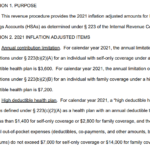

The IRS has released 2021 limits for High Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs). 2021 HSA Contribution Limits: Self-Only: $3,600 (up from $3,550 in 2020) Family: $7,200 (up from $7,100 in 2020) 2021 HDHP Deductible Minimum: Self-Only: $1,400 ($1,400 in 2020) Family: $2,800 ($2,800 in 2020) 2021 HDHP Out-of-Pocket Expense Maximum: Self-Only:… Read more about 2021 HSA Limits

Consumer Directed Health Plans

Getting Past The Health Insurance Plan Cancellation Hysteria

Much has been said recently about how the ACA is causing a tidal wave of policy cancellations, and resulting in people losing coverage that they would prefer to keep. The frustrating part about this – as has generally been the case with every big uproar about the ACA – is that we’re not really getting… Read more about Getting Past The Health Insurance Plan Cancellation Hysteria

Early Renewal Does Not Mean You’re Taking Advantage of a Loophole

A few weeks ago, I wrote a post about our family’s health insurance policy and the changes coming in 2014. To make a long story short, our premiums are going to go up significantly and we don’t qualify for subsidies. We’re not complaining… we know that the ACA makes healthcare more accessible for a lot… Read more about Early Renewal Does Not Mean You’re Taking Advantage of a Loophole

HSA Contribution Limits For 2014

After the PPACA was signed into law, questions started to come up regarding the impact of the law on HDHPs and HSAs. People wondered if HSA-qualified plans would still be available within the confines of being ACA-compliant, and there was plenty of confusion as far as how high deductible plans would fare. Now that we’re just a month away from the opening of the exchanges and four months away from ACA-compliant plans being effective, it’s clear that HDHPs and HSAs will continue to be available in 2014.

They may even become more popular than they currently are, as they will likely attract people who would otherwise buy plans with out-of-pocket limits too high to be HSA-qualified. The out-of-pocket limits on individual plans starting in 2014 will be equal to the out-of-pocket limits on HSA-qualified plans, so there will likely be HSA-qualified plans available in all of the state exchanges. Out-of-pocket limits that exceed that amount – for example, $10,000 individual deductibles – will no longer be allowed on any policies, which will make HSA-qualified plans a popular choice for people who want to keep their premiums as low as possible.

They may even become more popular than they currently are, as they will likely attract people who would otherwise buy plans with out-of-pocket limits too high to be HSA-qualified. The out-of-pocket limits on individual plans starting in 2014 will be equal to the out-of-pocket limits on HSA-qualified plans, so there will likely be HSA-qualified plans available in all of the state exchanges. Out-of-pocket limits that exceed that amount – for example, $10,000 individual deductibles – will no longer be allowed on any policies, which will make HSA-qualified plans a popular choice for people who want to keep their premiums as low as possible.

The IRS has set the HSA contribution limits for 2014:

Individual = $3300 and Family = $6550

These limits reflect a small increase ($50 and $100, respectively) over the 2013 limits.

The IRS kept minimum deductible amounts for HSA-qualified health insurance plans the same ($1250 for individual coverage, and $2500 for family coverage), but the maximum allowable out-of-pocket on HSA-qualified health insurance plans in 2014 will increase slightly, to $6350 for an individual and $12,700 for a family (up $100 and $200 respectively from 2013).

Subsidy Calculations Not As Simple As They Seem

If you’re confused about the subsidies for health insurance starting in the exchanges in 2014, you’re probably not alone. Although the basic math is quite simple in terms of the maximum amount a family or individual will have to pay based on their income if they earn less than 400% of federal poverty level, it’s still tough to pin down specifics in terms of who will end up getting subsidies, especially for people who are right on the border of the income cut-off.

There have been subsidy calculators online for quite some time. The first one we found was from the Kaiser Family Foundation, but numerous others have appeared recently. Connect for Health Colorado, the Colorado exchange, has a calculator on its website, but their calculations aren’t  based on Colorado data yet. On the contrary, the calculator includes language explaining that “The premiums in this calculator reflect national estimates from the Congressional Budget Office for silver plans, adjusted for premium inflation and age rating.” So for the time being anyway, you can’t use the Connect for Health Colorado calculator to generate Colorado-specific subsidy numbers.

based on Colorado data yet. On the contrary, the calculator includes language explaining that “The premiums in this calculator reflect national estimates from the Congressional Budget Office for silver plans, adjusted for premium inflation and age rating.” So for the time being anyway, you can’t use the Connect for Health Colorado calculator to generate Colorado-specific subsidy numbers.

