Since 2006, the Colorado Health Foundation has been grading the state on a variety of health-related measures reported on the Colorado Health Report Card each year. The 2011 report card was just released this week. The overall rankings haven’t changed much over the past couple years. The 2009 report card looks very similar to the 2011 version. The Healthy Children score rose from a D+ two years ago to a C- now. But the Healthy Aging score slipped from a B+ on the 2009 report card to a B in 2011 (after improving to an A- in 2010). The other three categories were unchanged from their results two years ago. […]

Blog

Another Perspective On Healthcare Spending In The US

When the values are graphed, the US appears to be a significant outlier. Our per-capita GDP does put us near the top of the scale, but our per-capita healthcare spending is dramatically higher (to the tune of more than 50% higher) than any of the other countries, even those that have a similar or higher GDP.

Jaan lets out his inner economist in this post, and provides interesting reasoning to explain the US position on the per-capita GDP/healthcare spending graph. His discussion about our wealth inequality may be a key factor. One would otherwise expect Luxembourg and Norway (with per capita GDP higher than or equal to the US) to have healthcare spending that is similar to that of the US. But since our healthcare spending is tallied on the per-person basis, our wealth inequality might make the average spending data appear skewed.

In addition to comparing our healthcare spending to religious tithing (where one is expected to give 10% of ones income to the church), Jaan notes that our willingness to spend more on our healthcare “doesn’t mean that we’re getting our money’s worth…”

Colorado AG Will Have A Seat In Supreme Court Chambers For ACA Arguments

Soon after the ACA was signed into law in 2010, Colorado’s Attorney General John Suthers joined with AGs from around the country (26 states in all) to file a lawsuit challenging the legality of the individual mandate. It was particularly interesting in Colorado because there were only a handful of states where the governor and the AG disagreed about the legality of the individual mandate – Colorado was one of them.

The fight over the constitutionality of the ACA has been winding through the court system for the last two years, and has predictably made its way to the Supreme Court. The Supreme Court will hear oral arguments for and against the ACA next week. The 26 AGs who filed the lawsuit challenging the ACA requested that all of them be allowed to sit in on the arguments, but the Supreme Court granted them six seats instead. John Suthers is one of the six AGs who will be allowed to sit in the Supreme Court chambers next week to hear the ACA arguments.

The Supreme Court schedule for the oral arguments includes 90 minutes on Monday, March 26th to discuss whether to throw out the challenges to the ACA on a technicality. Then on Tuesday, they’re planning a two-hour session where the federal government and the plaintiffs can present their arguments for and against the legality of the individual mandate. Then on Wednesday, the court will be hearing arguments for 90 minutes regarding whether the rest of the ACA could […]

Emergency Room Overcrowding Expected To Worsen In The Coming Decade

[…] The results of these studies are a convincing argument in favor of the model that has been used in Grand Junction, Colorado since the 70’s. Instead of being reimbursed on an individual basis by each patient’s health insurance carrier, doctors in Grand Junction agreed long ago to simply pool the reimbursements from private health insurance, Medicare, and Medicaid. From that pool of money, the doctors are paid equally for every patient they see, regardless of whether that patient has private health insurance or Medicaid. Medicaid reimbursements are lower than those of private health insurance, so it’s understandable that many doctors prefer to see patients with private health insurance. But the system in Grand Junction focuses on what’s best for the community and does away with the financial incentive to see privately insured patients rather than those with Medicaid.

Perhaps implementation of a similar model in other cities could help to improve Medicaid patients’ access to primary care and cut down on ER overcrowding.

Will Healthcare IT Lead To Lower Healthcare Costs?

[…] My guess is that increased HIT will eventually (after the hiccups and bugs are worked out) result in more efficient care, better coordination of care between multiple doctors, fewer medical errors, and more streamlined health insurance claim processing. After reading the articles by McCormick et al and Mostashari, I think it’s clear that there’s some controversy in terms of whether HIT will lead to lower costs. I do think that HIT is coming one way or the other. It’s 2012. Most Americans are walking around with a touch screen mini computer in their pockets. We expect lightening fast internet connections and instant access to virtually any data we can think of. HIT will have to keep up, simply because technology keeps improving and it has to follow suit. But we’d be wise to carefully consider empirical data as much as possible in order to implement systems that have the best chance of success in terms of improving care and also lowering costs.

