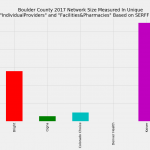

Statewide Results, Scientific Methodology, and links to other Colorado Counties Totals By Carrier for Boulder County Anthem BCBS 497 Bright 560 Cigna 59 Colorado Choice 101 Denver Health 4 Kaiser 1097 RMHP 965 Per Carrier Breakdown Anthem BCBS Anthem BCBS has 454 unique providers in Boulder County. Anthem BCBS has 43 unique facilities in Boulder… Read more about Boulder County Colorado Individual Market Network Size Rating Based on SERFF Data

Bent County Colorado Individual Market Network Size Rating Based on SERFF Data

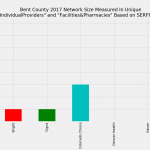

Statewide Results, Scientific Methodology, and links to other Colorado Counties Totals By Carrier for Bent County Anthem BCBS 6 Bright 1 Cigna 1 Colorado Choice 3 Denver Health 0 Kaiser 0 RMHP 8 Per Carrier Breakdown Anthem BCBS Anthem BCBS has 6 unique providers in Bent County. Anthem BCBS has 0 unique facilities in Bent… Read more about Bent County Colorado Individual Market Network Size Rating Based on SERFF Data

Baca County Colorado Individual Market Network Size Rating Based on SERFF Data

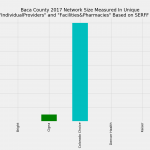

Statewide Results, Scientific Methodology, and links to other Colorado Counties Baca County is the south-easternmost county in Colorado, with an estimated population of 3,500. Most of the residents of Baca County need to travel to Pueblo, Lamar, or Trinidad to receive major care. Many cities in New Mexico, Oklahoma, Texas, and Kansas are closer than… Read more about Baca County Colorado Individual Market Network Size Rating Based on SERFF Data

Archuleta County Colorado Individual Market Network Size Rating Based on SERFF Data

Statewide Results, Scientific Methodology, and links to other Colorado Counties You can see why Pagosa Springs (which is the only incorporated municipality in Archuleta County) is known for having the most expensive premiums in the country. Anthem BCBS is the only insurance company available for sale in the individual health insurance market here, apparently with… Read more about Archuleta County Colorado Individual Market Network Size Rating Based on SERFF Data

Arapahoe County Colorado Individual Market Network Size Rating Based on SERFF Data

Home >> Statewide Network Size and links to all Colorado Counties >> Arapahoe County Totals By Carrier for Arapahoe County Anthem BCBS 947 Bright 2223 Cigna 105 Colorado Choice 431 Denver Health 12 Kaiser 3650 RMHP 1511 Per Carrier Breakdown Anthem BCBS Anthem BCBS has 870 unique providers in Arapahoe County. Anthem BCBS has 77… Read more about Arapahoe County Colorado Individual Market Network Size Rating Based on SERFF Data

Alamosa County Colorado Individual Market Network Size Rating Based on SERFF Data

Statewide Results, Scientific Methodology, and links to other Colorado Counties Colorado Choice (now “Friday Health Plans”) is based in Alamosa, so it’s no surprise to see so many providers in their network here. Bright Health has an impressive 75. RMHP is only sells individual plans in Mesa County. Totals By Carrier for Alamosa County Anthem… Read more about Alamosa County Colorado Individual Market Network Size Rating Based on SERFF Data

Adams County Colorado Individual Market Network Size Rating Based on SERFF Data

Home >> Statewide Network Size and links to all Colorado Counties >> Adams County Totals By Carrier for Adams County Anthem BCBS 569 Bright 510 Cigna 68 Colorado Choice 1425 Denver Health 6 Kaiser 684 RMHP 1760 Per Carrier Breakdown Anthem BCBS Anthem BCBS has 521 unique providers in Adams County. Anthem BCBS has 48… Read more about Adams County Colorado Individual Market Network Size Rating Based on SERFF Data

Colorado Individual Market Network Size Rating Based on SERFF Data

The size of insurers’ provider networks has been a headline grabber for the last few years, and there are some nascent efforts underway to make it easier to compare plans based on network size. Obviously, it’s in consumers’ best interest to search for specific providers if that’s a factor in their decision-making process, but what… Read more about Colorado Individual Market Network Size Rating Based on SERFF Data

Visualizing Kaiser CO 2018 Plan Popularity, Premium, and AV

Have you ever wondered how popular your health plan is, compared with the other available options? Curious about how your plan’s actuarial value (a measure of the percentage of average medical costs it covers) compares with the premium, and how that metric stacks up against other plans? View Full Size PDF Here’s a summary… Read more about Visualizing Kaiser CO 2018 Plan Popularity, Premium, and AV

The latest Health Wonk Review is up!

Trying to keep up with healthcare policy? The Health Wonk Review is hot off the press from our friend David Williams at the Health Business Blog. Enjoy!

