Kaiser Permanente has expanded hospital access across metro Denver, adding trusted locations like Rose Medical Center and St. Anthony North. Members now have more convenient options for care, including emergency, maternity, and specialty services. Learn how this update improves flexibility and keeps high-quality care close to home.

Kaiser Permanente

What is an Expanded Bronze Plan?

there is also an option to offer “expanded” bronze plans that can have higher AV than regular bronze plans. In order to be considered expanded bronze, a plan must

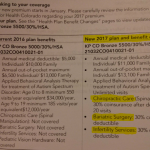

New Benefits in Colorado for 2017 – Bariatric Surgery, Infertility, Chiro?

Open enrollment is just around the corner, and you may have started receiving information from your health insurer regarding changes to your premium and coverage for 2017. I maintain a detailed overview of Colorado’s exchange at healthinsurance.org, so if you have questions, you might find answers there. But after receiving our own family’s renewal packet… Read more about New Benefits in Colorado for 2017 – Bariatric Surgery, Infertility, Chiro?

2017 Rate Increases for Colorado Individual Health Insurance Market

EDIT, 9/25/2016: Rates were approved recently by the Colorado Division of Insurance. The following average rate changes (actual changes will vary by plan) will take effect January 1, 2017 for the seven carriers that will offer individual market coverage through the exchange. They will also apply off-exchange, as all of these carriers offer their plans both… Read more about 2017 Rate Increases for Colorado Individual Health Insurance Market

Proposed rate increases in Colorado: CO-OP up 21%, Kaiser up 2%

The back-story Last September, when we wrote about the fact that the average individual rates increase in Colorado was less than one percent for 2015, we noted that the overall rate increase was astoundingly low – far lower than anything we’d seen during our time in this industry. And although it will be several more weeks… Read more about Proposed rate increases in Colorado: CO-OP up 21%, Kaiser up 2%

Connect for Health Colorado Exceeding Enrollment Targets

By February 17, Connect for Health Colorado had enrolled 79,779 people in private health insurance plans, and another 128,219 in Medicaid. Prior to the start of open enrollment, CMS published monthly enrollment targets for each state – based on those numbers, Colorado’s target for the end of February was 73,600 people enrolled in private plans…. Read more about Connect for Health Colorado Exceeding Enrollment Targets

Carrier Contact Information And Updates For People Who Need To Pay January’s Premium

Today, January 10th, is the payment deadline for most Connect for Health Colorado policies with January 1 effective dates. A few carriers have pushed the deadline out a little bit: Updated Anthem Blue Cross and Blue Shield is moving the payment deadline to 1/31 for 1/1 effective dates. Delta Dental: January 15. Premier Access Dental… Read more about Carrier Contact Information And Updates For People Who Need To Pay January’s Premium

How Does Obama’s Policy Continuation Announcement Impact Colorado’s Individual Market?

By now you’ve probably heard about the Obama Administration’s compromise over the policy cancellation uproar. The fix that Obama has offered is that health insurance companies can extend existing plans for one more year, allowing them to continue to exist in 2014. This has been incorrectly reported in some media outlets as allowing carriers to continue… Read more about How Does Obama’s Policy Continuation Announcement Impact Colorado’s Individual Market?

Fewer Plans Available In Exchanges In 2013, But Maybe That’s A Good Thing

At the end of September, just as the exchanges were about to open for business, HealthPocket created a comparison of the number of individual and family health insurance policies available in each state in 2013 and compared that with the number of policies that would be available in each state’s exchange in 2014. It’s an… Read more about Fewer Plans Available In Exchanges In 2013, But Maybe That’s A Good Thing

Renewal Options for Each Individual Health Insurance Carrier in Colorado

Last week I explained how early renewal at the end of 2013 might be a good option for some people who have individual health insurance. If you’re happy with your coverage and aren’t going to qualify for a subsidy in the Colorado exchange, keeping your existing plan for most of 2014 might be a good way to save some money on premiums. This is especially true for people who prefer very high deductibles, as those plans are generally not ACA compliant and thus will not be available for purchase after the end of 2013. But if your carrier allows it, you can keep your current policy until it renews in 2014, and switch to an ACA compliant plan at that time. For people with plans that renew late in the year, this could mean keeping a lower-cost, higher deductible policy for most of 2014. If you’ll be eligible for a premium subsidy, it’s definitely worth your time to compare a subsidized exchange plan with what you have now. But if you’re happy with your coverage and you’re going to be paying full price for an ACA compliant plan, check with your carrier to see about keeping your current plan in 2014.

