The IRS has announced the 2026 HSA contribution limits: $4,550 for self-only and $9,100 for family coverage. See how these updates affect HDHP requirements, and why HSA plans may still be worth considering for tax savings and future medical expenses.

HSA

2025 HSA Contribution Limits Announced

The IRS has released the 2025 HSA contribution limits: $4,300 for individuals and $8,550 for families. Learn how this impacts HDHP requirements and why these plans may not always be the cheapest despite high deductibles.

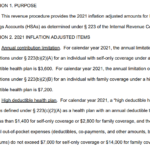

2021 HSA Limits

The IRS has released 2021 limits for High Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs). 2021 HSA Contribution Limits: Self-Only: $3,600 (up from $3,550 in 2020) Family: $7,200 (up from $7,100 in 2020) 2021 HDHP Deductible Minimum: Self-Only: $1,400 ($1,400 in 2020) Family: $2,800 ($2,800 in 2020) 2021 HDHP Out-of-Pocket Expense Maximum: Self-Only:… Read more about 2021 HSA Limits

IRS Announces 2020 HSA Limits

The IRS published Revenue Procedure 2019-25 last week, specifying the 2020 HSA contribution limits. 2020 HSA contribution limits If you have individual coverage under an HSA-qualified plan: $3,550 (up from $3,500 in 2019) If you have family coverage under an HSA-qualified plan: $7,100 (up from $7,000 in 2019) Minimum deductible for HSA-qualified plans Individual coverage: $1,400 (up from $1,350 in 2019) Family coverage:… Read more about IRS Announces 2020 HSA Limits

HSA Contribution Limits for 2019 Have Been Increased By the IRS

The IRS published Revenue Procedure 2018-30 last week, most importantly specifying the HSA contribution limits for 2019. In addition, the minimum deductibles for HDHP’s remained unchanged. However, the maximum out-of-pocket exposure on HSA-qualified plans increased. HSA contribution limits for 2019 For individual coverage under an HSA-qualified plan, the limit is $3,500, which is up from $3,450 in 2018. For family coverage… Read more about HSA Contribution Limits for 2019 Have Been Increased By the IRS

IRS 2018 HSA Contribution Limits, Minimum Deductibles & Maximum Out-of-Pocket

The IRS published Revenue Procedure 2017-37 last week, specifying the IRS 2018 HSA contribution limits, along with the minimum deductibles and maximum out-of-pocket exposure for HSA-qualified plans. IRS 2018 HSA contribution limits * If you have individual coverage under an HSA-qualified plan: $3,450 (up from $3,400 in 2017) If you have family coverage under an… Read more about IRS 2018 HSA Contribution Limits, Minimum Deductibles & Maximum Out-of-Pocket

Standardized plans don’t signal the death of HSAs

Is the HSA (health savings account) an endangered species? Yes, if you believe this National Review article. But at InsureBlog, Hank Stern explains why a lot of the National Review’s points are essentially conjecture. I agree with Hank on this one, and there’s more to the story if you read the details in the 2017 Benefit… Read more about Standardized plans don’t signal the death of HSAs

IRS 2015 HSA Contribution Limits and Regulations

The IRS has released guidelines for 2015 HSA contribution limit, minimum deductible amounts, and maximum out-of-pocket amounts. If you have an HSA or are considering opening one in 2015, here’s what you need to know: For a single individual, the 2015 HSA contribution limit will be $3,350 (a $50 increase). For a family, the 2015 HSA contribution… Read more about IRS 2015 HSA Contribution Limits and Regulations

Catastrophic Plans Not Significantly Less Expensive In Colorado

Even if you’ve been paying pretty close attention to media coverage of the ACA over the last few years, you might not know a whole lot about the ACA’s catastrophic plans. They haven’t been heavily publicized by HHS or the rest of the Obama Administration, they’re not eligible for subsidies, and they have relatively thin… Read more about Catastrophic Plans Not Significantly Less Expensive In Colorado

Getting Past The Health Insurance Plan Cancellation Hysteria

Much has been said recently about how the ACA is causing a tidal wave of policy cancellations, and resulting in people losing coverage that they would prefer to keep. The frustrating part about this – as has generally been the case with every big uproar about the ACA – is that we’re not really getting… Read more about Getting Past The Health Insurance Plan Cancellation Hysteria

Skinny Health Insurance In The Large Group Market

We’ve railed against “mini-med” health plans many times here on our blog, and have spoken with lots of people over the years who have found themselves stuck with medical bills because their mini-med had such low benefit limits. We’ve even had one client who found himself stuck paying for a mini-med until the following open-enrollment period, even after his plan had reached its very low benefit maximum.

