If you enroll through Connect for Health Colorado, there are now three types of financial help you might qualify for, depending on your income and household:

- Federal Premium Tax Credits (APTC) to lower your monthly premium.

- Colorado Premium Assistance (CPA), a new state-funded discount that stacks on top of the federal tax credit for many people.

- Cost-sharing reductions (CSR) that lower your deductible, copays, and out of pocket costs on Silver plans. Colorado has its own enhanced CSR program that makes these Silver plans especially generous.

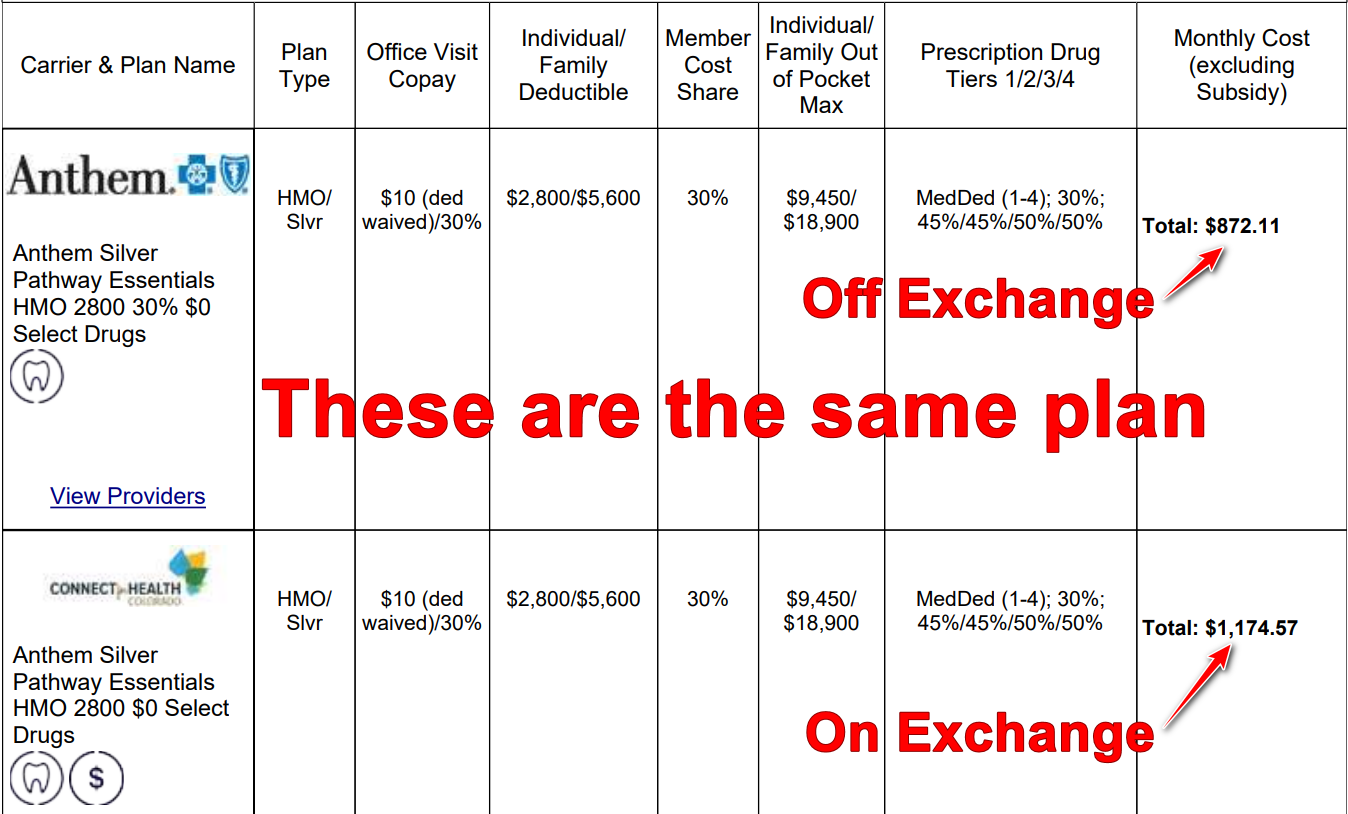

You must enroll through Connect for Health Colorado to get any subsidies. Plans bought “off exchange” are not eligible, even if they are identical plan designs from the same insurance company.

Note: Off exchange simply means not purchased through Connect for Health Colorado.

