there is also an option to offer “expanded” bronze plans that can have higher AV than regular bronze plans. In order to be considered expanded bronze, a plan must

Cigna

Proposed rate increases in Colorado: CO-OP up 21%, Kaiser up 2%

The back-story Last September, when we wrote about the fact that the average individual rates increase in Colorado was less than one percent for 2015, we noted that the overall rate increase was astoundingly low – far lower than anything we’d seen during our time in this industry. And although it will be several more weeks… Read more about Proposed rate increases in Colorado: CO-OP up 21%, Kaiser up 2%

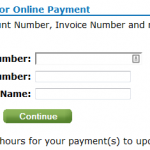

Carrier Contact Information And Updates For People Who Need To Pay January’s Premium

Today, January 10th, is the payment deadline for most Connect for Health Colorado policies with January 1 effective dates. A few carriers have pushed the deadline out a little bit: Updated Anthem Blue Cross and Blue Shield is moving the payment deadline to 1/31 for 1/1 effective dates. Delta Dental: January 15. Premier Access Dental… Read more about Carrier Contact Information And Updates For People Who Need To Pay January’s Premium

How Does Obama’s Policy Continuation Announcement Impact Colorado’s Individual Market?

By now you’ve probably heard about the Obama Administration’s compromise over the policy cancellation uproar. The fix that Obama has offered is that health insurance companies can extend existing plans for one more year, allowing them to continue to exist in 2014. This has been incorrectly reported in some media outlets as allowing carriers to continue… Read more about How Does Obama’s Policy Continuation Announcement Impact Colorado’s Individual Market?

Fewer Plans Available In Exchanges In 2013, But Maybe That’s A Good Thing

At the end of September, just as the exchanges were about to open for business, HealthPocket created a comparison of the number of individual and family health insurance policies available in each state in 2013 and compared that with the number of policies that would be available in each state’s exchange in 2014. It’s an… Read more about Fewer Plans Available In Exchanges In 2013, But Maybe That’s A Good Thing

Renewal Options for Each Individual Health Insurance Carrier in Colorado

Last week I explained how early renewal at the end of 2013 might be a good option for some people who have individual health insurance. If you’re happy with your coverage and aren’t going to qualify for a subsidy in the Colorado exchange, keeping your existing plan for most of 2014 might be a good way to save some money on premiums. This is especially true for people who prefer very high deductibles, as those plans are generally not ACA compliant and thus will not be available for purchase after the end of 2013. But if your carrier allows it, you can keep your current policy until it renews in 2014, and switch to an ACA compliant plan at that time. For people with plans that renew late in the year, this could mean keeping a lower-cost, higher deductible policy for most of 2014. If you’ll be eligible for a premium subsidy, it’s definitely worth your time to compare a subsidized exchange plan with what you have now. But if you’re happy with your coverage and you’re going to be paying full price for an ACA compliant plan, check with your carrier to see about keeping your current plan in 2014.

Keep in mind that each Colorado health insurance carrier is doing things a little differently in terms of 2013 renewals heading into 2014. It’s important to check with your carrier to make sure you’re aware of what steps you need to take – don’t assume that  your plan will automatically renew – or automatically not renew. The Colorado Division of Insurance has left a lot of leeway for carriers to determine their own protocol for renewals going into 2014. There is no state requirement that existing policies be cancelled as of the end of 2013, although some carriers have opted for that as a default. All plans must be ACA-compliant by January 1, 2015. So when your policy renews in 2014, you will have to transition to an ACA compliant plan. But the date of that renewal can be anytime from January to December.

your plan will automatically renew – or automatically not renew. The Colorado Division of Insurance has left a lot of leeway for carriers to determine their own protocol for renewals going into 2014. There is no state requirement that existing policies be cancelled as of the end of 2013, although some carriers have opted for that as a default. All plans must be ACA-compliant by January 1, 2015. So when your policy renews in 2014, you will have to transition to an ACA compliant plan. But the date of that renewal can be anytime from January to December.