We are not fans of mini-meds, and were glad that one of the provisions of the ACA was to do away with lifetime and annual benefit maximums on essential health benefits. For the past couple of years, most sources that report on healthcare reform (including us) have been explaining that mini-meds are going away in 2014. Not everyone was in agreement that  this was a good thing – some people expressed the view that businesses that hire large numbers of minimum wage workers would be switching to more part-time employees or suffering dire financial consequences. But the general consensus was the mini-meds would be a thing of the past once all of the benefit maximum waivers that HHS had granted ran out.

this was a good thing – some people expressed the view that businesses that hire large numbers of minimum wage workers would be switching to more part-time employees or suffering dire financial consequences. But the general consensus was the mini-meds would be a thing of the past once all of the benefit maximum waivers that HHS had granted ran out.

Alas, that doesn’t appear to be the case. Over the last few weeks, I’ve seen several articles explaining how a new type of “skinny” health insurance policy might take the place of mini-meds in the large group market for employers in the retail and food industries who typically hire minimum wage employees. The most thorough article I’ve seen is on Forbes, written by Avik Roy, and it’s worth a read.

To summarize, the ACA focused almost entirely on reforms in the small group and individual market. We’ve been talking about those reforms for three years now, and for the most part, they’re working well to improve the safety net that health insurance should provide. The primary reform in the large group market was the employer mandate, which requires employers with more than 50 full time-equivalent employees to offer health insurance or pay a penalty. This provision of the law has been delayed until 2015, so it’s even more of a back-burner issue right now as we head into open enrollment in the individual market and the opening of the exchanges for individual and small business coverage.

But although the idea was to make sure that large employers offered good qualify coverage in order to avoid paying a fine, it appears that some large employers will opt for the fine instead. The penalty is steep if a large employer doesn’t offer any coverage at all: if even one employee (of a business with at least 50 employees) seeks coverage in an exchange and gets a subsidy, the employer has to pay a penalty of $2000 per employee (the first 30 employees are waived). So if a company has 90 employees, doesn’t offer any coverage […]

HSA Contribution Limits For 2014

After the PPACA was signed into law, questions started to come up regarding the impact of the law on HDHPs and HSAs. People wondered if HSA-qualified plans would still be available within the confines of being ACA-compliant, and there was plenty of confusion as far as how high deductible plans would fare. Now that we’re just a month away from the opening of the exchanges and four months away from ACA-compliant plans being effective, it’s clear that HDHPs and HSAs will continue to be available in 2014.

They may even become more popular than they currently are, as they will likely attract people who would otherwise buy plans with out-of-pocket limits too high to be HSA-qualified. The out-of-pocket limits on individual plans starting in 2014 will be equal to the out-of-pocket limits on HSA-qualified plans, so there will likely be HSA-qualified plans available in all of the state exchanges. Out-of-pocket limits that exceed that amount – for example, $10,000 individual deductibles – will no longer be allowed on any policies, which will make HSA-qualified plans a popular choice for people who want to keep their premiums as low as possible.

They may even become more popular than they currently are, as they will likely attract people who would otherwise buy plans with out-of-pocket limits too high to be HSA-qualified. The out-of-pocket limits on individual plans starting in 2014 will be equal to the out-of-pocket limits on HSA-qualified plans, so there will likely be HSA-qualified plans available in all of the state exchanges. Out-of-pocket limits that exceed that amount – for example, $10,000 individual deductibles – will no longer be allowed on any policies, which will make HSA-qualified plans a popular choice for people who want to keep their premiums as low as possible.

The IRS has set the HSA contribution limits for 2014:

Individual = $3300 and Family = $6550

These limits reflect a small increase ($50 and $100, respectively) over the 2013 limits.