Colorado AG Files Lawsuit Against Discount And Mini-Med Health Plan

We’ve written several articles over the years about the importance of skepticism when an insurance product just seems too good to be true (ie, no medical underwriting and premiums that are a fraction of the cost of most policies on the market). Often, those policies are actually discount plans or mini-med coverage that won’t provide much of anything in terms of coverage when it’s actually needed.

The Colorado Division of Insurance has a good page with warnings and advice to consumers who are considering medical discount plans. These plans are generally legal, but buyers definitely need to understand what they’re getting into before they sign up – especially if they’re dropping a standard health insurance policy to switch to a discount or mini-med plan.

With shady medical benefits companies, the focus tends to be on consumers getting ripped off. In an interesting twist, the Colorado Attorney General has filed suit against a Highlands Ranch, Colorado LLC, Consolidated Medical Services, but the lawsuit isn’t regarding their product. It pertains to the way in which they recruit – and allegedly scam – their affiliate marketers. […]

A Need For Evidence Based Medicine

[…] One of my favorite articles in this edition of Grand Rounds comes from Dr. Elaine Schattner, writing about a study that found little rhyme or reason in terms of follow-up surgery rates for breast cancer patients who initially opted for lumpectomies. It appears that a breast cancer patient’s surgical treatment after a lumpectomy is often based more on the surgeon involved than the medical facts of the case. Although evidence-based medicine has gotten a lot of talk lately, the study that Dr. Schattner discusses highlights an example of how difficult it can be for a patient to receive evidence-based care. And we know how hard it is for patients to be truly informed consumers when it comes to healthcare. Even if they’re able to get basic information about pricing, it can be very difficult for a patient to realistically determine a treatment path – which is why most patients rely on their doctors for advice, especially for major illnesses like breast cancer.

Lack Of Public Understanding About Healthcare Reform Law

This article from Public News Service highlights some of the hurdles the ACA faces in terms of public opinion. An attorney with the Colorado Center on Law and Policy notes that more than 50% of consumers think that the healthcare reform law is creating a new government-run health insurance policy. Given the general unpopularity of government-run programs in general, it’s not surprising that the healthcare reform law has struggled in the court of popular opinion. The public tends to be quite wary of new government programs, especially before they’re in place. Once they’re up and running – like Medicare for example -they sometimes get a bit more popular. But proposing a new government program is generally a good way to get people fired up.

If you’ve been paying attention to the mundane details of the ACA, you know that there’s no new government-run health insurance plan. The public option got nixed from the healthcare reform strategy right from the beginning. The law does expand some of our public health programs that already exist (like Medicaid and CHIP). It seeks to insure most of the currently uninsured population via increased enrollment in private health insurance plans and expanded access to public health insurance. The individual mandate and guaranteed issue individual health insurance will hopefully result in far fewer people without health insurance. In addition, the provision that allows young people to remain on their parents’ health insurance through age 26 is helping to cut down on the number of young Americans without health insurance. […]

The Challenge Of Shopping Around For Healthcare

[…] Since most of us don’t have medical training, we might not even know the important questions to ask when we’re shopping around for healthcare. And even if we do, we also have to be able to discern whether the person we’re asking has any conflicts of interest (another excellent article in this week’s HWR from Dr. Roy Poses). Asking patients to have “skin in the game” sounds like a good idea until you really dig into what it means to be a healthcare consumer. Given the difficulty of comparing something as basic as prices for medical procedures – much less things like long-term safety and efficacy – it’s unlikely that patients can really be informed healthcare consumers unless things become a lot more transparent. More “skin in the game” probably just means patients pay more out of pocket for their healthcare (via higher health insurance deductibles and copays), or else put off healthcare until they can better afford it. Some might be shopping around, but it’s unlikely that many people are really able to be well-informed “comparison shoppers” yet – the information they would need just isn’t available.

