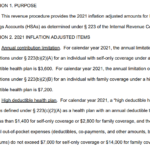

The IRS has released 2021 limits for High Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs). 2021 HSA Contribution Limits: Self-Only: $3,600 (up from $3,550 in 2020) Family: $7,200 (up from $7,100 in 2020) 2021 HDHP Deductible Minimum: Self-Only: $1,400 ($1,400 in 2020) Family: $2,800 ($2,800 in 2020) 2021 HDHP Out-of-Pocket Expense Maximum: Self-Only:… Read more about 2021 HSA Limits

HHS

Exchange Subsidy Eligibility Impeded By High-Priced Group Health Insurance Access

We were talking with a client last week about her health insurance situation, and it inspired me to do a little more digging around to see how eligibility for subsidies could be impacted by the availability of employer-sponsored health insurance. In our client’s situation, she’s a homemaker and her husband makes about $20,000 per year, working for a small business. They also have a child, who is currently covered by Medicaid. Her husband can get health insurance from his employer for $75/month. But if he adds his wife, the cost goes up to $500/month. $6,000 per year for health insurance when you earn $20,000 isn’t really a viable option. Fortunately, as of January 2014, Medicaid will be available in Colorado to families with household incomes up to 133% of FPL (in 2013, that’s almost $26,000 for a family of three).

But let’s consider a hypothetical family that makes a little more – say $28,000/year – and has the same option for employer-sponsored health  insurance. They would be above the cutoff for family Medicaid, but well below the 400% of poverty level that determines eligibility for premium assistance tax credits (subsidies) in the exchange (400% of FPL for a family of three is a little over $78,000 in 2013). And I think we can probably all agree that spending $6000 a year on health insurance would be a significant burden for a family that earns $28,000 a year.

insurance. They would be above the cutoff for family Medicaid, but well below the 400% of poverty level that determines eligibility for premium assistance tax credits (subsidies) in the exchange (400% of FPL for a family of three is a little over $78,000 in 2013). And I think we can probably all agree that spending $6000 a year on health insurance would be a significant burden for a family that earns $28,000 a year.

We’ve all heard lots of talk about how subsidies are available in the exchanges for people who don’t have access to “affordable” employer-sponsored health insurance. I think most of us take that to mean that for families who earn less than 400% of FPL, subsidies are available both to those without an option to purchase employer-sponsored health insurance, and for families that have the option to do so but at a prohibitively high premium. You’ve probably also heard that the cutoff for determining whether employer-sponsored health insurance is “affordable” is 9.5% of the employee’s wages.

Unfortunately, it’s not as simple as it might sound, and the official rules might leave some families without a lot of practical options. I discussed this scenario last week with the Colorado Coalition for the Medially Underserved (CCMU). Gretchen Hammer is the Executive Director of CCMU, and she’s also the Board Chair of Connect for Health Colorado (the state’s exchange), so there’s a good flow of information between the two organizations. CCMU (and Connect for Health Colorado, via CCMU) responded to my questions quickly and thoroughly, and I highly recommend both sources if you’re in Colorado and curious to see how your specific situation will be impacted as the ACA is implemented further (here’s contact info for CCMU and Connect for Health Colorado).

My concern in the case of our hypothetical family was that the employee’s contribution for his own health insurance is $75/month, which works out to only 3.2% of his income – well under the threshold for “affordable,” based on the 9.5% rule. And as […]

No Colorado Health Insurance Rate Information Yet

May 15th was the deadline for health insurance carriers in Colorado to submit rates for new plans that will be sold in the individual and small group markets in Colorado, both in and outside of the exchange/marketplace (Connect for Health Colorado). Much has been said about today – May 22nd – being the date when those rates are available to the public, and there has been a lot of anticipation about getting to find out what health insurance premiums are going to look like next year in Colorado. We know that in the Pacific Northwest, rates have come in lower than expected, attributed partially to the “heavy competition” in the WA and OR marketplaces (9 and 12 insurers, respectively). Colorado has even more competition than that, with 19 different carriers submitting rates for plans to be sold through Connect for Health Colorado and on the open market (I’ve seen other reports that say 17 carriers, but either way, it will be a robustly competitive market – just as we’ve always had in Colorado).