The IRS kept minimum deductible amounts for HSA-qualified health insurance plans the same ($1250 for individual coverage, and $2500 for family coverage), but the maximum allowable out-of-pocket on HSA-qualified health insurance plans in 2014 will increase slightly, to $6350 for an individual and $12,700 for a family (up $100 and $200 respectively from 2013).

Early Renewal Provides A Good Alternative For 2014

Over the last few years, opponents of health care reform have often exaggerated – and sometime outright lied about – the potential negative aspects of the reform law. This has resulted in a public that is often woefully misinformed about what the law does and does not do. But the spin is not limited to just opponents of the law. Sometimes ACA supporters spin things too. This Huffington Post article from a few months ago is a good example. The title, “Aetna seeks to avoid Obamacare rules next year” is designed to play on the general unpopularity (and over-estimation of perceived profits) of insurance companies. When you read a little further, you find that Aetna is reaching out to brokers and insureds to let them know that Aetna will be allowing members to opt for an early renewal in December of this year – if they want to keep their current policy until December 2014.

Why is this being portrayed as a bad thing?

It is indisputable that people who are healthy, buy their own health insurance, won’t qualify for subsidies and prefer high deductible health plans are going to have higher premiums for ACA-compliant plans than they have now. Some of these people don’t mind high deductibles. They don’t consider their policy to be skimpy or junk insurance just because it isn’t ACA compliant. You might have seen headlines about how only a tiny fraction of existing individual health plans meet the requirements that the ACA will impose next year, but that doesn’t mean that the existing  plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

There are absolutely some bad health insurance plans on the market, with skimpy coverage, limited networks and lots of fine print. But there are also lots of good quality health insurance plans and reputable carriers. And there are plenty of people who are not going to qualify for subsidies next year (roughly half of the people who currently buy individual health insurance). If those people currently have – and are happy with – a high deductible plan that is less expensive than what they would have to pay for an ACA-compliant plan, there’s no reason that they shouldn’t be able to keep their plan as long as possible in 2014. The law requires coverage to be ACA-compliant when a policy renews in 2014. Carriers that are offering early renewals in December are providing good customer service, especially for insureds who […]

Exchange Subsidy Eligibility Impeded By High-Priced Group Health Insurance Access

We were talking with a client last week about her health insurance situation, and it inspired me to do a little more digging around to see how eligibility for subsidies could be impacted by the availability of employer-sponsored health insurance. In our client’s situation, she’s a homemaker and her husband makes about $20,000 per year, working for a small business. They also have a child, who is currently covered by Medicaid. Her husband can get health insurance from his employer for $75/month. But if he adds his wife, the cost goes up to $500/month. $6,000 per year for health insurance when you earn $20,000 isn’t really a viable option. Fortunately, as of January 2014, Medicaid will be available in Colorado to families with household incomes up to 133% of FPL (in 2013, that’s almost $26,000 for a family of three).

But let’s consider a hypothetical family that makes a little more – say $28,000/year – and has the same option for employer-sponsored health  insurance. They would be above the cutoff for family Medicaid, but well below the 400% of poverty level that determines eligibility for premium assistance tax credits (subsidies) in the exchange (400% of FPL for a family of three is a little over $78,000 in 2013). And I think we can probably all agree that spending $6000 a year on health insurance would be a significant burden for a family that earns $28,000 a year.

insurance. They would be above the cutoff for family Medicaid, but well below the 400% of poverty level that determines eligibility for premium assistance tax credits (subsidies) in the exchange (400% of FPL for a family of three is a little over $78,000 in 2013). And I think we can probably all agree that spending $6000 a year on health insurance would be a significant burden for a family that earns $28,000 a year.

We’ve all heard lots of talk about how subsidies are available in the exchanges for people who don’t have access to “affordable” employer-sponsored health insurance. I think most of us take that to mean that for families who earn less than 400% of FPL, subsidies are available both to those without an option to purchase employer-sponsored health insurance, and for families that have the option to do so but at a prohibitively high premium. You’ve probably also heard that the cutoff for determining whether employer-sponsored health insurance is “affordable” is 9.5% of the employee’s wages.