Joe Paduda has an excellent Health Wonk Review

It’s a crazy time in healthcare and even the biggest health wonks are struggling to keep up. Get up to speed with the concisely written Health Wonk Review from our friend Joe Paduda. Hot off the press.

Connect for Health Colorado and the OIG Audit Report

On December 27, the U.S. Department of Health and Human Services’ Office of Inspector General (OIG) released an audit report (the full report is here) regarding Connect for Health Colorado’s use of federal start-up funding. This funding was provided for state-run exchanges to get their operations up and running in 2013 and 2014. To make a… Read more about Connect for Health Colorado and the OIG Audit Report

PEAK Issues

As of now, it appears that PEAK has various errors. If you’ve had coverage through PEAK in the past, submitting a financial determination for 2017 also re-determines your 2016 financial eligibility. This can cause major problems with your 1095-A, your billing, and your insurance plan. **NO Confirmed Fix Yet** I will update this page when there… Read more about PEAK Issues

Short and Sweet Health Wonk Review

Jason Shafrin has the latest Health Wonk Review at Healthcare Economist. You’ll find some of the greatest writing by healthcare experts about health insurance, pharmaceuticals, the ACA, mental health, and physician pay.

If you’re facing the subsidy cliff, enroll through Connect for Health Colorado

The Canon City Daily Record published a story this week highlighting how expensive health insurance is in the Colorado mountains, and how few carriers offer coverage in the mountains. Despite the fact that the Division of Insurance combined some rating areas to alleviate the problem ahead of the 2015 open enrollment period, rates for 2016… Read more about If you’re facing the subsidy cliff, enroll through Connect for Health Colorado

Connect for Health Colorado and non-resident brokers

At today’s Connect for Health Colorado board meeting, there was some discussion over the issue of whether or not Colorado’s exchange should work with out-of-state web brokers. Here’s the background on the issue, and I want to clarify my position in case there was any confusion. I’ve been a local broker in Colorado for 14… Read more about Connect for Health Colorado and non-resident brokers

Healthblawg has a great Health Wonk Review

Sit down with David Harlow for the Turkey Edition of the Health Wonk Review. It’s a full helping of educational and though provoking posts.

Assigning an agent/broker with Connect for Health Colorado

redirected

The Coming Storm Over the 340B Rx Drug Discount Program

We’ve invited Healthcare Lighthouse CEO Billy Wynne to share his posts with us. Today’s piece addresses the forthcoming regulation that will likely make sweeping changes to the 340B program. Keep an eye out for additional pieces in the coming weeks and be sure to check the Lighthouse Blog for some of our posts. Beneath the glare… Read more about The Coming Storm Over the 340B Rx Drug Discount Program

Infographic – Affordable Care Act and How Individual Health Insurance is Changing in 2014

A quick overview of how individual health insurance will change in 2014 due to the Affordable Care Act (ACA).

A Little Flurry of Snow in Northern Colorado Today!

Just enough snow came through the Fort Collins area for the kids to plow… and mow. We’re hoping the mountains get a lot for skiers and snowboarders. We put the kids to work in the yard. Plowing…

And mowing…

Here is a video of the front end loader in action plowing the snow off of the porch! It was a gift from a friend and is their favorite toy…

Rocky Mountain Health Plans 2013 Rate Increase Announced

Rocky Mountain Health Plans announces the 2013 new business rate increase for the “SOLO” individual/family health insurance plans in Colorado is 18%. As with all carriers, for existing clients on open plans, rate changes may be different due to age attainment and trend. Carriers may adjust rates differently for closed plans effective January 1, 2013.

RMHP posted the disclosure of the increase for new and renewing business on healthcare.gov.

For clients who pay monthly:

- January renewals were mailed Friday, November 30, 2012.

- February renewals will be mailed the end of December.

- March renewals will be mailed the end of January.

No 2013 Rate Increases for Cigna or Anthem Blue Cross of Colorado

Both Cigna and Anthem Blue Cross of Colorado report no rate increases on new business in Colorado. However, for existing clients on open plans, rates may change due to age attainment and trend. Carriers may adjust rates for closed plans effective January 1, 2013.

Kaiser Permanente 2013 Rate Increase Announced

Kaiser Permanente announces the average 2013 rate increase for individual/family health insurance in Colorado was 11%.

I wish my health insurance _____________?

I understand the trade off we got when we switched to a really inexpensive high deductible plan when even our high deductible HSA qualified plan was too rich and expensive. So I wish my health insurance had a monthly credit card billing option. Our current health insurance company, Anthem Blue Cross of Colorado used to have it, like most health insurance companies did. But then, like most other companies also did, they stopped offering that as an option about a year ago.

What would you change about your health insurance company or plan? It could be the coverage, billing, customer service, anything…