There has been much speculation about what the new rates will look like. 9News did a piece last week that highlighted the concerns that rates – particularly in the individual market – could be much higher next year. Over the last year or so, in talking with knowledgeable representatives from the various health insurance carriers (who are themselves talking with knowledgeable actuaries), we’ve heard predictions that range from rate decreases for older policy-holders to rates more than doubling for younger insureds… and just about everything in between. So we are very curious to see how things look once the DOI releases rates.

There has been much speculation about what the new rates will look like. 9News did a piece last week that highlighted the concerns that rates – particularly in the individual market – could be much higher next year. Over the last year or so, in talking with knowledgeable representatives from the various health insurance carriers (who are themselves talking with knowledgeable actuaries), we’ve heard predictions that range from rate decreases for older policy-holders to rates more than doubling for younger insureds… and just about everything in between. So we are very curious to see how things look once the DOI releases rates.

Today’s the day that those rates are scheduled to be made public, but I doubt that things will be particularly clear anytime soon […]

Colorado Health Insurance Exchange Won’t Be A Train Wreck

When Max Baucus predicted that the implementation of key aspects of the ACA could be a “huge train wreck coming down“, his comments were met with a lot of “see, I told you so!” comments from the right, and some surprise from the left, given how instrumental Baucus was in drafting the legislation. Now Harry Reid has stated that he agrees with Baucus. Reid noted that there is still much work to be done, and that significant  additional funding is needed in order to make the remaining implementation of the ACA successful. HHS Secretary Kathleen Sebelius pointed out that her requests for additional funding were rejected in a recent short-term funding plan, but she’s optimistic about the ACA implementation, saying “…we are on track to fully implement marketplaces in January 2014 and to be open for open enrollment.”

additional funding is needed in order to make the remaining implementation of the ACA successful. HHS Secretary Kathleen Sebelius pointed out that her requests for additional funding were rejected in a recent short-term funding plan, but she’s optimistic about the ACA implementation, saying “…we are on track to fully implement marketplaces in January 2014 and to be open for open enrollment.”

I would say that the job Sebelius has in front of her is a monumental one, no doubt made harder by the propagation of misinformation and outright lies (there are no death panels!). In addition, a majority of the states opted to either have the federal government run their exchanges (26 states) or partner with the state on a joint exchange (7 states). Only 17 states plus the District of Columbia have taken sole responsibility for running their own health insurance exchanges (Colorado is in this category). So although HHS will likely be able to implement very similar exchanges in the 26 states where they will be fully responsible for running the exchange, making economies of scale work in their favor, the fact remains that they face a significant task: getting exchanges going in more than half the states, often in places where resistance to the ACA […]

Healthcare For Cultural Minorities In Colorado

You probably already knew that a Caucasian in Colorado has a life expectancy of almost 80 years. But did you know that an American Indian’s life expectancy is 45 years? This article from the Colorado Health Foundation, written by Sandy Graham, is a must-read for anyone interested in healthcare for minorities, specifically American Indians. The article focuses on the work that Marguerite Salazar is doing as Region VIII director of HHS, based in Denver (In addition to Colorado, Region VIII encompasses UT, WY, MT, SD and ND). Prior to working with HHS,  Salazar was President and CEO of Valley-Wide Health Systems, a rural community-based healthcare program that served 40,000 people in Southern Colorado, including many migrant farm workers.

Salazar was President and CEO of Valley-Wide Health Systems, a rural community-based healthcare program that served 40,000 people in Southern Colorado, including many migrant farm workers.