Keep in mind that each Colorado health insurance carrier is doing things a little differently in terms of 2013 renewals heading into 2014. It’s important to check with your carrier to make sure you’re aware of what steps you need to take – don’t assume that  your plan will automatically renew – or automatically not renew. The Colorado Division of Insurance has left a lot of leeway for carriers to determine their own protocol for renewals going into 2014. There is no state requirement that existing policies be cancelled as of the end of 2013, although some carriers have opted for that as a default. All plans must be ACA-compliant by January 1, 2015. So when your policy renews in 2014, you will have to transition to an ACA compliant plan. But the date of that renewal can be anytime from January to December.

your plan will automatically renew – or automatically not renew. The Colorado Division of Insurance has left a lot of leeway for carriers to determine their own protocol for renewals going into 2014. There is no state requirement that existing policies be cancelled as of the end of 2013, although some carriers have opted for that as a default. All plans must be ACA-compliant by January 1, 2015. So when your policy renews in 2014, you will have to transition to an ACA compliant plan. But the date of that renewal can be anytime from January to December.

Here’s a brief summary of what we have heard so far from some of the main carriers in Colorado. This is subject to change, so check with us or your carrier before you make a decision.

Anthem Blue Cross Blue Shield: The default is for your plan to just keep its current renewal date and continue unchanged until that date in 2014. But Anthem is also offering insureds an option […]

Early Renewal Provides A Good Alternative For 2014

Over the last few years, opponents of health care reform have often exaggerated – and sometime outright lied about – the potential negative aspects of the reform law. This has resulted in a public that is often woefully misinformed about what the law does and does not do. But the spin is not limited to just opponents of the law. Sometimes ACA supporters spin things too. This Huffington Post article from a few months ago is a good example. The title, “Aetna seeks to avoid Obamacare rules next year” is designed to play on the general unpopularity (and over-estimation of perceived profits) of insurance companies. When you read a little further, you find that Aetna is reaching out to brokers and insureds to let them know that Aetna will be allowing members to opt for an early renewal in December of this year – if they want to keep their current policy until December 2014.

Why is this being portrayed as a bad thing?

It is indisputable that people who are healthy, buy their own health insurance, won’t qualify for subsidies and prefer high deductible health plans are going to have higher premiums for ACA-compliant plans than they have now. Some of these people don’t mind high deductibles. They don’t consider their policy to be skimpy or junk insurance just because it isn’t ACA compliant. You might have seen headlines about how only a tiny fraction of existing individual health plans meet the requirements that the ACA will impose next year, but that doesn’t mean that the existing  plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

There are absolutely some bad health insurance plans on the market, with skimpy coverage, limited networks and lots of fine print. But there are also lots of good quality health insurance plans and reputable carriers. And there are plenty of people who are not going to qualify for subsidies next year (roughly half of the people who currently buy individual health insurance). If those people currently have – and are happy with – a high deductible plan that is less expensive than what they would have to pay for an ACA-compliant plan, there’s no reason that they shouldn’t be able to keep their plan as long as possible in 2014. The law requires coverage to be ACA-compliant when a policy renews in 2014. Carriers that are offering early renewals in December are providing good customer service, especially for insureds who […]

Colorado Health Insurance Options On the Exchange in 2014

Although we’re still at least a week away from knowing the specific details on rates and plan designs for policies that will be sold in the Connect for Health Colorado exchange, the Division of Insurance has approved 242 plans that will be available in the exchange from 13 Colorado health insurance carriers. In late May, the number of carriers stood at 11 and the number of plans was 250+. But as we noted last week, there was still a lot going on behind the scenes over the summer, and some carriers had to resubmit plan information that was not accepted in the spring. The final count is 150 plans that will be available to individuals and 92 for small groups (keep in mind that this is just for plans within the exchange. There will be lots of other ACA-compliant plans available outside the exchange).

The plans for individuals will be available from ten different carriers (All Savers, Cigna, Colorado Choice, Colorado Health Insurance Cooperative,  Denver Health Medical Plan, HMO Colorado (Anthem), Humana, Kaiser, New Health Ventures and Rocky Mountain HMO). Although there are some new names in this list, there are also plenty of familiar ones (All Savers is a UnitedHealth company, which means that the main carriers that currently sell policies in the individual market in Colorado will all be represented in the exchange). Although we haven’t yet seen the final premium and plan details, it appears that Colorado will continue to have a robust individual health insurance market in 2014, both in and out of the exchange.

