Dr. Jaan Sirorov of the Disease Management Care Blog hosts this week’s Cavalcade of Risk, and it’s an excellent edition. Be sure to check out Jaan’s own article in the Cavalcade, discussing the practicality of small (four doctors) primary care practices entering into collaborative savings arrangements with health insurers. I recently wrote about how Cigna… Read more about Cavalcade Of Risk And Shared Savings Programs For Small Physician Groups

Who Pays The Bill If A Patient Checks Out Of The Hospital Against Medical Orders?

[…] None of that is true however. As long as the treatment provided is a covered service on the patient’s health insurance plan, and as long as any required pre-authorization was taken care of, the health insurance carrier does not withhold payment simply because the patient acted against medical orders and checked out of the hospital. This is also true of other forms of non-compliance: for example, patients who don’t fill their prescriptions or those who resume activity too soon after surgery will generally find that their health insurance still covers their bills according to the language of the contract.

If “never events” on the patient end of the scale were cause for claims denials, I have a feeling that there would be a lot more denied claims. Health insurance carriers can and do charge higher premiums for various choices people make (like smoking, for example). But once a policy is in force, and premiums are paid on time – and assuming the application was completed honestly – the coverage is usually not dependent on the patient following doctors orders

A Doctor Who Cooks Brussels Sprouts For A Patient

[…] Dr. Flansbaum’s article is a must-read if you’re interested in the socioeconomic factors that contribute to obesity and “lifestyle” health conditions. Colorado has the distinction of being the least-obese state in the US (although we recently passed the 20% mark in terms of the percentage of adults who are obese). I’m sure this is due in large part to the state’s relatively affluent population, the plethora of outdoor activities available (combined with 300 days of sunshine each year), and the plentiful food choices available. Of course there’s a bit of a chicken-or-the-egg question too… are there plenty of healthful food choices available here because the people who live here demand them, or are there healthy people here because of all the good food options we have?

Cigna And CSHP Collaborating On An Accountable Care Program

[…] The collaboration between Cigna and CSHP will focus on improving patient outcomes, making healthcare more accessible and affordable, and improving patient satisfaction. One of the key components of the Cigna program is registered nurses working at the medical offices who will serve as care coordinators. These care coordinators will follow up with recently hospitalized patients to try to avoid preventable re-hospitalizations (costly and definitely not likely to result in a satisfied patient). They will also work with patients who have chronic illnesses to make sure the patients are filling their prescriptions, receiving needed office visits and screenings, and getting referrals to disease management programs that could help to prevent the conditions from worsening. The hands-on approach that the medical offices will be taking is likely to result in fewer re-hospitalizations and better overall compliance with medical advice.

Hopefully the program will also provide guidance for patients who aren’t filling prescriptions because they cannot afford to do so (for example, a referral to pharmaceutical company programs that provide free medications to people who can’t afford them), and help to address issues like lack of transportation or inability to fit medical office visits into inflexible work schedules. Some people truly just need a reminder to go get a screening test or refill a prescription. Others have more significant obstacles preventing them from doing so. […]

A Possible Alternative To The Individual Mandate

[…] Guaranteed-issue health insurance is expensive. When it’s enacted without a mandate requiring people to buy it, the premiums can become out of reach very quickly. In Colorado, group health insurance (all eligible employees are guaranteed enrollment, regardless of medical history) is significantly more expensive than individual health insurance (medical underwriting applies until 2014 when the guaranteed issue provisions of the ACA kick in). But since employers usually pay at least a chunk of the premiums, people aren’t generally aware of the full cost of group health insurance. In the individual market, that cost will be more transparent (subsidies – also created by the ACA – will be a significant help for a lot of families).

Any way you look at it, the claims expenses will be high once all health insurance is guaranteed issue. I would assume that individual health insurance premiums will start to look more like group premiums as the years go by. The goal of increasing premiums for late enrollees should be three-fold: To make the practice of waiting to purchase health insurance until one is sick seem less attractive; to make sure that there are enough total premium dollars collected to pay for the total claims submitted; and to make things as fair as possible for people who opt to have health insurance all the time, even when they’re perfectly healthy. Those people should not be paying the lion’s share of the total premiums.

I agree with Jason that if this model were used, it should be up to the carriers – with regulatory oversight – to set the premium adjustments rather than having the government set the prices. But I think that if we use this model to try to accomplish all three of those goals I outlined, the premium adjustments for late enrollees would have to be pretty significant.