I particularly liked the focus on “culturally competent” healthcare – a concept that can be vital for the health of any minority group that doesn’t have the same heritage and traditions as the majority of healthcare providers in an area. And I liked this description from the article of work that Salazar did at Valley-Wide:

“…she [Salazar] and her staff had to explain to non-Hispanic providers that, yes, this person could not afford care, but had a cell phone – because he had to be able to hear from the field boss when agricultural work was available. And yes, the family drove a new truck – because they needed dependable transportation to get to the next farm job and that was most likely all they owned.”

It’s a perfect anecdote for anyone who has ever been frustrated by the internet meme describing how a patient in the ER has a cell phone (with a fancy ring tone!) and various other bling – and is on Medicaid. It seems to be circulated in an effort to show righteous indignation towards people who would dare to have anything more than a cardboard box and a blanket if they’re using “entitlements” to pay for things like food or healthcare. Salazar’s understanding of the healthcare needs of low-income families and cultural minorities comes[…]

Health Wonks Tackle New Questions in Healthcare Reform

Welcome to the Health Wonk Review! It’s an honor to host the HWR, and the posts in this edition are excellent, as always. We’ve got a wide range of topics today, but most of them are at least loosely associated with some aspect of health care reform, so here’s a brief visual summary for you.

Now that you know where we’re heading, here are the nitty gritty details. There’s something for everyone in this edition of the HWR, so keep reading!

Roy Poses, writing at Healthcare Renewal, explains how doctors are pushing back against corporate bosses who put profits above all else. His article describes two recent lawsuits filed by physician groups alleging that the hospital systems they worked for were sacrificing patient welfare in the name of profit. The details are sickening to read: One hospital group encouraged its docs to exaggerate the severity of patient conditions and needlessly admit patients from the ER to hospital beds in order to bill more for their treatment. Another hospital group that owns three hospitals and also partially owns an ambulance company was making patient transfers (using their own ambulance company despite slower response times) a top priority – to the extent that a doctor’s transfer rate was a factor in bonuses and performance reviews. An admin email stated that “the performance we are looking for are transfers.” Wow. Transfers just for the sake of racking up revenue – patient welfare had nothing to do with it, and was likely compromised when the slower ambulance company was used in cases where the transfer was actually warranted. These lawsuits are in their early stages and nothing has been settled in court yet, but they hint at some very serious problems brewing in for-profit (and even some non-profit) hospital systems.

Duncan Cross brings us an emotionally compelling article about Arijit Guha that is a must-read for anyone interested in the problem of under-insurance. Being under-insured might not be quite as bad as being uninsured, but while the uninsured know that they don’t have health insurance, people who are under-insured might not be aware of the specific short-comings of their coverage until they actually have a serious, ongoing medical condition. Arijit was a grad student at ASU, and he recently passed away from colon cancer. During his fight with cancer, he also had to battle his insurance carrier (Aetna) and raise money selling t-shirts in order to fund his treatment. He had a student health insurance policy, and those have long been notorious for having low coverage limits. Duncan has an insider view of some of the medical issues that Arijit had to face, and he, too, attended grad school for a while,  working on campus at a job that afforded him faculty health insurance rather than student coverage. He notes that a major problem that wasn’t often addressed in articles about Guha is that the university was the organization responsible for choosing a health insurance plan for its students – Aetna just provided the coverage that the school requested.

working on campus at a job that afforded him faculty health insurance rather than student coverage. He notes that a major problem that wasn’t often addressed in articles about Guha is that the university was the organization responsible for choosing a health insurance plan for its students – Aetna just provided the coverage that the school requested.

Maggie Mahar‘s article at Health Beats will be appreciated by NPs and PAs. Her post A Doctor Confides: “My Primary Doc is a Nurse” is a great look at the increase in the number of PAs and NPs who are providing primary care, and the myriad issues that accompany this change. Maggie delves into topics like turf war and resistance on the part of MDs to accept NPs as quality primary care providers. She also addresses patient and provider satisfaction, patient safety, the cost of primary care, and the shortage of MDs who are choosing primary care versus the willingness of NPs to […]