Here’s a brief summary of what we have heard so far from some of the main carriers in Colorado. This is subject to change, so check with us or your carrier before you make a decision.

Anthem Blue Cross Blue Shield: The default is for your plan to just keep its current renewal date and continue unchanged until that date in 2014. But Anthem is also offering insureds an option […]

Early Renewal Provides A Good Alternative For 2014

Over the last few years, opponents of health care reform have often exaggerated – and sometime outright lied about – the potential negative aspects of the reform law. This has resulted in a public that is often woefully misinformed about what the law does and does not do. But the spin is not limited to just opponents of the law. Sometimes ACA supporters spin things too. This Huffington Post article from a few months ago is a good example. The title, “Aetna seeks to avoid Obamacare rules next year” is designed to play on the general unpopularity (and over-estimation of perceived profits) of insurance companies. When you read a little further, you find that Aetna is reaching out to brokers and insureds to let them know that Aetna will be allowing members to opt for an early renewal in December of this year – if they want to keep their current policy until December 2014.

Why is this being portrayed as a bad thing?

It is indisputable that people who are healthy, buy their own health insurance, won’t qualify for subsidies and prefer high deductible health plans are going to have higher premiums for ACA-compliant plans than they have now. Some of these people don’t mind high deductibles. They don’t consider their policy to be skimpy or junk insurance just because it isn’t ACA compliant. You might have seen headlines about how only a tiny fraction of existing individual health plans meet the requirements that the ACA will impose next year, but that doesn’t mean that the existing  plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

plans are junk. If you look closely, you’ll see that when it comes to basic medical benefits, a lot of individual plans offer coverage that is in line with ACA regulations. But benefits like dental and vision coverage for children (required on ACA-compliant plans starting next year) are usually not part of individual coverage (Many plans allow applicants to select add-on dental and vision coverage, but a lot of people find that it’s more cost effective to pay for dental and vision out of pocket rather than paying for dental/vision insurance. Remember, nothing is free. And the more likely you are to use an aspect of your coverage, the higher your premiums will be in order to cover the cost. So coverage for something like dental and vision checkups – which people plan to use – has to be priced accordingly). In many states, maternity coverage is one of the most significant medical benefits missing from a lot of individual plans. But in Colorado we’ve had maternity on all plans for more than two years now.

There are absolutely some bad health insurance plans on the market, with skimpy coverage, limited networks and lots of fine print. But there are also lots of good quality health insurance plans and reputable carriers. And there are plenty of people who are not going to qualify for subsidies next year (roughly half of the people who currently buy individual health insurance). If those people currently have – and are happy with – a high deductible plan that is less expensive than what they would have to pay for an ACA-compliant plan, there’s no reason that they shouldn’t be able to keep their plan as long as possible in 2014. The law requires coverage to be ACA-compliant when a policy renews in 2014. Carriers that are offering early renewals in December are providing good customer service, especially for insureds who […]

Colorado Health Insurance Options On the Exchange in 2014

Although we’re still at least a week away from knowing the specific details on rates and plan designs for policies that will be sold in the Connect for Health Colorado exchange, the Division of Insurance has approved 242 plans that will be available in the exchange from 13 Colorado health insurance carriers. In late May, the number of carriers stood at 11 and the number of plans was 250+. But as we noted last week, there was still a lot going on behind the scenes over the summer, and some carriers had to resubmit plan information that was not accepted in the spring. The final count is 150 plans that will be available to individuals and 92 for small groups (keep in mind that this is just for plans within the exchange. There will be lots of other ACA-compliant plans available outside the exchange).

The plans for individuals will be available from ten different carriers (All Savers, Cigna, Colorado Choice, Colorado Health Insurance Cooperative,  Denver Health Medical Plan, HMO Colorado (Anthem), Humana, Kaiser, New Health Ventures and Rocky Mountain HMO). Although there are some new names in this list, there are also plenty of familiar ones (All Savers is a UnitedHealth company, which means that the main carriers that currently sell policies in the individual market in Colorado will all be represented in the exchange). Although we haven’t yet seen the final premium and plan details, it appears that Colorado will continue to have a robust individual health insurance market in 2014, both in and out of the exchange.