Colorado Expands Access to Medicaid For Adults With A Lottery System

[…] Unfortunately, the eligibility guidelines will eliminate all but the very lowest income people. In order to qualify, an applicant has to have an income of no more than 10% of the Federal Poverty Level – that amounts to $90 a month for a single person or $125/month for a married couple. As low as those numbers are, officials estimate that there are 50,000 adults in Colorado who would qualify based on those income requirements. And the Medicaid program only has room to enroll 10,000 of them – hence the lottery system.

I have to wonder what percentage of those 50,000 people will submit applications though? Back when the ACA created high risk pool health insurance programs in every state, they predicted that up to 375,000 people might enroll in 2010 alone. But as of early 2012, the high risk pools had actually enrolled about 50,000 people. Obviously cost is an issue – the high risk pools have significant premiums that may be out of reach for a lot of uninsured people, and that shouldn’t be a factor for the Medicaid expansion program. But there’s still the problem of getting information out to the people who might qualify, and getting them to submit applications – especially if they know that submitting an application is no guarantee of coverage, since the program is going to use a lottery to select 10,000 people to enroll.

Even though the income requirements are extremely low and the program only has the means to insure 20% of the eligible population, this is another step that Colorado is taking to try to insure more people. We’re slowing making progress there, due largely to the state’s efforts to expand access to public health insurance programs. We have a long way to go (currently ranked 24th out of 50 states for the percentage of our population that’s uninsured) but small changes like this one are better than no change at all.

Health Insurance And Newborns

Last week, we got a call from a lady who had several questions about maternity and newborn coverage. She lives here in Colorado and has her health insurance with one of the state’s large, reputable carriers. She had called her health insurance carrier to see how maternity coverage works (it’s a group policy) and the person she spoke with told her that her policy wouldn’t cover the baby after it’s born, since the baby isn’t named on the policy as a member.

Huh?

Colorado law requires health insurance carriers to add newborns to a parent’s policy as of the date of birth, with no medical underwriting. This automatic coverage is good for the first 31 days after the baby is born. In order to continue the baby’s coverage after the first month, the carrier has to be notified of the new addition to the policy within the first 31 days after the baby is born. No underwriting is allowed as long as the carrier is notified of the baby’s birth within that time frame. […]

Semantics In The Supreme Court Healthcare Arguments

[…] Although a lot of Americans have a problem with the idea of the government telling them they have to purchase a product like health insurance (and of course, there is concern that such a precedent could pave the way for other mandates that we haven’t thought of yet), the problem of providing unreimbursed healthcare for uninsured patients is a very real issue for providers. And unfortunately, the end result is that hospital overhead is higher (to cover the unreimbursed care) and those higher charges end up being passed on to health insurance carriers. Which means that health insurance premiums increase to cover the higher claims expenses. There is no “free” care. For all but the most wealthy among us, “self-insuring” really just means relying on luck. And luck doesn’t usually hold out forever.

Few Changes For Colorado’s Health Report Card, But Obesity Rises To 22%

Since 2006, the Colorado Health Foundation has been grading the state on a variety of health-related measures reported on the Colorado Health Report Card each year. The 2011 report card was just released this week. The overall rankings haven’t changed much over the past couple years. The 2009 report card looks very similar to the 2011 version. The Healthy Children score rose from a D+ two years ago to a C- now. But the Healthy Aging score slipped from a B+ on the 2009 report card to a B in 2011 (after improving to an A- in 2010). The other three categories were unchanged from their results two years ago. […]

Another Perspective On Healthcare Spending In The US

When the values are graphed, the US appears to be a significant outlier. Our per-capita GDP does put us near the top of the scale, but our per-capita healthcare spending is dramatically higher (to the tune of more than 50% higher) than any of the other countries, even those that have a similar or higher GDP.

Jaan lets out his inner economist in this post, and provides interesting reasoning to explain the US position on the per-capita GDP/healthcare spending graph. His discussion about our wealth inequality may be a key factor. One would otherwise expect Luxembourg and Norway (with per capita GDP higher than or equal to the US) to have healthcare spending that is similar to that of the US. But since our healthcare spending is tallied on the per-person basis, our wealth inequality might make the average spending data appear skewed.

In addition to comparing our healthcare spending to religious tithing (where one is expected to give 10% of ones income to the church), Jaan notes that our willingness to spend more on our healthcare “doesn’t mean that we’re getting our money’s worth…”

Colorado AG Will Have A Seat In Supreme Court Chambers For ACA Arguments

Soon after the ACA was signed into law in 2010, Colorado’s Attorney General John Suthers joined with AGs from around the country (26 states in all) to file a lawsuit challenging the legality of the individual mandate. It was particularly interesting in Colorado because there were only a handful of states where the governor and the AG disagreed about the legality of the individual mandate – Colorado was one of them.