1,000th Post

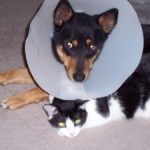

This is our 1000th post. We started this blog in the fall of 2006. At the time, 100 posts seemed like a lot. And here we are at a thousand. We decided that needed something a little different from the fascinating commentary we usually provide, so here’s a picture of our dog, Lukky, and our cat, Larry. They’re best buddies, and on the few occasions that Lukky has had to wear the cone of shame, Larry has always been right there keeping her company. […]

The Subjective Nature Of The Affordability Of Health Insurance

[…] Health insurance is definitely not cheap. For those who qualify for programs like Medicaid and CHP+, the subsidized or free coverage is likely a lifesaver. But what about middle class families who don’t qualify for public health insurance, but for whom health insurance premiums are a budget buster? Why is health insurance more of a priority for one family than for another (to the point that one family will cut their budget in other areas, like clothing and vacations and vehicles, in order to keep paying for their health insurance)? Is it all about personal experience? If you’ve had a medical scare or have a loved one who has had significant medical bills (especially at a young age, or for an out-of-the-blue medical condition), are you more likely to rearrange your priorities to make health insurance affordable, regardless of your income? If you’ve always been healthy, are you more likely to see health insurance as a money-pit and opt to spend your money elsewhere?

We know that the percentage of our income that is being spent on healthcare has climbed significantly over the past decade. For a lot of people, it’s becoming a much more significant monthly expense than it used to be. But whether or not it’s “affordable” really depends on the person being asked.

Would Premiums Without A Mandate Really Only Be 2.4% Higher Than With A Mandate?

[…] Keep in mind that all of those prices are based on the fact that the individual policies are medically underwritten (which means that the rates can be increased during underwriting or the application can be denied based on medical history), while the group plans are guaranteed issue and the rates cannot vary based on the group’s health status. There’s a huge range of options available, both in the individual and small group markets. But the premiums in the small group market for our family of four (parents in their 30s with two young children) would be roughly double what they are in the individual market.

Although I realize that the RAND study is important and useful, I wonder why the real-life scenario of individual versus small group premiums is so different. And although the ACA does put a cap on how much greater premiums can be for older people versus younger people, it doesn’t stipulate what the base premiums have to be for the younger people. Premiums have to follow the MLR rules (with insurers spending at least 80 – 85% of premiums on medical expenses), but they will reflect claims expenses pretty closely. […]

Will The Colorado Health Benefits Exchange Be Integrated With Public Assistance Programs?

[…] Last summer, lawmakers in Colorado were concerned that federal requirements that visitors to the exchanges be screened for eligibility for Medicaid, CHIP and federal health insurance subsidies would increase enrollment in Colorado’s safety-net health insurance programs. Given the budget woes that those programs have had, the lawmakers were hesitant to make the exchange a “one stop shop” for public assistance programs. But much has also been said about the importance of integrating the exchanges with public benefits programs in order to close the gaps that people can fall into if their incomes fluctuate between eligibility for federal health insurance subsidies and eligibility for Medicaid. This proposal calls for the exchange and the public benefits programs to be interoperable as of January 1, 2014 and integrated as of December 15, 2015. For the sake of simplicity and protecting the needs of low-income families, it seems that the more seamless we can make the health insurance enrollment process (particularly for those who go back and forth between Medicaid and private health insurance), the better.

It will be interesting to see how the separate/interoperable/integrated scenarios for the health benefits exchange and Colorado’s public assistance programs play out over the next couple years as the exchange is created and implemented.

Preauthorizations And Legal-eze: Why Health Insurers Have To Use Them

[…] Starting in 2014, health insurance will be guaranteed issue and all of us will be required to have coverage. But until then, individual health insurance is priced based on medical underwriting and (in most cases) slightly less comprehensive benefits than group policies. That’s why it’s less expensive to have an individual policy than a group policy or a guaranteed issue policy like CoverColorado. If health insurance carriers (both individual and group) don’t go over their claims closely and utilize preauthorizations, they run the risk of being defrauded – which will only drive premiums higher than they already are. If they don’t use the specific legal-eze required by state regulations, they will run afoul of the Division of Insurance.