Denver Health Medical Plan, HMO Colorado (Anthem), Humana, Kaiser, New Health Ventures and Rocky Mountain HMO). Although there are some new names in this list, there are also plenty of familiar ones (All Savers is a UnitedHealth company, which means that the main carriers that currently sell policies in the individual market in Colorado will all be represented in the exchange). Although we haven’t yet seen the final premium and plan details, it appears that Colorado will continue to have a robust individual health insurance market in 2014, both in and out of the exchange.

For consumers who will qualify for a subsidy, the exchange is definitely the place to be – subsidies are only available in the exchange. Consumers who do not qualify for a subsidy (either because their income is too high or because they have access to an employer group plan that is technically “affordable” but might actually be outside of their budget) can shop within the exchange (via an approved broker or directly through the exchange) or they can […]

Do You Need Critical Illness Insurance?

When my father was 54, he was diagnosed with an auto immune disease that struck quickly and in a devastating fashion. He lost his kidneys to the disease, and spent the next 11 years on dialysis until he received a kidney transplant last summer. Thankfully, he had long-term disability insurance through his employer, along with… Read more about Do You Need Critical Illness Insurance?

Networks And Carriers Are Part Of The Big Picture With Exchanges

[…] Aetna, United and Cigna are all absent from the CA exchange, and Dan looks into several reasons why some of the bigger carriers might have opted not to sell in the exchange on day one, and why some large provider networks are not going to be covered by plans sold in that state’s exchange.

Here in Colorado, Aetna stopped selling individual policies a couple years ago, so we weren’t expecting them to be in the state’s exchange, Connect for Health Colorado. United Healthcare has been a mainstay in the Colorado individual market, and while they submitted numerous plans to the DOI for small group products, they are all to be sold outside of the exchange and there don’t appear to be any individual plans in their new lineup. Cigna, however, will be selling individual plans both inside and outside of the exchange in Colorado.

Here in Colorado, Aetna stopped selling individual policies a couple years ago, so we weren’t expecting them to be in the state’s exchange, Connect for Health Colorado. United Healthcare has been a mainstay in the Colorado individual market, and while they submitted numerous plans to the DOI for small group products, they are all to be sold outside of the exchange and there don’t appear to be any individual plans in their new lineup. Cigna, however, will be selling individual plans both inside and outside of the exchange in Colorado.

We’ve heard from carrier representatives – who are familiar with multiple state exchanges – that Connect for Health Colorado has been particularly great to work with, and that is no doubt part of the reason Colorado will have a large number of carriers and policy options available within the exchange. We’re happy to be in a state that has been actively working on healthcare reform for several years, and that moved quickly to begin building an exchange and implementing the ACA as soon as it was passed.

Comparing CEO Compensation in Various Healthcare Industries

Joe Paduda of Managed Care Matters did an excellent job with the most recent Health Wonk Review – be sure to stop by his blog and check it out. I thought this article from Dr. Roy Poses was especially interesting. Writing at Health Care Renewal, Dr. Poses shines the spotlight on UnitedHealth Group’s CEO Stephen Hemsley’s oversized compensation. Roy notes that while the increase in CEO compensation does mirror the company’s overall financial success of late, it must also be considered in light of the fact that the company has made some missteps in terms of fulfilling its stated mission to provide health care “at an affordable price” and “expand access to quality health care.” Roy’s article cites several examples of allegedly unethical behavior, and concludes by noting that “Real health care reform needs to make health care leaders accountable, and especially accountable for the bad behavior that helped make them rich.”

I definitely do not disagree with Dr. Poses, and we’ve noted in the past that UnitedHealth Group has had issues with large executive compensation and backdating stock options (that was with a previous CEO, however). But I do want to use this as an opportunity to remind our readers and clients that most health insurance companies have CEO compensation packages that are far lower. Forbes compiled a list of the 498 highest-paid CEOs in 2012, and I scrolled through the first 150 on the list. UnitedHealth Group is there on the first page, ranked number 8 (they’re also ranked number 31 in Fortune 500 total profits, so as Roy said, the CEO salary is at least in the same ballpark with the company’s financial performance).