The fight over the constitutionality of the ACA has been winding through the court system for the last two years, and has predictably made its way to the Supreme Court. The Supreme Court will hear oral arguments for and against the ACA next week. The 26 AGs who filed the lawsuit challenging the ACA requested that all of them be allowed to sit in on the arguments, but the Supreme Court granted them six seats instead. John Suthers is one of the six AGs who will be allowed to sit in the Supreme Court chambers next week to hear the ACA arguments.

The Supreme Court schedule for the oral arguments includes 90 minutes on Monday, March 26th to discuss whether to throw out the challenges to the ACA on a technicality. Then on Tuesday, they’re planning a two-hour session where the federal government and the plaintiffs can present their arguments for and against the legality of the individual mandate. Then on Wednesday, the court will be hearing arguments for 90 minutes regarding whether the rest of the ACA could […]

Emergency Room Overcrowding Expected To Worsen In The Coming Decade

[…] The results of these studies are a convincing argument in favor of the model that has been used in Grand Junction, Colorado since the 70’s. Instead of being reimbursed on an individual basis by each patient’s health insurance carrier, doctors in Grand Junction agreed long ago to simply pool the reimbursements from private health insurance, Medicare, and Medicaid. From that pool of money, the doctors are paid equally for every patient they see, regardless of whether that patient has private health insurance or Medicaid. Medicaid reimbursements are lower than those of private health insurance, so it’s understandable that many doctors prefer to see patients with private health insurance. But the system in Grand Junction focuses on what’s best for the community and does away with the financial incentive to see privately insured patients rather than those with Medicaid.

Perhaps implementation of a similar model in other cities could help to improve Medicaid patients’ access to primary care and cut down on ER overcrowding.

Will Healthcare IT Lead To Lower Healthcare Costs?

[…] My guess is that increased HIT will eventually (after the hiccups and bugs are worked out) result in more efficient care, better coordination of care between multiple doctors, fewer medical errors, and more streamlined health insurance claim processing. After reading the articles by McCormick et al and Mostashari, I think it’s clear that there’s some controversy in terms of whether HIT will lead to lower costs. I do think that HIT is coming one way or the other. It’s 2012. Most Americans are walking around with a touch screen mini computer in their pockets. We expect lightening fast internet connections and instant access to virtually any data we can think of. HIT will have to keep up, simply because technology keeps improving and it has to follow suit. But we’d be wise to carefully consider empirical data as much as possible in order to implement systems that have the best chance of success in terms of improving care and also lowering costs.

Colorado AG Files Lawsuit Against Discount And Mini-Med Health Plan

We’ve written several articles over the years about the importance of skepticism when an insurance product just seems too good to be true (ie, no medical underwriting and premiums that are a fraction of the cost of most policies on the market). Often, those policies are actually discount plans or mini-med coverage that won’t provide much of anything in terms of coverage when it’s actually needed.

The Colorado Division of Insurance has a good page with warnings and advice to consumers who are considering medical discount plans. These plans are generally legal, but buyers definitely need to understand what they’re getting into before they sign up – especially if they’re dropping a standard health insurance policy to switch to a discount or mini-med plan.

With shady medical benefits companies, the focus tends to be on consumers getting ripped off. In an interesting twist, the Colorado Attorney General has filed suit against a Highlands Ranch, Colorado LLC, Consolidated Medical Services, but the lawsuit isn’t regarding their product. It pertains to the way in which they recruit – and allegedly scam – their affiliate marketers. […]

A Need For Evidence Based Medicine

[…] One of my favorite articles in this edition of Grand Rounds comes from Dr. Elaine Schattner, writing about a study that found little rhyme or reason in terms of follow-up surgery rates for breast cancer patients who initially opted for lumpectomies. It appears that a breast cancer patient’s surgical treatment after a lumpectomy is often based more on the surgeon involved than the medical facts of the case. Although evidence-based medicine has gotten a lot of talk lately, the study that Dr. Schattner discusses highlights an example of how difficult it can be for a patient to receive evidence-based care. And we know how hard it is for patients to be truly informed consumers when it comes to healthcare. Even if they’re able to get basic information about pricing, it can be very difficult for a patient to realistically determine a treatment path – which is why most patients rely on their doctors for advice, especially for major illnesses like breast cancer.