A quick refresher: Medicaid vs marketplace help

Colorado expanded Medicaid, which means Medicaid covers adults with income up to 138 percent of the Federal Poverty Level, with higher limits for children and pregnant people.

When you apply through Connect for Health Colorado, the system checks for Medicaid and CHP+ eligibility first.

- If you qualify for Medicaid or CHP+, you will not get marketplace subsidies.

- If you do not qualify, the system moves on to federal Premium Tax Credits and Colorado Premium Assistance.

Premium Tax Credits after 2025

From 2021 through 2025, federal law temporarily boosted Premium Tax Credits and removed the old income cap at 400 percent of the Federal Poverty Level. Many people paid no more than 8.5 percent of their income for the benchmark Silver plan, and higher income households could still qualify for help.

That temporary expansion ended on December 31, 2025. Beginning in 2026, we are back to the original ACA rules:

- Federal Premium Tax Credits are generally available for incomes roughly between 100 percent and 400 percent of the Federal Poverty Level.

- The amount you are expected to pay for the second lowest cost Silver plan is again on a sliding scale, roughly 2.1 percent to about 10 percent of your household income in 2026.

- If your income is over 400 percent of the Federal Poverty Level, you do not qualify for federal Premium Tax Credits. This is the return of the “subsidy cliff.”

The tax credit still works the same way:

- You estimate your household MAGI (modified adjusted gross income).

- The marketplace uses that estimate to calculate your advance tax credit.

- You can take the tax credit throughout the year to reduce your monthly cost, or wait and claim it when you file your taxes.

You can also choose to take less than the full amount during the year if your income is uncertain and you want to reduce the chance of owing money back later.

When you file your taxes, you reconcile the amount you used with the amount you qualify for. If your income ends up lower, you may get more credit. If it ends up higher, you may have to repay part of the advance.

How to claim the ACA tax credit

Colorado Premium Assistance (CPA)

Starting with plan year 2026, Colorado adds a new layer of help called Colorado Premium Assistance. This is financial help from the state that applies on top of the federal Premium Tax Credit.

To qualify for CPA, you must:

- Enroll through Connect for Health Colorado

- Be eligible for a federal Premium Tax Credit

- Have income under 400 percent of the Federal Poverty Level

- Still have a remaining premium after the federal tax credit is applied

For eligible households, CPA provides:

- Up to $80 per month for the first household member who has a premium, plus

- Up to $29 per month for each additional household member who has a premium,

- Or the entire remaining premium after the federal tax credit,

- Whichever is smaller.

A few important things to know:

- CPA is not a tax credit. You do not claim it on your taxes and you do not have to repay it if your income changes.

- It is applied automatically. There is no second application.

- If your net premium after APTC is smaller than your CPA amount, Colorado will only apply enough CPA to bring your premium to zero*.

*Actually not zero, the lowest premium you’ll get is $1/month per person. See why premiums only go as low as $1/month per person.

In simple terms:

Federal APTC is an advance on a tax credit that gets settled at tax time. Colorado Premium Assistance is a monthly discount from the state that never has to be paid back.

Cost-sharing reductions and Colorado’s enhanced Silver plans

Cost-sharing reductions (CSR) are available on Silver plans for households with income roughly between 100 percent and 250 percent of the Federal Poverty Level who do not qualify for Medicaid.

These reduce your deductible, your copays, and your out-of-pocket maximum.

Colorado enhances these even more. The state’s program raises the value of CSR Silver plans so that everyone who qualifies gets a plan with about a 94 percent actuarial value, which is richer than a typical Platinum plan.

This often means:

- Very low deductibles

- Lower copays for most services

- A much lower out-of-pocket maximum

If you qualify for CSR and are currently in a Bronze or Gold plan, it is worth looking at the enhanced Silver options, because they dramatically reduce what you pay when you actually use care.

If you do not qualify for CSR, Bronze and Gold plans are often better values than Silver, since Silver plans are priced higher due to “silver loading.”

A few final reminders

- You can only enroll in ACA-compliant plans during Open Enrollment or after a qualifying life event.

- Catastrophic plans are not eligible for subsidies, even when bought through the exchange.

- If your income or household size changes, update your application so your APTC stays accurate.

If you are unsure where your 2026 income will land or are worried about crossing the 400 percent FPL cliff, reach out. We are happy to look at scenarios with you and help you understand how the mix of APTC, Colorado Premium Assistance, and cost-sharing reductions could apply to your situation.