The New Individual Health Insurance Application Questions

For more than a decade now, we’ve been helping our clients complete individual health insurance applications. Before online applications were common, we would drive to our clients’ homes and help them fill out paper applications. These days, Jay spends many hours each week on the phone with clients who have questions at some point during… Read more about The New Individual Health Insurance Application Questions

Most Americans Might Not See Big Premium Hikes, But The Individual Market Is Different

One of our all-time favorite bloggers, Julie Ferguson of Workers’ Comp Insider, hosted the most recent Health Wonk Review – the “why hasn’t spring sprung?” edition. Maybe Julie just needs to move to Colorado… here on the Front Range, we’re definitely starting to see signs of spring – today was a beautiful sunny day,… Read more about Most Americans Might Not See Big Premium Hikes, But The Individual Market Is Different

Let Medicare Negotiate Drug Prices And The Government Can Afford Subsidies

Right in the middle of the sequestration mess seems like a good time to discuss the subsidies that are going to be a major part of the ACA starting next year. As of 2014, nearly everyone in the US will be required to have health insurance, and all individual health insurance will become guaranteed issue. There are concerns that premiums in the individual market might increase significantly, but for many families the subsidies enacted by the ACA will help to make coverage more affordable. The subsidies will be available to families earning up to 400% of the federal poverty level; the premium assistance will be awarded on a sliding scale, with the families on the upper edge of that income threshold receiving the smallest subsidies.

Right in the middle of the sequestration mess seems like a good time to discuss the subsidies that are going to be a major part of the ACA starting next year. As of 2014, nearly everyone in the US will be required to have health insurance, and all individual health insurance will become guaranteed issue. There are concerns that premiums in the individual market might increase significantly, but for many families the subsidies enacted by the ACA will help to make coverage more affordable. The subsidies will be available to families earning up to 400% of the federal poverty level; the premium assistance will be awarded on a sliding scale, with the families on the upper edge of that income threshold receiving the smallest subsidies.

But how much will those subsidies cost the taxpayers? How will a government that is so cash-strapped that it’s curbing spending on programs like Head Start and special education be able to fund the subsidies called for in the ACA?

Last summer, the CBO estimated that the exchange subsidies will cost $1,017 billion over the next ten years. Undoubtedly a large sum, but probably necessary in order to make guaranteed issue health insurance affordable for low- and middle-income families.

That sum is partially offset by the CBO’s projections of $515 billion (over the next ten years) in revenue from individual mandate penalties (fines imposed on non-exempt people who opt to go without health insurance starting in 2014), excise tax on “Cadillac” group health insurance policies, and “other budgetary effects” enacted by the healthcare reform law.

That leaves us with $502 billion. Not an insignificant sum of money even when […]

Will Marketplace Customer Service Be On A Par With Private Industry?

One of our clients recently told us about a health insurance plan that was being marketed to him, and we were curious enough to want to look into the situation further. In a nutshell, it’s not a discount plan, not a mini-med, and not a traditional limited-benefit indemnity plan. All of those plans should be avoided in general, and the ACA has sort of skirted around them a bit: numerous mini-meds have been granted temporary waivers in order to continue to operate, discount plans aren’t addressed by the ACA at all (and aren’t regulated by most state Division of Insurance departments either, since they aren’t actually insurance), and limited benefit indemnity plans are exempted from ACA rules (although people who have them will likely have to pay a penalty for not meeting minimum benefit requirements).

Anyway, the plan that was marketed to our client resembled traditional health insurance, but was very convoluted and sold with numerous riders to cover all sorts of different scenarios. The brochure was 27 pages long and included numerous detailed examples showing how awesome the marketed coverage was when compared with “traditional major medical.” It noted that the plan isn’t subject to ACA mandates, and the policy is still being marketed with a $5 million lifetime maximum. When I spoke with an agent for the plan (a captive agent, of course – plans like that are never marketed by brokers who have access to other policies), he told me that the policy will not be guaranteed issue next year, and that they aren’t concerned about the potential penalties that their clients will have to pay starting in 2014 for not having ACA-compliant coverage. His reasoning (and the marketing pitch that they’re making to their clients) is that their premiums will be so much lower than ACA-compliant plans that their clients will save enough money to more than make up for the penalty (currently their premiums were roughly the same as those of reputable health insurance policies).