Denver Health Medical Plan, HMO Colorado (Anthem), Humana, Kaiser, New Health Ventures and Rocky Mountain HMO). Although there are some new names in this list, there are also plenty of familiar ones (All Savers is a UnitedHealth company, which means that the main carriers that currently sell policies in the individual market in Colorado will all be represented in the exchange). Although we haven’t yet seen the final premium and plan details, it appears that Colorado will continue to have a robust individual health insurance market in 2014, both in and out of the exchange.

For consumers who will qualify for a subsidy, the exchange is definitely the place to be – subsidies are only available in the exchange. Consumers who do not qualify for a subsidy (either because their income is too high or because they have access to an employer group plan that is technically “affordable” but might actually be outside of their budget) can shop within the exchange (via an approved broker or directly through the exchange) or they can […]

Subsidies Are Key To Limiting Rate Shock for Coverage in Exchanges

[…] because it provides premiums for bronze-level plans as well as the standard silver-level (subsidies are calculated based on premiums for silver plans, and premiums that have been discussed in the media thus far have been almost entirely for silver plans). Healthy individuals and families who currently opt for higher deductible plans will be the ones who see the biggest change in premiums, since the ACA generally shifts plans towards richer benefits. So while benefits will be greater in the future, premiums will be too – and families who would rather have lower premiums and higher out-of-pocket exposure will be herded onto higher-priced, richer-benefit plans. Bronze-level plans will be their obvious choice, although even those plan s will have richer benefits than many of the high deductible plans that are currently available in the individual market. Families and individuals who prefer richer benefits already will find that their premium changes are not as dramatic, since they will likely end up with an ACA-compliant plan that is more similar in design to what they currently buy (they will be more likely to opt for silver or gold plans).

s will have richer benefits than many of the high deductible plans that are currently available in the individual market. Families and individuals who prefer richer benefits already will find that their premium changes are not as dramatic, since they will likely end up with an ACA-compliant plan that is more similar in design to what they currently buy (they will be more likely to opt for silver or gold plans).

I’m using a family of four modeled after my own family so that I can compare premiums with what we pay now. Our current plan is $403/month for two adults (mid/late 30s) and two small children. That’s $4836 per year, and we spend an additional $540 per year on an accident supplement that would cover most of our out-of-pocket exposure if we were to have a claim because of an injury.

According to the KFF subsidy calculator, a bronze plan for our family would cost $9330/year – almost double what we pay now. The benefits would be richer than what we have now (more in line with HSA-qualified plans, which we’ve opted not to have anymore because of their higher cost), but the premiums will be significantly higher too. Of course we have to assume that even if the ACA had not passed, our premiums would continue to increase each year. Over the last several years, premiums in the individual market in Colorado have increased for most of our clients by double digits most years, so we can safely assume that we’d probably have had at least a $500/year premium increase next year anyway. But that’s not even close to the 93% increase to the bronze level premium for an ACA-compliant plan.

Those numbers don’t take subsidies into account though. The $9330 is the base price for a bronze plan for a family similar to ours. The actual amount the family will pay in premiums depends entirely on the family’s modified adjusted gross income (MAGI). Here are the premium amounts that the family would pay for a bronze plan at various income levels, assuming that they purchase their coverage through their state’s exchange and take advantage of the available subsidy:

- $40,000 annual income: Bronze plan premium = $38/year (subsidy pays $9292)

- $50,000 annual income: Bronze plan premium = $1438/year (subsidy pays $7892)

- $60,000 annual income: Bronze plan premium = $2986/year (subsidy pays $6344)

- $70,000 annual income: Bronze plan premium = $4667/year (subsidy pays $4663)

- $80,000 annual income: Bronze plan premium = $5673/year (subsidy pays $3657)

- $90,000 annual income: Bronze plan premium = $6623/year (subsidy pays $2707)

- $95,000 annual income (and above): Bronze plan premium = $9330/year, with no subsidy.

The estimated median income for FY 2013 for four-person households in the US is $74,964 (note that this is higher than the overall estimated median household income, because it’s specific to four-person households, which often include two working parents and people who are further along in their careers, as opposed to people who have just finished school and entered the workforce for the first time). And keep in mind the math[…]

Subsidy Calculations Not As Simple As They Seem

If you’re confused about the subsidies for health insurance starting in the exchanges in 2014, you’re probably not alone. Although the basic math is quite simple in terms of the maximum amount a family or individual will have to pay based on their income if they earn less than 400% of federal poverty level, it’s still tough to pin down specifics in terms of who will end up getting subsidies, especially for people who are right on the border of the income cut-off.