I definitely do not disagree with Dr. Poses, and we’ve noted in the past that UnitedHealth Group has had issues with large executive compensation and backdating stock options (that was with a previous CEO, however). But I do want to use this as an opportunity to remind our readers and clients that most health insurance companies have CEO compensation packages that are far lower. Forbes compiled a list of the 498 highest-paid CEOs in 2012, and I scrolled through the first 150 on the list. UnitedHealth Group is there on the first page, ranked number 8 (they’re also ranked number 31 in Fortune 500 total profits, so as Roy said, the CEO salary is at least in the same ballpark with the company’s financial performance).

But you have to click through several pages of the CEO compensation list to get to the next health insurance carrier. Humana was the next one I found, ranked at […]

Let Medicare Negotiate Drug Prices And The Government Can Afford Subsidies

Right in the middle of the sequestration mess seems like a good time to discuss the subsidies that are going to be a major part of the ACA starting next year. As of 2014, nearly everyone in the US will be required to have health insurance, and all individual health insurance will become guaranteed issue. There are concerns that premiums in the individual market might increase significantly, but for many families the subsidies enacted by the ACA will help to make coverage more affordable. The subsidies will be available to families earning up to 400% of the federal poverty level; the premium assistance will be awarded on a sliding scale, with the families on the upper edge of that income threshold receiving the smallest subsidies.

Right in the middle of the sequestration mess seems like a good time to discuss the subsidies that are going to be a major part of the ACA starting next year. As of 2014, nearly everyone in the US will be required to have health insurance, and all individual health insurance will become guaranteed issue. There are concerns that premiums in the individual market might increase significantly, but for many families the subsidies enacted by the ACA will help to make coverage more affordable. The subsidies will be available to families earning up to 400% of the federal poverty level; the premium assistance will be awarded on a sliding scale, with the families on the upper edge of that income threshold receiving the smallest subsidies.

But how much will those subsidies cost the taxpayers? How will a government that is so cash-strapped that it’s curbing spending on programs like Head Start and special education be able to fund the subsidies called for in the ACA?

Last summer, the CBO estimated that the exchange subsidies will cost $1,017 billion over the next ten years. Undoubtedly a large sum, but probably necessary in order to make guaranteed issue health insurance affordable for low- and middle-income families.

That sum is partially offset by the CBO’s projections of $515 billion (over the next ten years) in revenue from individual mandate penalties (fines imposed on non-exempt people who opt to go without health insurance starting in 2014), excise tax on “Cadillac” group health insurance policies, and “other budgetary effects” enacted by the healthcare reform law.

That leaves us with $502 billion. Not an insignificant sum of money even when […]

Health Insurance Premiums Mirror Healthcare Costs

[…] Colorado has taken a much more proactive and transparent position in terms of the rate review process, and we’ve written about it several times. Although rate increases on health insurance policies are frustrating when they continue to far outpace inflation, they’re being driven largely by the increases in the cost of healthcare. But most of us are very insulated from the cost of our healthcare. Since the bills go to our health insurance carriers, many people don’t really know how much it costs to have any sort of significant medical treatment. We know how much our health insurance costs though, and when the price goes up, we feel it. Even though the price increase is directly linked to the increases in healthcare spending, we’re much more likely to focus on the  health insurance premiums, since those are the bills we pay ourselves (this is especially true for people who buy their own individual health insurance, without assistance from an employer). […]

health insurance premiums, since those are the bills we pay ourselves (this is especially true for people who buy their own individual health insurance, without assistance from an employer). […]

No 2013 Rate Increases for Cigna or Anthem Blue Cross of Colorado

Both Cigna and Anthem Blue Cross of Colorado report no rate increases on new business in Colorado. However, for existing clients on open plans, rates may change due to age attainment and trend. Carriers may adjust rates for closed plans effective January 1, 2013.