In short, everything about this policy sounded sketchy.

A rather lengthy Google search didn’t bring up much in the way of regulations pertaining to this sort of issue. I remembered my efforts in the fall of 2011 to get specific details about regulations regarding mini-meds… and I wasn’t encouraged. At the time, the Colorado Division of Insurance wasn’t aware of a solution to the problem our client was facing (although to give them credit, I was able to speak with someone as soon as I called them). They referred me to HHS, where I had to leave a voice mail. The outgoing message said that someone would get back to me within five business days, but that was a year and a half ago and I’m not holding my breath for a reply. I also left a message for the National Association of Insurance Commissioners (NAIC) about the issue and never heard back from anyone there. We ended up getting the client onto an Anthem Blue Cross Blue Shield plan, but we never heard back from any of the government agencies we contacted regarding his mini-med situation.

A rather lengthy Google search didn’t bring up much in the way of regulations pertaining to this sort of issue. I remembered my efforts in the fall of 2011 to get specific details about regulations regarding mini-meds… and I wasn’t encouraged. At the time, the Colorado Division of Insurance wasn’t aware of a solution to the problem our client was facing (although to give them credit, I was able to speak with someone as soon as I called them). They referred me to HHS, where I had to leave a voice mail. The outgoing message said that someone would get back to me within five business days, but that was a year and a half ago and I’m not holding my breath for a reply. I also left a message for the National Association of Insurance Commissioners (NAIC) about the issue and never heard back from anyone there. We ended up getting the client onto an Anthem Blue Cross Blue Shield plan, but we never heard back from any of the government agencies we contacted regarding his mini-med situation.

So back to our current questions about the sketchy-sounding health insurance being marketed to our client. I contacted HealthCare.gov via Twitter but got no response. I called the Colorado Division of Insurance and was told that I should send in an email with the specifics. I did that on Wednesday and haven’t heard anything back from them yet. I called them this morning to follow up, and they told me that they had received my email but didn’t know to whom it had been assigned yet – this is two days after I sent it, so I would assume that perhaps the employees there are overworked and understaffed. I didn’t contact the national HHS office again, because I didn’t feel like wasting my time any further. However, I did send an email on Friday morning to the regional HHS office in Denver, so hopefully I’ll hear back from them sometime soon.

I’m also hopeful that I’ll hear back from the Colorado DOI sometime next week. They usually end up being a helpful – and local – resource, even if we have to wait a few days. Once we get some more information, I’ll write a follow-up post about how an individual carrier is apparently able to operate entirely outside the regulations of the ACA.

But for now, I’m struck by how difficult it can be to obtain information from a government agency, or even speak with a real person as opposed to just leaving a message or sending an email that may or may not ever get read. I know that private companies aren’t always shining examples of customer service, but I can’t imagine calling the claims or customer service number on the back of our Anthem Blue Cross Blue Shield card and being told […]

Infographic – Affordable Care Act and How Individual Health Insurance is Changing in 2014

A quick overview of how individual health insurance will change in 2014 due to the Affordable Care Act (ACA).

Are Marketplaces Duplicating Existing Health Insurance Comparison Sites?

[…] So although I agree with Senator Lundberg when it comes to what’s available in Colorado, I don’t think we can necessarily extend that generalization to all states. And the subsidies (only available in the health insurance marketplaces, aka exchanges) have to be taken into consideration too, since those are the overwhelming “carrot” that officials are hoping to use to entice millions of currently uninsured middle-income Americans onto the health insurance rosters. In a state like Colorado, we probably could have done just fine by adding subsidies to our current system. We already had a solid high risk pool (not all states did) and we’ve already been making progress in terms of general reform and access to care. So the changes brought by the introduction of the ACA and the health insurance marketplace in Colorado might not be as significant as they will be in other states. That perspective – as well as the idea that we’re all in this together as a country rather than a bunch of isolated states – is helpful in terms of understanding “why all the fuss” about setting up marketplaces that might seem to duplicate a lot of existing services. In some places, yes. In others, definitely not.