There have been subsidy calculators online for quite some time. The first one we found was from the Kaiser Family Foundation, but numerous others have appeared recently. Connect for Health Colorado, the Colorado exchange, has a calculator on its website, but their calculations aren’t  based on Colorado data yet. On the contrary, the calculator includes language explaining that “The premiums in this calculator reflect national estimates from the Congressional Budget Office for silver plans, adjusted for premium inflation and age rating.” So for the time being anyway, you can’t use the Connect for Health Colorado calculator to generate Colorado-specific subsidy numbers.

based on Colorado data yet. On the contrary, the calculator includes language explaining that “The premiums in this calculator reflect national estimates from the Congressional Budget Office for silver plans, adjusted for premium inflation and age rating.” So for the time being anyway, you can’t use the Connect for Health Colorado calculator to generate Colorado-specific subsidy numbers.

That might change after the Division of Insurance releases official rates at the end of July. Part of the confusion around rates and subsidies stems from the fact that rates are not yet finalized. There’s still a lot of number-crunching (and maybe some “do-overs” from carriers) going on, and July 31 has been set as the date for final numbers to be released in Colorado.

For now, it appears that most subsidy calculators are using generalized national average data, estimated by the CBO. But the numbers turn out differently depending on what calculator you use. Let’s consider a family of four, with an income right around the cut-off for subsidy qualification. We’ll do a calculation based on an income of $94,000 and another using $94,500 (which puts them just above the subsidy qualification limit of 400% of FPL). For two parents (age 37 and 35) and two young children with an annual household income of $94,000, the Kaiser Family Foundation calculator estimates a total subsidy of […]

No Colorado Health Insurance Rate Information Yet

May 15th was the deadline for health insurance carriers in Colorado to submit rates for new plans that will be sold in the individual and small group markets in Colorado, both in and outside of the exchange/marketplace (Connect for Health Colorado). Much has been said about today – May 22nd – being the date when those rates are available to the public, and there has been a lot of anticipation about getting to find out what health insurance premiums are going to look like next year in Colorado. We know that in the Pacific Northwest, rates have come in lower than expected, attributed partially to the “heavy competition” in the WA and OR marketplaces (9 and 12 insurers, respectively). Colorado has even more competition than that, with 19 different carriers submitting rates for plans to be sold through Connect for Health Colorado and on the open market (I’ve seen other reports that say 17 carriers, but either way, it will be a robustly competitive market – just as we’ve always had in Colorado).

There has been much speculation about what the new rates will look like. 9News did a piece last week that highlighted the concerns that rates – particularly in the individual market – could be much higher next year. Over the last year or so, in talking with knowledgeable representatives from the various health insurance carriers (who are themselves talking with knowledgeable actuaries), we’ve heard predictions that range from rate decreases for older policy-holders to rates more than doubling for younger insureds… and just about everything in between. So we are very curious to see how things look once the DOI releases rates.

There has been much speculation about what the new rates will look like. 9News did a piece last week that highlighted the concerns that rates – particularly in the individual market – could be much higher next year. Over the last year or so, in talking with knowledgeable representatives from the various health insurance carriers (who are themselves talking with knowledgeable actuaries), we’ve heard predictions that range from rate decreases for older policy-holders to rates more than doubling for younger insureds… and just about everything in between. So we are very curious to see how things look once the DOI releases rates.

Today’s the day that those rates are scheduled to be made public, but I doubt that things will be particularly clear anytime soon […]

Comparing CEO Compensation in Various Healthcare Industries

Joe Paduda of Managed Care Matters did an excellent job with the most recent Health Wonk Review – be sure to stop by his blog and check it out. I thought this article from Dr. Roy Poses was especially interesting. Writing at Health Care Renewal, Dr. Poses shines the spotlight on UnitedHealth Group’s CEO Stephen Hemsley’s oversized compensation. Roy notes that while the increase in CEO compensation does mirror the company’s overall financial success of late, it must also be considered in light of the fact that the company has made some missteps in terms of fulfilling its stated mission to provide health care “at an affordable price” and “expand access to quality health care.” Roy’s article cites several examples of allegedly unethical behavior, and concludes by noting that “Real health care reform needs to make health care leaders accountable, and especially accountable for the bad behavior that helped make them rich.”