There are plenty of examples of health insurance carriers using unfair or deceptive practices. We’re lucky in Colorado to have a strong Division of Insurance that works hard to protect consumers. Regulations that protect patients and insureds from unfair business practices are largely beneficial (and tend to weed out the shady insurance carriers). But Jaan’s article highlights the fact that health insurance carriers also have to protect themselves. If they don’t, they will end up with premiums that are far higher than the rest of their competition – and that isn’t sustainable.

Too Much Paperwork

[…] I don’t know what the solution is here. On the one hand, we need regulation. We know that without it, there are way too many cracks into which all sorts of things can fall. And regulation is meaningless without having a way to objectively measure compliance and progress. But when we reach the point where doctors feel that they’re spending more of their time doing clerical work (eg, filling out compliance paperwork, documenting everything for their lawyers and for their patients’ health insurance carriers, etc.) than interacting with patients, perhaps it’s time to re-evaluate.

This is especially important as the ACA rolls out over the next few years. One of the goals is to make healthcare more efficient. But if we inadvertently end up bogging down the healthcare professionals in a sea of red tape and bureaucracy, efficiency is likely to decline. Hopefully doctors and nurses and other healthcare professionals – who work in the healthcare field on a daily basis – can be consulted to provide input on how best to measure compliance with well-intentioned regulatory programs.

New T.R. Reid Documentary Highlights Greatness In Our Healthcare System

[…] Overutilization – driven by supply rather than demand – was another common theme in the program. Basically, that the more healthcare supply we have (eg, scanning machines), the more utilization we have. This accounts for a large part of the huge variation in healthcare costs from one city to another. And in all of the hospitals and medical practices featured on the program, curbing over-utilization has been a high priority. One hospital figured out that blood transfusions during surgery aren’t nearly as necessary as they once thought (and indeed, the patients often do better without them). Given that the total cost of blood transfusions is about $1000/pint (!), that’s quite a cost-saving discovery. In another large clinic, pharmaceutical reps were no longer allowed to visit and they also removed the samples of brand name drugs that once filled their drawers. This was a controversial move, but they analyzed a lot of data provided by their local Blue Cross insurance carrier and found that they could optimize pharmaceutical care for a lot less money – patients had better outcomes and the clinic reduced overall Rx spending by $88/million a year compared with the state average.

The Program also showed and example of how patient-centered medical homes work in the real world. PCMHs are a huge buzz word these days, but the PBS documentary shows one in action, and they did a great job of making it easy for patients to visualize how such a program would work and how it would benefit us – including things like much more face time with doctors, and a reduction in the number of hospitalizations and ER visits. In addition to PCMHs, shared decision making between doctors and patients (another buzz word in healthcare reform) was highlighted as having a positive impact on both utilization and patient satisfaction. […]

Health Wonk Review At The Healthcare Economist

[…] One of the most interesting pieces in this edition comes from Avik Roy, writing at Forbes about the historical relationship between political conservatives and individual mandates for health insurance. It’s a long article, but definitely worth reading. The individual mandate is going to be on everyone’s radar this year (if it wasn’t already) once it gets taken up by the Supreme Court. Roy’s piece gives us a bit of perspective on how political viewpoints regarding an individual mandate have changed over the decades.

Doctors, Patients, and The Exercise Discussion

[…] Encouraging people to take responsibility for their health (specifically in terms of what they eat and how much they exercise) could be one of the keys to reducing our out-of-control healthcare spending (and in turn, help to control ever-increasing health insurance premiums). I think that discussions about exercise and nutrition have to become a cornerstone of every preventive care office visit, and hopefully also find a place in visits with specialists. But getting from here to there will take an adjustment of expectations on the part of both patients and their doctors. Kudos to Dr. Schattner for starting the discussion.