It’s a Health Insurance Marketplace, Not An Exchange

HHS has officially started referring to “marketplaces” instead of “exchanges” when describing the state-based online venues where people will be able to purchase health insurance and receive income-based subsidies starting in 2014. Some are calling this a sign that HHS is desperate to garner approval for the ACA-created system for purchasing individual and small group… Read more about It’s a Health Insurance Marketplace, Not An Exchange

Strengthening The ACA Individual Mandate

Many people have expressed concerns that the mandate portion of the ACA isn’t strong enough to balance out the expected sharp increase in premiums that will accompany guaranteed issue coverage starting next year. Open enrollment windows are a possibility, but I’m not the only person who has noted that compressing each year’s applications into a… Read more about Strengthening The ACA Individual Mandate

Tobacco Cessation And Health Insurance

[…] Although higher health insurance premiums do provide a financial deterrent to smoking, the number of smokers who try and fail to quit every year is testament to the powerful nature of nicotine addiction. Providing real support in the form of therapy and/or medication designed to help smokers kick the habit seems like a better solution. Including smoking cessation treatment in the list of preventive services that must be covered by all health insurance plans without cost sharing was a good provision of the ACA. But a study released last fall indicates that implementation of the provision has been inconsistent at best. Hopefully this issue will be fully resolved as new health plans are designed heading into 2014, and tobacco cessation will no longer be a grey area when it comes to health insurance benefits and provider reimbursement. […]

Open Enrollment For Individual Health Insurance Plans Starting in 2014

Ever since the PPACA was first being discussed, the individual mandate has been touted as a buffer to protect health insurance carriers – and in turn, policyholders – from adverse selection that would otherwise certainly occur in a guaranteed issue individual market. It seemed that as long as people were required to maintain health insurance coverage, adverse selection would be minimized and people would be unlikely to purchase health insurance only during periods of sickness. But there was still enough concern about adverse selection that HHS issued a proposal for open enrollment periods in the individual market starting next year. This proposal was released at the end of November, and the specific details regarding the open enrollment period are on page 70595 of this Federal Register.

To sum it up, they’re proposing an initial open enrollment period for individual/family health insurance that starts in October 2013 and runs through the end of March, 2014 (a six month window in order to accommodate the large influx of initial applications), and then open enrollment periods that mirror Medicare’s: October 15th until December 7th each year. Beyond that window, only “qualifying event” applications would be allowed for […]

To sum it up, they’re proposing an initial open enrollment period for individual/family health insurance that starts in October 2013 and runs through the end of March, 2014 (a six month window in order to accommodate the large influx of initial applications), and then open enrollment periods that mirror Medicare’s: October 15th until December 7th each year. Beyond that window, only “qualifying event” applications would be allowed for […]

How the Affordable Care Act Affects You

For the first couple years after the Affordable Care Act was signed into law, everything seemed to be a bit up in the air. There was almost constant bickering about the subtle nuances of the legislation, along with uncertainty from both sides of the political spectrum insofar as whether or not the law would stand the test of time. The Supreme Court had to weigh in, and we also had a major election cycle midway between the signing of the law and the enactment of many of its main provisions.

Most of that has settled down now. SCOTUS upheld the law. And there was no election upheaval in Congress to tilt the legislative body towards a crowd that would be likely to repeal it. States – like Colorado – that had been working towards setting up a health benefits exchange can continue to do so without as much worry that their work might be in vain (there had been  some concern that the law would be tossed after states had invested a lot of time and money in the exchange-creation process). We are just over a year out now from January 2014, when many of the major provisions of the ACA will go into effect; it seems relatively certain at this point that the ACA will continue to move forward now that some of the potential roadblocks are in the rearview mirror.

some concern that the law would be tossed after states had invested a lot of time and money in the exchange-creation process). We are just over a year out now from January 2014, when many of the major provisions of the ACA will go into effect; it seems relatively certain at this point that the ACA will continue to move forward now that some of the potential roadblocks are in the rearview mirror.