I definitely do not disagree with Dr. Poses, and we’ve noted in the past that UnitedHealth Group has had issues with large executive compensation and backdating stock options (that was with a previous CEO, however). But I do want to use this as an opportunity to remind our readers and clients that most health insurance companies have CEO compensation packages that are far lower. Forbes compiled a list of the 498 highest-paid CEOs in 2012, and I scrolled through the first 150 on the list. UnitedHealth Group is there on the first page, ranked number 8 (they’re also ranked number 31 in Fortune 500 total profits, so as Roy said, the CEO salary is at least in the same ballpark with the company’s financial performance).

I definitely do not disagree with Dr. Poses, and we’ve noted in the past that UnitedHealth Group has had issues with large executive compensation and backdating stock options (that was with a previous CEO, however). But I do want to use this as an opportunity to remind our readers and clients that most health insurance companies have CEO compensation packages that are far lower. Forbes compiled a list of the 498 highest-paid CEOs in 2012, and I scrolled through the first 150 on the list. UnitedHealth Group is there on the first page, ranked number 8 (they’re also ranked number 31 in Fortune 500 total profits, so as Roy said, the CEO salary is at least in the same ballpark with the company’s financial performance).

But you have to click through several pages of the CEO compensation list to get to the next health insurance carrier. Humana was the next one I found, ranked at […]

Most Americans Might Not See Big Premium Hikes, But The Individual Market Is Different

One of our all-time favorite bloggers, Julie Ferguson of Workers’ Comp Insider, hosted the most recent Health Wonk Review – the “why hasn’t spring sprung?” edition. Maybe Julie just needs to move to Colorado… here on the Front Range, we’re definitely starting to see signs of spring – today was a beautiful sunny day,… Read more about Most Americans Might Not See Big Premium Hikes, But The Individual Market Is Different

Let Medicare Negotiate Drug Prices And The Government Can Afford Subsidies

Right in the middle of the sequestration mess seems like a good time to discuss the subsidies that are going to be a major part of the ACA starting next year. As of 2014, nearly everyone in the US will be required to have health insurance, and all individual health insurance will become guaranteed issue. There are concerns that premiums in the individual market might increase significantly, but for many families the subsidies enacted by the ACA will help to make coverage more affordable. The subsidies will be available to families earning up to 400% of the federal poverty level; the premium assistance will be awarded on a sliding scale, with the families on the upper edge of that income threshold receiving the smallest subsidies.

Right in the middle of the sequestration mess seems like a good time to discuss the subsidies that are going to be a major part of the ACA starting next year. As of 2014, nearly everyone in the US will be required to have health insurance, and all individual health insurance will become guaranteed issue. There are concerns that premiums in the individual market might increase significantly, but for many families the subsidies enacted by the ACA will help to make coverage more affordable. The subsidies will be available to families earning up to 400% of the federal poverty level; the premium assistance will be awarded on a sliding scale, with the families on the upper edge of that income threshold receiving the smallest subsidies.

But how much will those subsidies cost the taxpayers? How will a government that is so cash-strapped that it’s curbing spending on programs like Head Start and special education be able to fund the subsidies called for in the ACA?

Last summer, the CBO estimated that the exchange subsidies will cost $1,017 billion over the next ten years. Undoubtedly a large sum, but probably necessary in order to make guaranteed issue health insurance affordable for low- and middle-income families.

That sum is partially offset by the CBO’s projections of $515 billion (over the next ten years) in revenue from individual mandate penalties (fines imposed on non-exempt people who opt to go without health insurance starting in 2014), excise tax on “Cadillac” group health insurance policies, and “other budgetary effects” enacted by the healthcare reform law.

That leaves us with $502 billion. Not an insignificant sum of money even when […]

Kaiser Permanente 2013 Rate Increase Announced

Kaiser Permanente announces the average 2013 rate increase for individual/family health insurance in Colorado was 11%.

No 2013 CoverColorado Assessment

CoverColorado announced that there will be no assessment in 2013 on Colorado health insurance carriers. The 2012 assessment was roughly $3.79/month/contract for individual/family insureds.

Anthem Blue Cross of Colorado has also announced that their membership this year was higher than expected this year. They were making up for a shortfall by charging $4.36/month/contract in 2012. Due to the higher enrollment, Anthem BCBS has enough funding to satisfy December without billing subscribers a CoverColorado assessment.

More About Colorado’s Kaiser Permanente Benchmark Health Insurance Plan

Yesterday’s article about Colorado selecting a benchmark health insurance plan for individual and small group policies sold starting in 2014 has raised a few more questions and I wanted to clarify some details.