Unfortunately, it’s not as simple as it might sound, and the official rules might leave some families without a lot of practical options. I discussed this scenario last week with the Colorado Coalition for the Medially Underserved (CCMU). Gretchen Hammer is the Executive Director of CCMU, and she’s also the Board Chair of Connect for Health Colorado (the state’s exchange), so there’s a good flow of information between the two organizations. CCMU (and Connect for Health Colorado, via CCMU) responded to my questions quickly and thoroughly, and I highly recommend both sources if you’re in Colorado and curious to see how your specific situation will be impacted as the ACA is implemented further (here’s contact info for CCMU and Connect for Health Colorado).

My concern in the case of our hypothetical family was that the employee’s contribution for his own health insurance is $75/month, which works out to only 3.2% of his income – well under the threshold for “affordable,” based on the 9.5% rule. And as […]

Subsidies Are Key To Limiting Rate Shock for Coverage in Exchanges

[…] because it provides premiums for bronze-level plans as well as the standard silver-level (subsidies are calculated based on premiums for silver plans, and premiums that have been discussed in the media thus far have been almost entirely for silver plans). Healthy individuals and families who currently opt for higher deductible plans will be the ones who see the biggest change in premiums, since the ACA generally shifts plans towards richer benefits. So while benefits will be greater in the future, premiums will be too – and families who would rather have lower premiums and higher out-of-pocket exposure will be herded onto higher-priced, richer-benefit plans. Bronze-level plans will be their obvious choice, although even those plan s will have richer benefits than many of the high deductible plans that are currently available in the individual market. Families and individuals who prefer richer benefits already will find that their premium changes are not as dramatic, since they will likely end up with an ACA-compliant plan that is more similar in design to what they currently buy (they will be more likely to opt for silver or gold plans).

s will have richer benefits than many of the high deductible plans that are currently available in the individual market. Families and individuals who prefer richer benefits already will find that their premium changes are not as dramatic, since they will likely end up with an ACA-compliant plan that is more similar in design to what they currently buy (they will be more likely to opt for silver or gold plans).

I’m using a family of four modeled after my own family so that I can compare premiums with what we pay now. Our current plan is $403/month for two adults (mid/late 30s) and two small children. That’s $4836 per year, and we spend an additional $540 per year on an accident supplement that would cover most of our out-of-pocket exposure if we were to have a claim because of an injury.

According to the KFF subsidy calculator, a bronze plan for our family would cost $9330/year – almost double what we pay now. The benefits would be richer than what we have now (more in line with HSA-qualified plans, which we’ve opted not to have anymore because of their higher cost), but the premiums will be significantly higher too. Of course we have to assume that even if the ACA had not passed, our premiums would continue to increase each year. Over the last several years, premiums in the individual market in Colorado have increased for most of our clients by double digits most years, so we can safely assume that we’d probably have had at least a $500/year premium increase next year anyway. But that’s not even close to the 93% increase to the bronze level premium for an ACA-compliant plan.

Those numbers don’t take subsidies into account though. The $9330 is the base price for a bronze plan for a family similar to ours. The actual amount the family will pay in premiums depends entirely on the family’s modified adjusted gross income (MAGI). Here are the premium amounts that the family would pay for a bronze plan at various income levels, assuming that they purchase their coverage through their state’s exchange and take advantage of the available subsidy:

- $40,000 annual income: Bronze plan premium = $38/year (subsidy pays $9292)

- $50,000 annual income: Bronze plan premium = $1438/year (subsidy pays $7892)

- $60,000 annual income: Bronze plan premium = $2986/year (subsidy pays $6344)

- $70,000 annual income: Bronze plan premium = $4667/year (subsidy pays $4663)

- $80,000 annual income: Bronze plan premium = $5673/year (subsidy pays $3657)

- $90,000 annual income: Bronze plan premium = $6623/year (subsidy pays $2707)

- $95,000 annual income (and above): Bronze plan premium = $9330/year, with no subsidy.