Several provisions of the Affordable Care Act – ACA have already been implemented over the past two years: Young adults can remain on their parents’ health insurance policy until […]

2012 Obamacare Premium Rebates (Infographic)

Did you receive a health insurance premium rebate this year? If so, how much was it? We created a simple visualization of how the PPACA (Obamacare) health insurance premium rebates break down between the individual/family, small group and large group markets and how Colorado’s rebates compared to the national average.

More About Colorado’s Kaiser Permanente Benchmark Health Insurance Plan

Yesterday’s article about Colorado selecting a benchmark health insurance plan for individual and small group policies sold starting in 2014 has raised a few more questions and I wanted to clarify some details.

This publication from the Colorado Division of Insurance, the Health Benefit Exchange and the Governor’s office is an excellent resource and answers a lot of frequently asked questions. It was released earlier this summer, before the Kaiser small group plan was selected, so it includes details about all nine options that were considered as possible benchmark plans. The Kaiser small group plan that was ultimately picked as the benchmark is listed on page 11 as option A, under “one of the three largest small group plans in the state”.

The 2011 Colorado health insurance plan description for the Kaiser policy is here if you’re interested in the plan specifics. We had a question from a reader who wondered whether chiropractic care would be covered, but it’s listed as “not covered” on the plan description form (item number 30). It’s important to note that cost sharing details like deductible, coinsurance and copays are not part of the benchmark program. The concept of benchmark here only applies to the benefits provided by the Kaiser Permanente health insurance plan. The deductible on the Kaiser health insurance plan is $1200, but that DOES NOT mean that all policies will have to have a $1200 deductible in 2014. In order to be sold in the exchanges, health insurance plans will have to cover at least 60% of costs in order to qualify for a “bronze” designation. And there will also be silver, gold and platinum ratings, so there will still be plenty of variation in terms of cost sharing.

If Colorado had not selected a benchmark plan, HHS would have picked one for us. HHS would have […]

Colorado Selects Kaiser Permanente As Its Benchmark Health Insurance Plan

Last December, HHS made it clear that they were giving states a lot of flexibility in determining what plan would serve as the benchmark for the state’s “essential benefits” for individual and small group health insurance policies that would be sold starting in 2014.

After months of consideration, Colorado has selected Kaiser Permanente’s small group plan as a benchmark. This is the largest small group plan in the state, with almost fourteen thousand members, and was selected by a group of officials from the Colorado Division of Insurance, the Governor’s office, and the health benefits exchange. The Division of Insurance will be taking comments until next Monday before making a final announcement, and you can contact them by email ([email protected]) if you’d like your comments to be considered.

The Kaiser plan covers services in the ten areas that are required by the PPACA (ambulatory patient services, emergency care, hospitalization, maternity and newborn care, mental health and substance abuse services, prescription medications, rehabilitative services, lab work, preventive care/disease management, and pediatric care), which means that it will serve as a benchmark for services in those areas without the DOI having to add additional coverage minimums. In addition, the Kaiser plan was generally considered to be a good balance between comprehensive coverage and affordable coverage. It’s not the most comprehensive policy out there (the much maligned “Cadillac plans” offer more benefits), but it provides […]

Colorado Health Insurance CO-OP Receives Loan From HHS

At the end of July, the first of Colorado’s health insurance CO-OP plans got a $69 million loan from HHS as part of a push by the ACA to develop consumer-owned-and-operated health insurance plans (“CO-OP” is short for Consumer Oriented and Operated Plans). The CO-OP is sponsored by Rocky Mountain Farmers Union and the bulk of the loan from HHS will be put in reserve to fund claims expenses for initial enrollees. As premium dollars are collected, the loan will be paid back to HHS.