This publication from the Colorado Division of Insurance, the Health Benefit Exchange and the Governor’s office is an excellent resource and answers a lot of frequently asked questions. It was released earlier this summer, before the Kaiser small group plan was selected, so it includes details about all nine options that were considered as possible benchmark plans. The Kaiser small group plan that was ultimately picked as the benchmark is listed on page 11 as option A, under “one of the three largest small group plans in the state”.

The 2011 Colorado health insurance plan description for the Kaiser policy is here if you’re interested in the plan specifics. We had a question from a reader who wondered whether chiropractic care would be covered, but it’s listed as “not covered” on the plan description form (item number 30). It’s important to note that cost sharing details like deductible, coinsurance and copays are not part of the benchmark program. The concept of benchmark here only applies to the benefits provided by the Kaiser Permanente health insurance plan. The deductible on the Kaiser health insurance plan is $1200, but that DOES NOT mean that all policies will have to have a $1200 deductible in 2014. In order to be sold in the exchanges, health insurance plans will have to cover at least 60% of costs in order to qualify for a “bronze” designation. And there will also be silver, gold and platinum ratings, so there will still be plenty of variation in terms of cost sharing.

If Colorado had not selected a benchmark plan, HHS would have picked one for us. HHS would have […]

Colorado Selects Kaiser Permanente As Its Benchmark Health Insurance Plan

Last December, HHS made it clear that they were giving states a lot of flexibility in determining what plan would serve as the benchmark for the state’s “essential benefits” for individual and small group health insurance policies that would be sold starting in 2014.

After months of consideration, Colorado has selected Kaiser Permanente’s small group plan as a benchmark. This is the largest small group plan in the state, with almost fourteen thousand members, and was selected by a group of officials from the Colorado Division of Insurance, the Governor’s office, and the health benefits exchange. The Division of Insurance will be taking comments until next Monday before making a final announcement, and you can contact them by email ([email protected]) if you’d like your comments to be considered.

The Kaiser plan covers services in the ten areas that are required by the PPACA (ambulatory patient services, emergency care, hospitalization, maternity and newborn care, mental health and substance abuse services, prescription medications, rehabilitative services, lab work, preventive care/disease management, and pediatric care), which means that it will serve as a benchmark for services in those areas without the DOI having to add additional coverage minimums. In addition, the Kaiser plan was generally considered to be a good balance between comprehensive coverage and affordable coverage. It’s not the most comprehensive policy out there (the much maligned “Cadillac plans” offer more benefits), but it provides […]

Will Exchanges Really Be Able To Provide Lower Cost Health Insurance?

[…] It will be interesting to see how health insurance premiums in both the individual and small group market look in 2014 when the exchanges get underway, and then again in 2015. If we do see a significant reduction in the cost of small group health insurance via the exchanges, I have no doubt that plenty of small businesses will be eager to set up group plans for their employees – we already know that cost is the primary barrier, and that a lot of businesses would like to offer health insurance but simply cannot afford to do so. But I also wonder whether we might see trends in premium increases that are similar to what we have now, even within the exchange. In order to really get a handle on health insurance premiums, we have to find effective ways of controlling healthcare costs first. The ACA included numerous cost-control provisions, but it remains to be seen how effective they will be. The exchanges are a good way for people and businesses to be able to shop for health insurance and coordinate their coverage with their federal health insurance subsidies. But the exchanges cannot address the actual cost of healthcare, which continues to climb much faster than inflation.

Best Health Insurance Companies In Colorado

We recently got a call from a client who mentioned that he had done a Google search for the “best health insurance companies in Colorado” and his concern was that Anthem Blue Cross Blue Shield was not on the top ten list that he said came up as the first search result. We were a… Read more about Best Health Insurance Companies In Colorado

Kaiser Will Soon Be Available In Northern Colorado

[…] The new Kaiser facilities will be in Fort Collins at Harmony and Ziegler, and in Loveland at I-25 and Hwy 34. For hospital services, Kaiser is partnering with Banner Health and members will be able to use McKee Medical Center in Loveland and North Colorado Medical Center in Greeley. The medical offices in Fort Collins and Loveland will offer a wide range of services (primary care, lab work, pharmacy, and x-rays, and mammograms will be available at the Loveland office), and are expected to begin providing care by the fall of 2012. A medical office is projected to open in Greeley by 2014. Between now and then however, northern Colorado Kaiser members will be able to see doctors at the Fort Collins and Loveland offices, as well as physicians on the Banner Health network.

Kaiser is planning to offer group coverage to employers in northern Colorado by October 1, 2012. Individual and family coverage should be available sometime next year.