent flyers.” We’ve written before about the fact that most emergency room patients do have health insurance and that emergency room overcrowding cannot be blamed on uninsured patients (as is often cited in casual conversation). Although most emergency room visitors do have health insurance, many of them have public health insurance via Medicare or Medicaid. And since the Medicaid rolls are expected to grow significantly over the next several years, it’s likely that ER overcrowding will grow to become more of a problem as some of those Medicaid patients are unable to access primary care outside the emergency room. […]

CORHIO Continues To Make Progress On Colorado Health Information Exchange

There are 110 hospitals in Colorado, and so far CORHIO has connected 27 of them to the health information exchange, and they are actively working on connecting two more. They are also currently working to add 800 more medical offices to the health information exchange, to join the 290 who are already connected.

Health IT has been a major talking point throughout the healthcare reform process, and the steps that CORHIO is taking will no doubt make for a more efficient healthcare system throughout Colorado once the entire state is linked through the HIE. Patients who see multiple doctors or who are treated at more than one hospital […]

Program Encourages Rural Students To Pursue Careers In Medicine

[…] I’ve written before about the PCP shortage, which exists even though many patients in well-served areas (and those with good private health insurance) may be unaware of it. Compounding the problem is the often lower median income in many rural communities. There are some exceptions of course, but in general the metropolitan areas of the state have higher average incomes than the rural areas. That means that it’s likely that a higher percentage of rural families – living in areas that are already underserved in terms of healthcare providers – qualify for state and federal health insurance programs that might further limit the options in terms of healthcare providers they can see.

All of this serves to highlight the importance of programs like CREATE Health Scholars. The program is relatively new and its first group of students is now moving on to post-graduate studies in medicine, pharmacy, dentistry and research. It will be interesting to look at the distribution of healthcare providers in rural areas of Colorado a decade from now. Hopefully the CREATE Health Scholars and other programs like it will have helped to close the gap between medically well-served and under-served areas of the state.

Colorado Hospital Payment Assistance Act Takes Effect Next Week

[…] To sum up the new law, hospitals will be required to charge uninsured patients earning less than 250% of FPL (and who are not covered by the Colorado Indigent Care Program) no more than the lowest negotiated price the hospital has with a private health insurance carrier. In addition, hospitals will have to clearly post their financial assistance, charity care and payment plan information so that patients will be aware of the financial options that are available.

In an article I wrote last week about the shooting victims in Aurora, I noted that although highly publicized tragedies tend to generate a lot of financial support (and in this case some of the hospitals treating the victims have offered to waive charges), there are many other people suffering from all sorts of injuries and illnesses whose cases do not receive media attention and who are crippled by the cost of their care. The Hospital Payment Assistance Program will hopefully provide some measure of relief for uninsured Coloradans who find themselves in need of hospital care in the future.

A Shared-Risk Success Story

[…] In addition to beating their target financially, the program has also resulted in happier patients, increased market share for Blue Shield, fewer patient readmissions (likely due to the comprehensive patient discharge program that they created, and better chronic care management), a significant decrease in the number of inpatient days per thousand members, and far lower start-up administration costs than are typically projected for ACOs (although they note that they worked with existing programs and already-established relationships, so they weren’t building an ACO from scratch. But I imagine that would likely be the case with most ACO creation?). […]

New Healthcare Price Comparison Database Coming Soon In Colorado

[…] Happily, it looks like we’re going to be getting a good healthcare price comparison database here in Colorado next year. This article from Kaiser Health News has all the details, and it looks promising. As the article states – and as we’ve noted here many times – healthcare costs sometimes seem to have little rhyme or reason. They can vary widely from one provider to another and from one area to another without much of a difference in quality of care or patient outcomes. But there are also some variables that have a justifiable impact on healthcare cost variation, such as the overhead expenses associated with teaching hospitals and hospitals that treat a higher-than-average number of uninsured patients. It sounds like the All Payor Claims Database is addressing those issues, so it will be interesting to see how the database accounts for them. I also like the fact that providers will be able to see how they compare with other providers before the data is released to the public, in order to allow the providers to start making improvements where necessary.

I can see this comparison tool – especially given how comprehensive it looks to be – being very beneficial for Colorado residents, and also helping to foster more competition among healthcare providers in the state.