The estimated median income for FY 2013 for four-person households in the US is $74,964 (note that this is higher than the overall estimated median household income, because it’s specific to four-person households, which often include two working parents and people who are further along in their careers, as opposed to people who have just finished school and entered the workforce for the first time). And keep in mind the math[…]

Many Traditional Plans Are Currently Less Expensive Than HDHPs

We used to be just as impressed with HDHPs and HSAs, but – at least in Colorado – they have lost some of their appeal over the last few years because HDHPs aren’t as price competitive as they once were. Our own family had an HDHP and HSA for several years, but we switched a couple years ago to a new  plan that is not HSA-qualified (we’re still allowed to have our HSA, and we are able to withdraw money from it if we need to pay medical expenses. But we can’t contribute any additional money to it unless we switch back to an HSA-qualified HDHP). The reason we switched was the premium. Our HSA-qualified plan was going up to $570/month, and the new plan we chose was $311/month (it’s now right around $400). HSA-qualified plans have one joint deductible for the whole family, and expenses like prescriptions are rolled into that unified deductible. That’s in contrast to the type of plan we have now, with a maximum out of pocket that allows for two family members to meet individual deductible and coinsurance limits (basically doubling the potential – although unlikely – out of pocket exposure). Our current plan also follows the recent trend of incorporating a separate prescription deductible that must be met before prescriptions are covered with a traditional copay. This type of plan has lesser benefits than an HDHP, and thus the premiums tend to be lower as well.

plan that is not HSA-qualified (we’re still allowed to have our HSA, and we are able to withdraw money from it if we need to pay medical expenses. But we can’t contribute any additional money to it unless we switch back to an HSA-qualified HDHP). The reason we switched was the premium. Our HSA-qualified plan was going up to $570/month, and the new plan we chose was $311/month (it’s now right around $400). HSA-qualified plans have one joint deductible for the whole family, and expenses like prescriptions are rolled into that unified deductible. That’s in contrast to the type of plan we have now, with a maximum out of pocket that allows for two family members to meet individual deductible and coinsurance limits (basically doubling the potential – although unlikely – out of pocket exposure). Our current plan also follows the recent trend of incorporating a separate prescription deductible that must be met before prescriptions are covered with a traditional copay. This type of plan has lesser benefits than an HDHP, and thus the premiums tend to be lower as well.

Several years ago, HDHPs were very popular among our clients in Colorado. But over the last few years, they’ve become much less popular, mainly because there are so many less-expensive health insurance options on the market now. HDHPs haven’t really changed in terms of design, but their premiums have climbed to reflect the rising cost of health care. In order to provide more affordable options, health insurance carriers have designed new plans with increased out-of-pocket exposure and lower premiums. Because HDHPs are relatively constrained by regulations regarding their structure, they haven’t been able to remain at the low end of the price scale in the health insurance market. In fact, many HDHP plan designs are now […]

Subsidy Calculations Not As Simple As They Seem

If you’re confused about the subsidies for health insurance starting in the exchanges in 2014, you’re probably not alone. Although the basic math is quite simple in terms of the maximum amount a family or individual will have to pay based on their income if they earn less than 400% of federal poverty level, it’s still tough to pin down specifics in terms of who will end up getting subsidies, especially for people who are right on the border of the income cut-off.

There have been subsidy calculators online for quite some time. The first one we found was from the Kaiser Family Foundation, but numerous others have appeared recently. Connect for Health Colorado, the Colorado exchange, has a calculator on its website, but their calculations aren’t  based on Colorado data yet. On the contrary, the calculator includes language explaining that “The premiums in this calculator reflect national estimates from the Congressional Budget Office for silver plans, adjusted for premium inflation and age rating.” So for the time being anyway, you can’t use the Connect for Health Colorado calculator to generate Colorado-specific subsidy numbers.

based on Colorado data yet. On the contrary, the calculator includes language explaining that “The premiums in this calculator reflect national estimates from the Congressional Budget Office for silver plans, adjusted for premium inflation and age rating.” So for the time being anyway, you can’t use the Connect for Health Colorado calculator to generate Colorado-specific subsidy numbers.

That might change after the Division of Insurance releases official rates at the end of July. Part of the confusion around rates and subsidies stems from the fact that rates are not yet finalized. There’s still a lot of number-crunching (and maybe some “do-overs” from carriers) going on, and July 31 has been set as the date for final numbers to be released in Colorado.