Nearly Half Of The Uninsured Believe The ACA Won’t Affect Them

[…] One of the most interesting parts of the interview is the discussion about Americans’ awareness of the ACA details, and their expectation of whether the bill will impact them directly. Karen notes that a poll conducted by the Kaiser Family Foundation last August found that only half of uninsured Americans had a good understanding of the main provisions of the ACA. This is particularly interesting because the 50 million uninsured people in this country were one of the primary groups that the ACA was aiming to help. In addition, 47 percent of the uninsured felt that the ACA wasn’t going to affect them directly. I have to wonder if there is any overlap between the people who are unaware of how the major provisions in the ACA work, and the people who have expressed an opinion – one way or the other – about whether they support or oppose the ACA. Karen also pointed out that a lot of Americans are getting their information about the ACA from sources like talk radio and cable TV programs. The likelihood that this information is biased and/or overly hyped in one direction or the other is quite high. […]

Jon Stewart Interview With Sebelius Focuses Mostly On Health Insurance

[…] I get the point that Stewart and Sebelius were making. They were addressing the aspects of the ACA that most directly impact people, since health insurance tends to be where most of us interact with healthcare costs. And the interview did – very briefly – touch on healthcare costs when Stewart mentioned that one of the reasons wages have stagnated is because “healthcare costs keep going up.” That is a key point, but they seemed to only be addressing it from the standpoint of health insurance premiums continuing to go up. It’s true that the actual check the employer writes each month to cover healthcare is paid in the form of health insurance premiums. But we have to address the root cause here, rather than just trying to figure out how to reign in premiums.

Steward did ask – in his usual joking manner – whether we all need to start exercising and eating better, which also touches briefly on the idea that a healthier nation would have lower healthcare costs. But overall, nearly the entire interview focused on how the ACA will impact health insurance. While that makes for an interesting interview, it also presents the ACA (at least as far as pop culture is concerned) as health insurance reform rather than healthcare reform. While there were definitely aspects of health insurance that needed reform, addressing health insurance as if it’s the crux of the issue is very much putting the cart before the horse.

A Look At Canadian And US “Mini-Med” Health And Dental Insurance

[…] Glenn notes that although most people there have provincial health insurance policies, they often get additional coverage from their employers for things like prescriptions and dental care. And he points out that all too often, people think that they’re “covered” just because they have a health insurance card in their hands – even though the coverage might have very low annual limits. Of course that only becomes a problem when you have a catastrophic claim, which is of course when you need your health insurance the most.

Although the ACA has nixxed lifetime benefit maximums on health insurance policies here in the US, significantly increased annual maximum thresholds, and designated several categories of “essential benefits” that must be covered at specified levels, HHS has granted plenty of waivers for employers who are offering “mini-med” policies to their workers. These policies are far from being a safety net in the event of a catastrophic illness or injury, and often only cover a few thousand dollars in benefits per year. They remind me a lot of the type of policies Glenn is describing. […]

A Visual Of Our Healthcare Spending

[…] This RAND Corporation infographic paints a pretty clear picture of how healthcare costs have increased over the past decade (specifically, the data refers to 1999 – 2009). Healthcare spending nearly doubled in that time frame, from $1.3 trillion to $2.5 trillion, but the second graphic shows how our complicated method of paying for healthcare makes it harder for the average family to see how their own healthcare costs have been impacted. The last graphic in the series shows what the average family could have done with the extra $2880 they would have had in 2009 if healthcare costs had grown during the 2000’s at the same rate they did in the 1990’s (GDP + 1%). Given how cash-strapped a lot of families have been for the past few years, I’m sure an extra three grand could have made a big difference. […]

Anthem Blue Cross Blue Shield’s New Medical Home Program In Colorado

[…] I can obviously see how this structure can result in lower costs, and I particularly like the fact that it will be paying primary care doctors for “non-visit” services that are not currently reimbursed (the example given in the press release is “preparing care plans for patients with multiple and complex conditions” but I can see how this could be extended to other areas of care and could help to move away from the current ten minute visit + diagnosis + prescription scenario that is so common). But particular care will need to be taken to make sure that the end result is truly healthier patients, as well as lower healthcare costs.