Colorado Senator Irene Aguilar introduced a bill last year to create a state-wide Colorado health insurance co-op, but the bill was tabled in May 2011 after passing its second reading in the Senate.

The new CO-OP being created with the loan money will be especially focused on rural areas of Colorado – which are generally underserved in terms of health insurance options. In addition, residents in rural areas are often already familiar with the concept of co-ops for other services like utilities. So a Colorado health insurance plan that is owned and operated by its members should be an especially good fit.

The CO-OP will begin marketing plans next fall with policy effective dates starting January 1, 2014, and is hoping to enroll 10,000 Colorado residents in its first year. Unlike most commercial health insurance plans available in Colorado, the CO-OP will be able to direct profits back into the plan in the form of lower premiums and/or higher quality service rather than sending profits to shareholders. And while most health insurance carriers that do business in Colorado are multi-state organizations, the CO-OP will be a local plan based here in Colorado (Rocky Mountain Health Plans is another example of a local, non-profit health insurance option for people in Colorado).

The CO-OP expects to be available both through the Colorado Health Benefits Exchange (aka “the exchange”) and also via independent health insurance brokers and agents. An innovative new health insurance product – especially one that strives to serve populations that are underserved by our current health insurance industry – is good news for Colorado, as it should foster more competition among the existing health insurance carriers in the market. Congratulations to Rocky Mountain Farmers Union for the approval from HHS for the loan to get the CO-OP going!

Colorado Gets $26.1 Million Award For Insuring More Children

For the second year in a row, Colorado has received a significant grant from the federal government (funded under the Children’s Health Insurance Program Reauthorization Act) to help fund the state’s Medicaid system. A year ago, Colorado received $13.7 million. Last week, Colorado got $26.1 million – the third highest amount awarded to any of the states that qualified for the performance bonuses this time around. Colorado was one of the states with an enrollment increase of more than 10%, which qualified for a higher “Tier 2” bonus award. The program awarded a total of over $296 million at the end of 2011, and it was spread across 23 states, as opposed to only 15 that qualified a year earlier.

In order to qualify for a bonus, a state has to implement at least five of the eight provisions that have been proven to increase enrollment and retention numbers for Medicaid and CHIP, and the state has to also prove that they have had a significant increase in the number of children enrolled in Medicaid during the year.

[…]

Interesting Reading In The HHS Bulletin On Essential Health Benefits

[…] I particularly appreciated Jaan’s link to this bulletin about Essential Health Benefits from the Center for Consumer Information and Insurance Oversight. It’s a comprehensive look at how EHB will be defined based on the current proposal from HHS, and it includes a call for public comment between now and the end of January 2012. In reading through the bulletin, I was especially interested in the bottom of page 7. They note that in states that mandate coverage for in-vitro fertilization, the mandate increases average health insurance premiums by about one percent. And in states that mandate coverage for Applied Behavior Analysis (ABA) therapy for autism, that mandate results in average premiums being 0.3% higher than they would be without it.

We’ve written a few times about infertility treatments and health insurance, and it’s always generated a lot of (usually quite polarized) comments. People tend to feel strongly one way or the other, often based on their own experiences or those of friends and family members. People who have had to fork over tens of thousands of dollars to pay for IVF tend to be more sympathetic to the idea that health insurance coverage of fertility treatments would be a good thing. Those who have been able to conceive without medical interventions and those who have no desire to have children tend to balk at the idea of paying higher health insurance premiums to cover fertility treatments for other people. But would knowing that mandates on fertility treatment have only increased premiums by about one percent make a difference in how those people feel? […]

Retiree Health Insurance Benefits Based On Age Makes Sense

Last week, the Equal Employment Opportunity Commission agreed that employers have the right to reduce or eliminate medical benefits for retirees who reach age 65 and become eligible for federally funded Medicare. This ruling has been met with both support and criticism from several sides. It includes a specific provision that exempts employers from age… Read more about Retiree Health Insurance Benefits Based On Age Makes Sense