For now, it appears that most subsidy calculators are using generalized national average data, estimated by the CBO. But the numbers turn out differently depending on what calculator you use. Let’s consider a family of four, with an income right around the cut-off for subsidy qualification. We’ll do a calculation based on an income of $94,000 and another using $94,500 (which puts them just above the subsidy qualification limit of 400% of FPL). For two parents (age 37 and 35) and two young children with an annual household income of $94,000, the Kaiser Family Foundation calculator estimates a total subsidy of […]

Comparing Individual Marketplace Premiums to Small Group is Disingenuous

After a lot of confusion late last month regarding 2014 health insurance rates in Colorado and information about which carriers would be offering policies in the exchange (Connect for Health Colorado), off the exchange, or both, a lot of the dust started to settle late last week and more information has become available both in terms of rates (although they won’t be finalized for another couple months) and carriers. The Colorado Division of Insurance has released a full list of the carriers that submitted rates for next year, including details regarding whether each plan will be for individual or small group, and sold on exchange, off exchange, or both. Detailed rate information is available from some carriers on the Colorado Division of Insurance website, although there will likely be a lot of change between now and October.

As soon as rate data started becoming available in a few states, both supporters and opponents of the ACA jumped on the info and used it to paint two very different pictures. HealthBeat’s Maggie Mahar (who has astutely and accurately rebuked a lot of political spin and fear-mongering from opponents of the ACA ever since it was signed into law) called out Avik Roy for his critical view of the new rates, noting that he was comparing “apples to rotten apples” in his Forbes article about rate shock. But Roy did make a very good point is his article, which was based on the release of rates in CA. He noted that

“The rates submitted to Covered California for the 2014 individual market,” the state said in a press release, “ranged from two percent above to 29 percent below the 2013 average premium for small employer plans in California’s most populous regions.”

That’s the sentence that led to all of the triumphant commentary from the left. “This is a home run for consumers in every region of California,” exulted Peter Lee.

Roy went on to point out the key words there, which might have gone unnoticed by people who aren’t in the health insurance industry or paying very close attention to the details: The rates for the new individual market are being compared to the existing rates in the small group market.

Roy went on to point out the key words there, which might have gone unnoticed by people who aren’t in the health insurance industry or paying very close attention to the details: The rates for the new individual market are being compared to the existing rates in the small group market.

It is not at all surprising that the new individual rates are looking similar to existing small group rates. Earlier this year I wrote about how difficult it was going to be for the individual market to be priced significantly lower than the small group market once medical underwriting was no longer a factor.

But I’m not sure that most people (other than business owners) are completely aware of how high small group health insurance premiums are. As we’ve noted many times, people who have employer-based health insurance are often insulated from the true cost of the coverage, thanks to the fact that at least a portion of the premium is paid by the employer. Some people started […]

You Have To Have An HSA Qualified Health Plan In Order To Set Up An HSA

It’s tax season, and that always correlates with an increase in questions about HSAs. We always get several calls at this time of year from people who want to set up just an HSA by itself and are wondering how to go about that, and we’ve even had people call and tell us that their accountant told them to go set up an HSA because it would be an excellent way to get an additional tax deduction.

HSAs (health savings accounts) are indeed a great way to get an above-the-line tax deduction. They’re also a great way to save for future medical expenses and/or retirement. But it’s not as simple as just setting one up and contributing money. You have to have an HSA qualified high deductible health plan in place in order to be able to contribute money to an HSA. Not all high deductible health insurance policies are HSA qualified. The IRS has very specific guidelines in terms of how HSA qualified HDHPs have to be structured, and if a plan meets those guidelines, it will be labeled as such in the marketing materials.

Look at the picture below:

“PPO (0) – HMO (0)” ??? That’s confusing too! PPO and HMO are network types and HSA qualified has nothing to do with networks. HSA qualified plans can be PPO or HMO. In Colorado, all individual health insurance is PPO, except for Kaiser Permanente. They’re the only individual/family HMO.