That might change after the Division of Insurance releases official rates at the end of July. Part of the confusion around rates and subsidies stems from the fact that rates are not yet finalized. There’s still a lot of number-crunching (and maybe some “do-overs” from carriers) going on, and July 31 has been set as the date for final numbers to be released in Colorado.

For now, it appears that most subsidy calculators are using generalized national average data, estimated by the CBO. But the numbers turn out differently depending on what calculator you use. Let’s consider a family of four, with an income right around the cut-off for subsidy qualification. We’ll do a calculation based on an income of $94,000 and another using $94,500 (which puts them just above the subsidy qualification limit of 400% of FPL). For two parents (age 37 and 35) and two young children with an annual household income of $94,000, the Kaiser Family Foundation calculator estimates a total subsidy of […]

You Have To Have An HSA Qualified Health Plan In Order To Set Up An HSA

It’s tax season, and that always correlates with an increase in questions about HSAs. We always get several calls at this time of year from people who want to set up just an HSA by itself and are wondering how to go about that, and we’ve even had people call and tell us that their accountant told them to go set up an HSA because it would be an excellent way to get an additional tax deduction.

HSAs (health savings accounts) are indeed a great way to get an above-the-line tax deduction. They’re also a great way to save for future medical expenses and/or retirement. But it’s not as simple as just setting one up and contributing money. You have to have an HSA qualified high deductible health plan in place in order to be able to contribute money to an HSA. Not all high deductible health insurance policies are HSA qualified. The IRS has very specific guidelines in terms of how HSA qualified HDHPs have to be structured, and if a plan meets those guidelines, it will be labeled as such in the marketing materials.

Look at the picture below:

“PPO (0) – HMO (0)” ??? That’s confusing too! PPO and HMO are network types and HSA qualified has nothing to do with networks. HSA qualified plans can be PPO or HMO. In Colorado, all individual health insurance is PPO, except for Kaiser Permanente. They’re the only individual/family HMO.

To give an example, our family had an HSA qualified HDHP for several years, and we contributed to our HSA during those years. But in 2011, we switched to a Core Share plan from Anthem Blue Cross and Blue Shield. It’s less expensive than Anthem’s HSA qualified plans (and less expensive than most of the other plans we looked at as well), and even though it’s a high deductible plan, it doesn’t meet the requirements for being HSA qualified. The maximum allowable out-of-pocket expense limit for a family on an HSA qualified plan is $12,500 in 2013, and our plan has a $15,000 maximum out-of-pocket exposure for a family. So even though the policy has a high deductible, covers preventive care before the deductible, doesn’t have copays, and generally meets all of the other requirements, the higher out-of-pocket limit means that we cannot contribute money to our HSA unless we switch back to an HSA qualified health plan in the future.

That same IRS link also explains how you can switch to an HSA qualified health plan anytime up until […]

The ACAs Looming Premium Hikes are Big – How We Can Lower Them

It’s been almost three years since the ACA was signed into law, and in that time, the implementation process has been both steady and plagued with difficulties. The major provisions of the law have largely adhered to the original scheduled time frames, but there have been numerous hiccups along the way, culminating last summer in a Supreme Court case that challenged the legality of several aspects of the law. Once SCOTUS ruled in favor of the ACA, the path was largely cleared for implementation of the health insurance exchanges (marketplaces) that are scheduled to be open for business this fall with policies effective next January. The individual mandate will also take effect in January, but the penalty for not having health insurance in 2014 will be very small ($95 per uninsured person, or 1% of taxable household income). This has caused some concern that the mandate might not be strong enough to avoid the looming problem of adverse selection: specifically, that people who are in need of healthcare might be much more likely to purchase health insurance than people who are currently healthy once all plans are guaranteed issue.

Last month I wrote an article about how the ACA will largely erase the differences that currently exist between the small group and the individual health insurance markets. Once that happens, it would be odd to expect to not see a corresponding change reflected in the premiums. I think it’s unlikely that the premiums will equalize via a drop in small group premiums (if anything, the requirement that small group plan deductibles not exceed $2000 might mean that the average small group premiums increase too). The individual market is poised to become more like the small group market once the policies become guaranteed issue, and the premiums in the small group market are currently significantly higher than the premiums in the individual market. There will likely be a price decrease for people at the upper end of the age spectrum in the individual market, since their premiums are going to be limited to a maximum of 3 times the premiums for young people. But there is a growing concern that those young people – and probably a lot of people in the middle too – might be in for some sticker shock.