Lack Of Public Understanding About Healthcare Reform Law

This article from Public News Service highlights some of the hurdles the ACA faces in terms of public opinion. An attorney with the Colorado Center on Law and Policy notes that more than 50% of consumers think that the healthcare reform law is creating a new government-run health insurance policy. Given the general unpopularity of government-run programs in general, it’s not surprising that the healthcare reform law has struggled in the court of popular opinion. The public tends to be quite wary of new government programs, especially before they’re in place. Once they’re up and running – like Medicare for example -they sometimes get a bit more popular. But proposing a new government program is generally a good way to get people fired up.

If you’ve been paying attention to the mundane details of the ACA, you know that there’s no new government-run health insurance plan. The public option got nixed from the healthcare reform strategy right from the beginning. The law does expand some of our public health programs that already exist (like Medicaid and CHIP). It seeks to insure most of the currently uninsured population via increased enrollment in private health insurance plans and expanded access to public health insurance. The individual mandate and guaranteed issue individual health insurance will hopefully result in far fewer people without health insurance. In addition, the provision that allows young people to remain on their parents’ health insurance through age 26 is helping to cut down on the number of young Americans without health insurance. […]

The Challenge Of Shopping Around For Healthcare

[…] Since most of us don’t have medical training, we might not even know the important questions to ask when we’re shopping around for healthcare. And even if we do, we also have to be able to discern whether the person we’re asking has any conflicts of interest (another excellent article in this week’s HWR from Dr. Roy Poses). Asking patients to have “skin in the game” sounds like a good idea until you really dig into what it means to be a healthcare consumer. Given the difficulty of comparing something as basic as prices for medical procedures – much less things like long-term safety and efficacy – it’s unlikely that patients can really be informed healthcare consumers unless things become a lot more transparent. More “skin in the game” probably just means patients pay more out of pocket for their healthcare (via higher health insurance deductibles and copays), or else put off healthcare until they can better afford it. Some might be shopping around, but it’s unlikely that many people are really able to be well-informed “comparison shoppers” yet – the information they would need just isn’t available.

1,000th Post

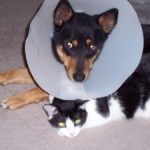

This is our 1000th post. We started this blog in the fall of 2006. At the time, 100 posts seemed like a lot. And here we are at a thousand. We decided that needed something a little different from the fascinating commentary we usually provide, so here’s a picture of our dog, Lukky, and our cat, Larry. They’re best buddies, and on the few occasions that Lukky has had to wear the cone of shame, Larry has always been right there keeping her company. […]

The Subjective Nature Of The Affordability Of Health Insurance

[…] Health insurance is definitely not cheap. For those who qualify for programs like Medicaid and CHP+, the subsidized or free coverage is likely a lifesaver. But what about middle class families who don’t qualify for public health insurance, but for whom health insurance premiums are a budget buster? Why is health insurance more of a priority for one family than for another (to the point that one family will cut their budget in other areas, like clothing and vacations and vehicles, in order to keep paying for their health insurance)? Is it all about personal experience? If you’ve had a medical scare or have a loved one who has had significant medical bills (especially at a young age, or for an out-of-the-blue medical condition), are you more likely to rearrange your priorities to make health insurance affordable, regardless of your income? If you’ve always been healthy, are you more likely to see health insurance as a money-pit and opt to spend your money elsewhere?

We know that the percentage of our income that is being spent on healthcare has climbed significantly over the past decade. For a lot of people, it’s becoming a much more significant monthly expense than it used to be. But whether or not it’s “affordable” really depends on the person being asked.

Would Premiums Without A Mandate Really Only Be 2.4% Higher Than With A Mandate?

[…] Keep in mind that all of those prices are based on the fact that the individual policies are medically underwritten (which means that the rates can be increased during underwriting or the application can be denied based on medical history), while the group plans are guaranteed issue and the rates cannot vary based on the group’s health status. There’s a huge range of options available, both in the individual and small group markets. But the premiums in the small group market for our family of four (parents in their 30s with two young children) would be roughly double what they are in the individual market.

Although I realize that the RAND study is important and useful, I wonder why the real-life scenario of individual versus small group premiums is so different. And although the ACA does put a cap on how much greater premiums can be for older people versus younger people, it doesn’t stipulate what the base premiums have to be for the younger people. Premiums have to follow the MLR rules (with insurers spending at least 80 – 85% of premiums on medical expenses), but they will reflect claims expenses pretty closely. […]

Will The Colorado Health Benefits Exchange Be Integrated With Public Assistance Programs?