Individual Health Insurance After Donating A Kidney

This recent AARP article caught my attention last week. My father lost his kidneys in 2001 as a result of Wegener’s Granulomatosis, a rare autoimmune disease. In August, he was the recipient of a kidney generously donated by the family of a young man who had passed away. And this fall, for the first time in 11 years, he’s been able to go about his life without being tethered to a dialysis machine every evening. So I’m drawn to stories about kidney transplants, living donors, or families who choose to donate a deceased loved ones organs.

To sum it up, Radburn Royer is a healthy 57 year old who donated a kidney to his daughter four year ago, after her own had failed as a result of lupus. Prior to donating a kidney, Royer was covered by Blue Cross Blue Shield of Minn. It’s unclear what his health insurance status was in the interim, but last year he reapplied for coverage with them and  was turned down. He’s appealed several times, but for now he’s covered by his state’s high risk pool (he has to pay $130 more per month for his coverage and has a higher deductible, both of which are common in high risk pools).

was turned down. He’s appealed several times, but for now he’s covered by his state’s high risk pool (he has to pay $130 more per month for his coverage and has a higher deductible, both of which are common in high risk pools).

Individual health insurance in Colorado is underwritten just as it is in Minn., but underwriting guidelines usually vary from one state to another and from one carrier to another. So we contacted three of the top individual health insurance carriers in Colorado to see how they would underwrite an applicant who had previously donated a kidney. Cigna, Humana and Anthem Blue Cross Blue Shield all said that as long as the donor had been released from medical care and had normal blood pressure and blood lab results, the most likely underwriting outcome would be acceptance with a standard rate.

At first glance, this seems to be at odds with the situation experienced by Royer, but maybe it’s not. The AARP article notes that Royer underwent […]

[…] In the context of kidney donation, it’s important that potential donors not be inadvertently scared off by AARP’s article. Kidney donors are heroes – anyone who had received a transplant will attest to that fact – and they save lives. The study that I linked to above followed donors for 20 – 37 years after their transplants. While some donors did end up having kidney problems, the majority had normal kidney function 20 – 37 years out from surgery, and would likely not have a problem obtaining individual health insurance, even prior to it being guaranteed issue in 2014. Most people who are healthy enough to be accepted as a donor will continue to be healthy after they donate a kidney.

No 2013 CoverColorado Assessment

CoverColorado announced that there will be no assessment in 2013 on Colorado health insurance carriers. The 2012 assessment was roughly $3.79/month/contract for individual/family insureds.

Anthem Blue Cross of Colorado has also announced that their membership this year was higher than expected this year. They were making up for a shortfall by charging $4.36/month/contract in 2012. Due to the higher enrollment, Anthem BCBS has enough funding to satisfy December without billing subscribers a CoverColorado assessment.

Primary Care Practices In Colorado Chosen As Part Of CMS Pilot Program

The Centers for Medicare & Medicaid Services (CMS) announced this week the start of a pilot program to enhance primary care via collaboration among CMS, private health insurance carriers and 500 primary care practices in seven regions across the US. 73 of those practices are in Colorado, with 335 participating physicians, and several of the top health insurance carriers in Colorado are participating too: Anthem Blue Cross Blue Shield, Cigna, Humana, Rocky Mountain Health Plans, and United Healthcare, in addition to Colorado Medicaid, Colorado Choice Health Plans, and Colorado Access (a health plan specifically designed for underserved populations).

CMS will be paying participating providers a “care management fee” which is estimated to be about $20 per month per beneficiary, in addition to the usual fee-for-service reimbursements. The private health insurance carriers that are participating have worked out their own reimbursement schedules, but one would assume that the setup will be similar to the one that CMS has devised. […]

A Shared-Risk Success Story

[…] In addition to beating their target financially, the program has also resulted in happier patients, increased market share for Blue Shield, fewer patient readmissions (likely due to the comprehensive patient discharge program that they created, and better chronic care management), a significant decrease in the number of inpatient days per thousand members, and far lower start-up administration costs than are typically projected for ACOs (although they note that they worked with existing programs and already-established relationships, so they weren’t building an ACO from scratch. But I imagine that would likely be the case with most ACO creation?). […]