Yes, the subsidies will help cushion the blow for people earning less than 400% of federal poverty level. But that still leaves a lot of people facing higher premiums and no subsidies. People who aren’t poor but definitely aren’t wealthy either – in other words, people who are middle class. Some of them are probably quite healthy. Some of them might have money stashed away in HSAs in order to pay for unexpected medical bills. Some of them might be happy to opt for higher deductibles and “catastrophic” health insurance plans in trade for lower premiums. But the way the ACA is currently written, they won’t be allowed to do that. The “catastrophic” plans will only be available to people under the age of 30 or people who meet the economic hardship qualifications. Everyone else will have to have at least a “bronze” plan that provides a broad range of benefits mandated by the ACA.

Yes, the subsidies will help cushion the blow for people earning less than 400% of federal poverty level. But that still leaves a lot of people facing higher premiums and no subsidies. People who aren’t poor but definitely aren’t wealthy either – in other words, people who are middle class. Some of them are probably quite healthy. Some of them might have money stashed away in HSAs in order to pay for unexpected medical bills. Some of them might be happy to opt for higher deductibles and “catastrophic” health insurance plans in trade for lower premiums. But the way the ACA is currently written, they won’t be allowed to do that. The “catastrophic” plans will only be available to people under the age of 30 or people who meet the economic hardship qualifications. Everyone else will have to have at least a “bronze” plan that provides a broad range of benefits mandated by the ACA.

Please don’t misunderstand me here. I firmly believe that our healthcare system needed […]

Colorado Health Insurance CO-OP Receives Loan From HHS

At the end of July, the first of Colorado’s health insurance CO-OP plans got a $69 million loan from HHS as part of a push by the ACA to develop consumer-owned-and-operated health insurance plans (“CO-OP” is short for Consumer Oriented and Operated Plans). The CO-OP is sponsored by Rocky Mountain Farmers Union and the bulk of the loan from HHS will be put in reserve to fund claims expenses for initial enrollees. As premium dollars are collected, the loan will be paid back to HHS.

Colorado Senator Irene Aguilar introduced a bill last year to create a state-wide Colorado health insurance co-op, but the bill was tabled in May 2011 after passing its second reading in the Senate.

The new CO-OP being created with the loan money will be especially focused on rural areas of Colorado – which are generally underserved in terms of health insurance options. In addition, residents in rural areas are often already familiar with the concept of co-ops for other services like utilities. So a Colorado health insurance plan that is owned and operated by its members should be an especially good fit.

The CO-OP will begin marketing plans next fall with policy effective dates starting January 1, 2014, and is hoping to enroll 10,000 Colorado residents in its first year. Unlike most commercial health insurance plans available in Colorado, the CO-OP will be able to direct profits back into the plan in the form of lower premiums and/or higher quality service rather than sending profits to shareholders. And while most health insurance carriers that do business in Colorado are multi-state organizations, the CO-OP will be a local plan based here in Colorado (Rocky Mountain Health Plans is another example of a local, non-profit health insurance option for people in Colorado).

The CO-OP expects to be available both through the Colorado Health Benefits Exchange (aka “the exchange”) and also via independent health insurance brokers and agents. An innovative new health insurance product – especially one that strives to serve populations that are underserved by our current health insurance industry – is good news for Colorado, as it should foster more competition among the existing health insurance carriers in the market. Congratulations to Rocky Mountain Farmers Union for the approval from HHS for the loan to get the CO-OP going!

How Individual Health Insurance Measures Up

[…] So although it’s true that out-of-pocket costs are higher in the individual market (likely due in large part to people opting for policies that are less expensive), if we combine the premiums and the out-of-pocket costs, the total expenses are lower in the individual market ($8,821 in the individual market versus $15,158 in the group market, using Colorado private sector family premiums for the group data). To ignore cost when comparing the policies is to leave out a large piece of the equation.