[…] Last summer, lawmakers in Colorado were concerned that federal requirements that visitors to the exchanges be screened for eligibility for Medicaid, CHIP and federal health insurance subsidies would increase enrollment in Colorado’s safety-net health insurance programs. Given the budget woes that those programs have had, the lawmakers were hesitant to make the exchange a “one stop shop” for public assistance programs. But much has also been said about the importance of integrating the exchanges with public benefits programs in order to close the gaps that people can fall into if their incomes fluctuate between eligibility for federal health insurance subsidies and eligibility for Medicaid. This proposal calls for the exchange and the public benefits programs to be interoperable as of January 1, 2014 and integrated as of December 15, 2015. For the sake of simplicity and protecting the needs of low-income families, it seems that the more seamless we can make the health insurance enrollment process (particularly for those who go back and forth between Medicaid and private health insurance), the better.

It will be interesting to see how the separate/interoperable/integrated scenarios for the health benefits exchange and Colorado’s public assistance programs play out over the next couple years as the exchange is created and implemented.

Preauthorizations And Legal-eze: Why Health Insurers Have To Use Them

[…] Starting in 2014, health insurance will be guaranteed issue and all of us will be required to have coverage. But until then, individual health insurance is priced based on medical underwriting and (in most cases) slightly less comprehensive benefits than group policies. That’s why it’s less expensive to have an individual policy than a group policy or a guaranteed issue policy like CoverColorado. If health insurance carriers (both individual and group) don’t go over their claims closely and utilize preauthorizations, they run the risk of being defrauded – which will only drive premiums higher than they already are. If they don’t use the specific legal-eze required by state regulations, they will run afoul of the Division of Insurance.

There are plenty of examples of health insurance carriers using unfair or deceptive practices. We’re lucky in Colorado to have a strong Division of Insurance that works hard to protect consumers. Regulations that protect patients and insureds from unfair business practices are largely beneficial (and tend to weed out the shady insurance carriers). But Jaan’s article highlights the fact that health insurance carriers also have to protect themselves. If they don’t, they will end up with premiums that are far higher than the rest of their competition – and that isn’t sustainable.

Too Much Paperwork

[…] I don’t know what the solution is here. On the one hand, we need regulation. We know that without it, there are way too many cracks into which all sorts of things can fall. And regulation is meaningless without having a way to objectively measure compliance and progress. But when we reach the point where doctors feel that they’re spending more of their time doing clerical work (eg, filling out compliance paperwork, documenting everything for their lawyers and for their patients’ health insurance carriers, etc.) than interacting with patients, perhaps it’s time to re-evaluate.

This is especially important as the ACA rolls out over the next few years. One of the goals is to make healthcare more efficient. But if we inadvertently end up bogging down the healthcare professionals in a sea of red tape and bureaucracy, efficiency is likely to decline. Hopefully doctors and nurses and other healthcare professionals – who work in the healthcare field on a daily basis – can be consulted to provide input on how best to measure compliance with well-intentioned regulatory programs.

New T.R. Reid Documentary Highlights Greatness In Our Healthcare System

[…] Overutilization – driven by supply rather than demand – was another common theme in the program. Basically, that the more healthcare supply we have (eg, scanning machines), the more utilization we have. This accounts for a large part of the huge variation in healthcare costs from one city to another. And in all of the hospitals and medical practices featured on the program, curbing over-utilization has been a high priority. One hospital figured out that blood transfusions during surgery aren’t nearly as necessary as they once thought (and indeed, the patients often do better without them). Given that the total cost of blood transfusions is about $1000/pint (!), that’s quite a cost-saving discovery. In another large clinic, pharmaceutical reps were no longer allowed to visit and they also removed the samples of brand name drugs that once filled their drawers. This was a controversial move, but they analyzed a lot of data provided by their local Blue Cross insurance carrier and found that they could optimize pharmaceutical care for a lot less money – patients had better outcomes and the clinic reduced overall Rx spending by $88/million a year compared with the state average.

The Program also showed and example of how patient-centered medical homes work in the real world. PCMHs are a huge buzz word these days, but the PBS documentary shows one in action, and they did a great job of making it easy for patients to visualize how such a program would work and how it would benefit us – including things like much more face time with doctors, and a reduction in the number of hospitalizations and ER visits. In addition to PCMHs, shared decision making between doctors and patients (another buzz word in healthcare reform) was highlighted as having a positive impact on both utilization and patient satisfaction. […]

Health Wonk Review At The Healthcare Economist

[…] One of the most interesting pieces in this edition comes from Avik Roy, writing at Forbes about the historical relationship between political conservatives and individual mandates for health insurance. It’s a long article, but definitely worth reading. The individual mandate is going to be on everyone’s radar this year (if it wasn’t already) once it gets taken up by the Supreme Court. Roy’s piece gives us a bit of perspective on how political viewpoints regarding an individual mandate have changed over the decades.