A measure of patient satisfaction could also be beneficial here. This is a tough one though, as patients might tend to have less of a focus on the overall picture (outcome + cost) and more focus on the factors that directly and immediately impact them, such as outcome and convenience. Cost is a factor for patients, but since most of us have health insurance, we tend to be largely insulated from the immediate costs of our healthcare. We get the annual rate increase notification or a letter from our employer saying that our deductible and copays are going up, but most patients probably don’t consider how their own healthcare usage directly impacts the overall “big picture” of healthcare spending (and thus the resulting health insurance premium hikes). But in general, a program that results in an overall improvement in patient health and lower costs should also end up with satisfied patients. Things like more face-time with their primary care doctor (who is being compensated for keeping the patient healthy, not just fixing problems once they occur) ought to improve patients’ overall perception of the care they are receiving. […]

Health Wonk Review – Campaign 2012 Edition

All of the  candidates are well qualified and knowledgeable about healthcare, from many different angles. And they all write quite convincingly. Some take polar opposite positions, while others lean more toward the center. I’ll summarize each candidate’s platform, and you can get all the details by clicking on the names. Once you’re finished, cast your vote for your favorite in the comments. Be warned, however – you will have a hard time choosing!

candidates are well qualified and knowledgeable about healthcare, from many different angles. And they all write quite convincingly. Some take polar opposite positions, while others lean more toward the center. I’ll summarize each candidate’s platform, and you can get all the details by clicking on the names. Once you’re finished, cast your vote for your favorite in the comments. Be warned, however – you will have a hard time choosing!

Ladies and gentlemen, here are your candidates for Wonkiest Health Wonk 2012:

Anthony Wright‘s camp is taking issue with Rep. Dave Camp’s position that the ACA is the reason for the decrease in the percentage of employers who offer health insurance benefits and the increase in premiums (both trends that were well established long before the ACA was crafted, and as Anthony points out, most of the provisions of the ACA haven’t been implemented yet). Rep. Camp quoted Wright on his website, and mis-used the words to support his position that the ACA is to blame for the current problems. Anthony is – quite understandably – unimpressed.

Joe Paduda‘s platform is all about taking aim at Mitt Romney’s enjoyment of firing people – and insurance companies. Although it sounds nice (and very “free-market-y”) to say that if you don’t like your health insurance company you can just fire them, that isn’t usually the case. Joe explains how most people have limited options (if any at all) when it comes to their health insurance, particularly if they have any health conditions. Firing ones health insurance carrier isn’t really a possibility for most of the population. Joe’s common sense approach should win over a lot of voters.

if they have any health conditions. Firing ones health insurance carrier isn’t really a possibility for most of the population. Joe’s common sense approach should win over a lot of voters.

Gary Schwitzer‘s campaign is focused on calling out half-truths and shoddy journalism. He cites an example of an ABC News segment that purports to be a journalistic look at a new “lifesaving” technology. But it might just be blatant self-promotion on the part of the doctor being interviewed. And even worse, it might convince countless viewers that they need the same high-tech test (along with several others that are mentioned in the story), despite the far less flashy stories about the comparative effectiveness data that indicate that the tests in question aren’t really useful for low-risk individuals. And that leads to over-utilization of healthcare. Which leads to increased healthcare spending. Which leads to higher health insurance premiums. Which leads to more people […]

Retiree-Only Health Insurance Plans And The ACA

[…] Sandy’s daughter ended up getting an individual health insurance policy for $143/month. But individual health insurance in Colorado is medically underwritten (and will be for almost two more years until the guaranteed-issue provision of the ACA begins in 2014), which means that she had to be relatively healthy in order to qualify for coverage and/or avoid an underwriting rate increase. The benefit of the ACA rule that allows young adults to remain on their parents’ plan is that there is no need for additional underwriting – the coverage is continuous, regardless of any new medical issues that might have arisen since the plan was originally purchased. This can be very useful for young adults with pre-existing conditions who haven’t yet secured a job that provides guaranteed issue group health insurance coverage.

I don’t know what percentage of the population is covered by retiree-only health plans, but it seems that group might be more likely than others to have children who are young adults. I’m sure Sandy and her husband aren’t the only parents to have found out that the ACA doesn’t apply to their retiree-only health plan. […]