Cigna And CSHP Collaborating On An Accountable Care Program

[…] The collaboration between Cigna and CSHP will focus on improving patient outcomes, making healthcare more accessible and affordable, and improving patient satisfaction. One of the key components of the Cigna program is registered nurses working at the medical offices who will serve as care coordinators. These care coordinators will follow up with recently hospitalized patients to try to avoid preventable re-hospitalizations (costly and definitely not likely to result in a satisfied patient). They will also work with patients who have chronic illnesses to make sure the patients are filling their prescriptions, receiving needed office visits and screenings, and getting referrals to disease management programs that could help to prevent the conditions from worsening. The hands-on approach that the medical offices will be taking is likely to result in fewer re-hospitalizations and better overall compliance with medical advice.

Hopefully the program will also provide guidance for patients who aren’t filling prescriptions because they cannot afford to do so (for example, a referral to pharmaceutical company programs that provide free medications to people who can’t afford them), and help to address issues like lack of transportation or inability to fit medical office visits into inflexible work schedules. Some people truly just need a reminder to go get a screening test or refill a prescription. Others have more significant obstacles preventing them from doing so. […]

Colorado Child-Only Open Enrollment Details For January 2012

The next open enrollment for child-only policies is almost here, so I thought it might be helpful to provide some specific details in terms of what policies are available and what parents should expect when submitting child-only applications next month.

The first open enrollment window in 2012 will be the month of January. Applications for child-only policies have to be submitted between January 1 and January 31. Application not submitted by the end of January will have to wait and re-submit in July, which is the second open-enrollment period of the year. For most carriers, each child in a family will have to have a separate application.

All eligible child-only applications submitted during the open enrollment period are guaranteed issue, so the child cannot be refused coverage. However, the applications are still medically underwritten and the rate can be increased by up to 200% based on the child’s medical history (so if the standard price is $100, the policy could actually be assigned a rate of $300, which is equal to a 200% rate increase).

Colorado Senate Bill 128 requires all Colorado health insurance carriers that offer coverage for adults to also offer child-only plans during the two annual open enrollment windows. But the bill does not require carriers to provide guaranteed issue coverage for children who are eligible for health insurance from another source (other than a high risk pool like CoverColorado or GettingUSCovered – see the bottom of page 4).

Most Colorado carriers have selected one or two plan designs that will be available for child-only applications next month. To give you an idea of what is available in Colorado for child-only coverage, we’re providing information here regarding child-only options from six of the top individual health insurance carriers in the state. […]

Health Insurance Exchange Payroll and Admin Expenses

[…] One of the comments on the post was from Dede de Percin, the Executive Director of the Colorado Consumer Health Initiative (CCHI). […] Dede’s comment on my article referenced the point I made about consumers not having to pay additional fees to have a broker. Basically, health insurance is priced the same whether you go directly through a health insurance carrier (calling Anthem Blue Cross Blue Shield directly, for example) or through a broker (who will compare options from multiple carriers for you). Dede made this point:

“While a consumer or business doesn’t not pay a health insurance broker directly, broker fees and commissions are paid by the insurance companies – and rolled into […]”

Decline And Rate Up Statistics – Interesting But Confusing

[…] Your policy will cost the same amount regardless of whether you use a broker, but an experienced broker will be able to help you make sense of the plan comparison information, including the underwriting statistics. A policy or carrier’s statistical likelihood of declining or rating up any one application isn’t really relevant to each specific client… what is relevant however, is each carrier’s underwriting guidelines for the particular pre-existing condition the applicant has. […]

Cigna 2011 Rates Are Live

Cigna is quoting 2011 rates on their online quote tool. And our quote comparison engine is being updated right now and will be quoting Cigna soon. Click through to the article for links.

Last Day To Submit Cigna and Aetna applications for 2010 rates

Make sure to get Cigna and Aetna applications in if you want 2010 rates. Cigna has specified 10pm MST as the deadline. For the online applications, click through to the post for the links[…]