The Commonwealth Fund study mentions maternity coverage as an example of a benefit that is often not included on individual policies, thus earning them a “tin” rating. In Colorado, maternity is now included on all policies that have been issued or renewed since January 2011 (the data for the study was collected in 2010). But in many states, maternity coverage in the individual market is rare and/or quite expensive as an optional rider. This will change in 2014, and based on our observations of the Colorado individual market over the past year and a half, I would say that the change will be a positive one. But given the fact that so many individual policies did not include maternity coverage in 2010, I’m curious as to what percentage of individual health insurance plans would have earned at least a “bronze” ranking if maternity had been excluded from the data. If we don’t count maternity, how do individual health insurance plans measure up? Most individual plans (assuming they aren’t mini-meds or some sort of limited benefit coverage) in Colorado in 2010 covered complications of pregnancy and charges incurred by a newborn (eg, a premature baby who is in NICU for weeks). But routine maternity care was included on very few individual plans in Colorado prior to 2011. Given that fact, and the fact that all new individual plans in Colorado now have maternity coverage, I’d be curious to see how individual and group plans compare in 2012.

Overall, I think that The Commonwealth Fund study is a good one. It highlights the out-of-pocket exposure that people have in the individual market, and it’s true that the average plan in the individual market has higher out-of-pocket exposure than the average plan in the group market. But to make the comparison without also looking at the premium costs in each market seems a bit disingenuous. If individual health insurance were two to three times as expensive as it is now, it could cover more costs for members with less cost-sharing. But that doesn’t seem like a good solution either.

New Healthcare Price Comparison Database Coming Soon In Colorado

[…] Happily, it looks like we’re going to be getting a good healthcare price comparison database here in Colorado next year. This article from Kaiser Health News has all the details, and it looks promising. As the article states – and as we’ve noted here many times – healthcare costs sometimes seem to have little rhyme or reason. They can vary widely from one provider to another and from one area to another without much of a difference in quality of care or patient outcomes. But there are also some variables that have a justifiable impact on healthcare cost variation, such as the overhead expenses associated with teaching hospitals and hospitals that treat a higher-than-average number of uninsured patients. It sounds like the All Payor Claims Database is addressing those issues, so it will be interesting to see how the database accounts for them. I also like the fact that providers will be able to see how they compare with other providers before the data is released to the public, in order to allow the providers to start making improvements where necessary.

I can see this comparison tool – especially given how comprehensive it looks to be – being very beneficial for Colorado residents, and also helping to foster more competition among healthcare providers in the state.

Hospital Payment Assistance Program Will Benefit Colorado’s Uninsured Population

[…] SB12-134 will result in some significant changes in terms of how uninsured patients are billed when they receive treatment in a hospital (note that the bill only applies to hospitals – outpatient clinics, medical offices, and other non-hospital providers will not be impacted). Most people are aware that private health insurance carriers have negotiated rates that are lower than the “retail” price for medical services. Medicare and Medicaid have even lower negotiated prices. The reason SB12-134 is so important is that uninsured patients (usually those who have the least ability to pay medical bills) typically get charged the retail price. There is usually a cash discount available, but most uninsured patients typically don’t have enough cash sitting around to pay the whole bill up front. So – assuming they are able to pay the bill at all – they often end up on a payment plan (sometimes through a third party where interest rates can rival those of credit cards) and ultimately pay far more than any insurance carrier would pay.

SB12-134 applies to medically necessary care provided to uninsured patients who have a family income of not more than 250% of the federal poverty level ($57,625 for a family of four in 2012). And SB12-134 applies only if the care is not eligible for coverage through the Colorado Indigent Care Program (CICP). For those patients, hospitals may not charge more than the lowest rate they have negotiated with a private health insurance plan. This is a huge change from the status quo.

SB12-134 also requires hospitals to clearly state their financial assistance, charity care, and payment plan information on their website, in patient waiting areas, directly to patients before they are discharged, and in writing on the patients’ billing statements. Hospitals will also have to allow a patient’s bill to go at least 30 days past due before initiating collections procedures. […]

The Challenge Of Shopping Around For Healthcare

[…] Since most of us don’t have medical training, we might not even know the important questions to ask when we’re shopping around for healthcare. And even if we do, we also have to be able to discern whether the person we’re asking has any conflicts of interest (another excellent article in this week’s HWR from Dr. Roy Poses). Asking patients to have “skin in the game” sounds like a good idea until you really dig into what it means to be a healthcare consumer. Given the difficulty of comparing something as basic as prices for medical procedures – much less things like long-term safety and efficacy – it’s unlikely that patients can really be informed healthcare consumers unless things become a lot more transparent. More “skin in the game” probably just means patients pay more out of pocket for their healthcare (via higher health insurance deductibles and copays), or else put off healthcare until they can better afford it. Some might be shopping around, but it’s unlikely that many people are really able to be well-informed “comparison shoppers” yet – the information they would need just isn’t available.