To give an example, our family had an HSA qualified HDHP for several years, and we contributed to our HSA during those years. But in 2011, we switched to a Core Share plan from Anthem Blue Cross and Blue Shield. It’s less expensive than Anthem’s HSA qualified plans (and less expensive than most of the other plans we looked at as well), and even though it’s a high deductible plan, it doesn’t meet the requirements for being HSA qualified. The maximum allowable out-of-pocket expense limit for a family on an HSA qualified plan is $12,500 in 2013, and our plan has a $15,000 maximum out-of-pocket exposure for a family. So even though the policy has a high deductible, covers preventive care before the deductible, doesn’t have copays, and generally meets all of the other requirements, the higher out-of-pocket limit means that we cannot contribute money to our HSA unless we switch back to an HSA qualified health plan in the future.

That same IRS link also explains how you can switch to an HSA qualified health plan anytime up until […]

The ACAs Looming Premium Hikes are Big – How We Can Lower Them

It’s been almost three years since the ACA was signed into law, and in that time, the implementation process has been both steady and plagued with difficulties. The major provisions of the law have largely adhered to the original scheduled time frames, but there have been numerous hiccups along the way, culminating last summer in a Supreme Court case that challenged the legality of several aspects of the law. Once SCOTUS ruled in favor of the ACA, the path was largely cleared for implementation of the health insurance exchanges (marketplaces) that are scheduled to be open for business this fall with policies effective next January. The individual mandate will also take effect in January, but the penalty for not having health insurance in 2014 will be very small ($95 per uninsured person, or 1% of taxable household income). This has caused some concern that the mandate might not be strong enough to avoid the looming problem of adverse selection: specifically, that people who are in need of healthcare might be much more likely to purchase health insurance than people who are currently healthy once all plans are guaranteed issue.

Last month I wrote an article about how the ACA will largely erase the differences that currently exist between the small group and the individual health insurance markets. Once that happens, it would be odd to expect to not see a corresponding change reflected in the premiums. I think it’s unlikely that the premiums will equalize via a drop in small group premiums (if anything, the requirement that small group plan deductibles not exceed $2000 might mean that the average small group premiums increase too). The individual market is poised to become more like the small group market once the policies become guaranteed issue, and the premiums in the small group market are currently significantly higher than the premiums in the individual market. There will likely be a price decrease for people at the upper end of the age spectrum in the individual market, since their premiums are going to be limited to a maximum of 3 times the premiums for young people. But there is a growing concern that those young people – and probably a lot of people in the middle too – might be in for some sticker shock.

Yes, the subsidies will help cushion the blow for people earning less than 400% of federal poverty level. But that still leaves a lot of people facing higher premiums and no subsidies. People who aren’t poor but definitely aren’t wealthy either – in other words, people who are middle class. Some of them are probably quite healthy. Some of them might have money stashed away in HSAs in order to pay for unexpected medical bills. Some of them might be happy to opt for higher deductibles and “catastrophic” health insurance plans in trade for lower premiums. But the way the ACA is currently written, they won’t be allowed to do that. The “catastrophic” plans will only be available to people under the age of 30 or people who meet the economic hardship qualifications. Everyone else will have to have at least a “bronze” plan that provides a broad range of benefits mandated by the ACA.

Yes, the subsidies will help cushion the blow for people earning less than 400% of federal poverty level. But that still leaves a lot of people facing higher premiums and no subsidies. People who aren’t poor but definitely aren’t wealthy either – in other words, people who are middle class. Some of them are probably quite healthy. Some of them might have money stashed away in HSAs in order to pay for unexpected medical bills. Some of them might be happy to opt for higher deductibles and “catastrophic” health insurance plans in trade for lower premiums. But the way the ACA is currently written, they won’t be allowed to do that. The “catastrophic” plans will only be available to people under the age of 30 or people who meet the economic hardship qualifications. Everyone else will have to have at least a “bronze” plan that provides a broad range of benefits mandated by the ACA.