Prescription Drug Reuse And Disposal Programs In Colorado

Four years ago, we wrote an article about recycling prescription drugs to be used by patients who don’t have health insurance or cannot afford their medications. This has remained a popular post on our blog, and people frequently search our site for information about prescription recycling and/or disposal programs in Colorado. So I wanted to write an updated post with information that we’ve come across in the years since we published that first article. […]

Kaiser Will Soon Be Available In Northern Colorado

[…] The new Kaiser facilities will be in Fort Collins at Harmony and Ziegler, and in Loveland at I-25 and Hwy 34. For hospital services, Kaiser is partnering with Banner Health and members will be able to use McKee Medical Center in Loveland and North Colorado Medical Center in Greeley. The medical offices in Fort Collins and Loveland will offer a wide range of services (primary care, lab work, pharmacy, and x-rays, and mammograms will be available at the Loveland office), and are expected to begin providing care by the fall of 2012. A medical office is projected to open in Greeley by 2014. Between now and then however, northern Colorado Kaiser members will be able to see doctors at the Fort Collins and Loveland offices, as well as physicians on the Banner Health network.

Kaiser is planning to offer group coverage to employers in northern Colorado by October 1, 2012. Individual and family coverage should be available sometime next year.

Replicating Grand Junction’s Healthcare System

[…] This is a scenario that I could see being implemented even without a monopoly by one health insurance carrier. Grand Junction aside, if we look at the whole state of Colorado, the top 70% of the health insurance market is comprised of ten carriers. I wonder if it would be possible for medical offices to set up agreements whereby they pool money received from those ten carriers and from Medicare, Medicaid, and CHP+. Then instead of paying physicians directly from the health insurer depending on the insurance coverage of each specific patient, the doctors could simply be paid either a salary or an average reimbursement for each patient, regardless of which insurance that patient had. This would require some restructuring in terms of how medical billing is done, but it would allow medical offices to continue to negotiate competitive contracts with private health insurers (and the higher the contracted rate, the more total dollars the medical practice would have to put into their payment pool).

One of the major factors that contributes to the success of the system in Grand Junction is that doctors there are ok with receiving lower total incomes than they would in other areas that don’t function the way Grand Junction does. When you pool Medicare and Medicaid payments together with private health insurance payments, the public health insurance reimbursements drag down the average payment. In order to make sure that people with public health insurance are receiving equal access to healthcare (which they currently do not, especially those with Medicaid), the per-patient average reimbursement for physicians would have to decrease, since it would mean that more lower-paying patients would be treated. The caveat that doctors would have to be willing to work for a little less money is especially true of specialists, which is where the highest incomes are. […]

Hospital Payment Assistance Program Will Benefit Colorado’s Uninsured Population

[…] SB12-134 will result in some significant changes in terms of how uninsured patients are billed when they receive treatment in a hospital (note that the bill only applies to hospitals – outpatient clinics, medical offices, and other non-hospital providers will not be impacted). Most people are aware that private health insurance carriers have negotiated rates that are lower than the “retail” price for medical services. Medicare and Medicaid have even lower negotiated prices. The reason SB12-134 is so important is that uninsured patients (usually those who have the least ability to pay medical bills) typically get charged the retail price. There is usually a cash discount available, but most uninsured patients typically don’t have enough cash sitting around to pay the whole bill up front. So – assuming they are able to pay the bill at all – they often end up on a payment plan (sometimes through a third party where interest rates can rival those of credit cards) and ultimately pay far more than any insurance carrier would pay.

SB12-134 applies to medically necessary care provided to uninsured patients who have a family income of not more than 250% of the federal poverty level ($57,625 for a family of four in 2012). And SB12-134 applies only if the care is not eligible for coverage through the Colorado Indigent Care Program (CICP). For those patients, hospitals may not charge more than the lowest rate they have negotiated with a private health insurance plan. This is a huge change from the status quo.

SB12-134 also requires hospitals to clearly state their financial assistance, charity care, and payment plan information on their website, in patient waiting areas, directly to patients before they are discharged, and in writing on the patients’ billing statements. Hospitals will also have to allow a patient’s bill to go at least 30 days past due before initiating collections procedures. […]