Please don’t misunderstand me here. I firmly believe that our healthcare system needed […]

Committee Kills Bill That Would Have Repealed Colorado Exchange Law

Colorado Representative Janak Joshi (R, Colorado Springs) is continuing his efforts to get government out of healthcare, but his latest bill died in a 9-2 vote in the House Health, Insurance and Environment Committee, with the no votes coming from both political parties. Joshi’s defeated bill would have repealed the 2011 law that created Colorado’s… Read more about Committee Kills Bill That Would Have Repealed Colorado Exchange Law

Value Based Health Insurance Plan Design Pilot Program Shows Promise

[…] With HSA-qualified plans, there have long been concerns that policy-holders are more likely to avoid necessary as well as unnecessary treatments, in an effort to save money. This is because the plan structure usually doesn’t cover any costs except preventive care until the insured has met the deductible. With the sort of value-based plan design being tested in the San Luis Valley HMO program, care that has a high level of evidence-based backing might be covered with no cost-sharing, while other treatments require some financial contribution from the patient. So it’s not the same as an HSA-qualified plan’s structure that just relies on a high deductible to deter a patient from seeking excessive care. And instead of putting all of the burden on the patient, the value-based insurance design incorporates a team approach, with involvement from patients, doctors and health insurance carriers. All in all, it seems like an excellent idea.

How Does Health Care Reform Impact HDHPs and HSAs?

Will HSA qualified health insurance plans and Health Savings Accounts (HSA) still exist after the majority of the remaining PPACA changes are implemented in 2014? That’s a question that we often hear from Colorado health insurance clients who are concerned about their existing HSA qualified high deductible health plan (HDHP)/HSA, as well as people who are considering an HDHP but uncertain about the future of that type of health insurance.

In terms of direct impact, the PPACA changes very little about HDHPs and HSAs. There are only two […]

How Individual Health Insurance Measures Up

[…] So although it’s true that out-of-pocket costs are higher in the individual market (likely due in large part to people opting for policies that are less expensive), if we combine the premiums and the out-of-pocket costs, the total expenses are lower in the individual market ($8,821 in the individual market versus $15,158 in the group market, using Colorado private sector family premiums for the group data). To ignore cost when comparing the policies is to leave out a large piece of the equation.

The Commonwealth Fund study mentions maternity coverage as an example of a benefit that is often not included on individual policies, thus earning them a “tin” rating. In Colorado, maternity is now included on all policies that have been issued or renewed since January 2011 (the data for the study was collected in 2010). But in many states, maternity coverage in the individual market is rare and/or quite expensive as an optional rider. This will change in 2014, and based on our observations of the Colorado individual market over the past year and a half, I would say that the change will be a positive one. But given the fact that so many individual policies did not include maternity coverage in 2010, I’m curious as to what percentage of individual health insurance plans would have earned at least a “bronze” ranking if maternity had been excluded from the data. If we don’t count maternity, how do individual health insurance plans measure up? Most individual plans (assuming they aren’t mini-meds or some sort of limited benefit coverage) in Colorado in 2010 covered complications of pregnancy and charges incurred by a newborn (eg, a premature baby who is in NICU for weeks). But routine maternity care was included on very few individual plans in Colorado prior to 2011. Given that fact, and the fact that all new individual plans in Colorado now have maternity coverage, I’d be curious to see how individual and group plans compare in 2012.

Overall, I think that The Commonwealth Fund study is a good one. It highlights the out-of-pocket exposure that people have in the individual market, and it’s true that the average plan in the individual market has higher out-of-pocket exposure than the average plan in the group market. But to make the comparison without also looking at the premium costs in each market seems a bit disingenuous. If individual health insurance were two to three times as expensive as it is now, it could cover more costs for members with less cost-sharing. But that doesn’t seem like a good solution either.

New Healthcare Price Comparison Database Coming Soon In Colorado

[…] Happily, it looks like we’re going to be getting a good healthcare price comparison database here in Colorado next year. This article from Kaiser Health News has all the details, and it looks promising. As the article states – and as we’ve noted here many times – healthcare costs sometimes seem to have little rhyme or reason. They can vary widely from one provider to another and from one area to another without much of a difference in quality of care or patient outcomes. But there are also some variables that have a justifiable impact on healthcare cost variation, such as the overhead expenses associated with teaching hospitals and hospitals that treat a higher-than-average number of uninsured patients. It sounds like the All Payor Claims Database is addressing those issues, so it will be interesting to see how the database accounts for them. I also like the fact that providers will be able to see how they compare with other providers before the data is released to the public, in order to allow the providers to start making improvements where necessary.

I can see this comparison tool – especially given how comprehensive it looks to be – being very beneficial for Colorado residents, and also helping to foster more competition among healthcare providers in the state.