On Friday, HHS published their proposed benefit and payment parameters for 2017. It’s a good read, if you’re into HHS regulations. They’ll accept comments on the proposals through December 21, and final regulations will likely be published in February or March 2016.

open enrollment schedule for 2017

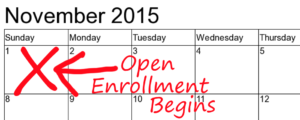

HHS has proposed that open enrollment for 2017 follow the same dates as the current open enrollment for 2016: November 1 through January 31. We like this, and explained last year why we believe it’s best to have open enrollment extend at least through January each year. There will always be some people who let their plans auto-renew, and some of them will be surprised by their January premium amount. Giving them the first month of the new year to change their mind and select a new plan is a good idea, and we’re glad HHS is proposing the same open enrollment period next year. Not to mention the fact that it would be good to get on a regular schedule with open enrollment, rather than having the dates change each year and add to the confusion that already surrounds open enrollment.

maximum out-of-pocket for 2017

HHS has also proposed increasing the 2017 maximum out-of-pocket limit to $7,150 for an individual, and $14,300 for a family (family plans must have embedded individual out-of-pocket limits beginning in 2016). This is calculated based on the premium adjustment percentage, which is a measure of premium growth since 2013, divided by income growth since 2013. Premiums are increasing faster than income, which means the maximum out-of-pocket limits have to keep increasing too. The adjustment method makes sense… higher out-of-pocket limits are a way that plans can curb premium increases; if we kept the maximum out-of-pockets at the same level they were in 2014, premiums would be significantly higher in 2017 than they’ll be with the new limits. But a 13 percent increase in maximum out-of-pocket exposure (an extra $800 for a single individual) from 2014 to 2017 is still a hard pill to swallow. This is likely to continue to be the case until we get healthcare costs under control.

Standardized plan designs

HHS has also proposed standardized plan designs in the federally-facilitated exchange (FFE). State-based exchanges always have the option of aligning themselves with the federally-facilitated exchange on issues like this, so Connect for Health Colorado will have to consider the issue over the next few months. Here’s the language in the proposed HHS regulations (“EHB” refers to essential health benefits, added emphasis is my own):

“To simplify the consumer plan selection process, HHS is proposing to establish “standardized options” in the individual market FFEs. These plans would have standardized cost sharing for a key set of EHB that comprise a large percentage of the total allowable costs for an average enrollee. We propose that issuers would not be required to offer standardized options in 2017 and would retain the flexibility to offer non-standardized plans, but we are considering ways that standardized options, when certified by an FFE, could be displayed on HealthCare.gov in a manner that makes it easier for consumers to find and identify them, including distinguishing them from non-standardized plans. We envision standardized options to include a single provider tier, a fixed in-network deductible, a fixed annual limitation on cost sharing, and standardized copayments and coinsurance for a key set of EHB that comprise a large percentage of the total allowable costs for an average enrollee.“

This sounds reasonable. As long as they retain the provision that standardized plans are optional and that carriers can offer other plans in addition to the standardized plans, we see no reason to oppose this proposal. It remains to be seen whether the standardized plan proposal will be part of the final benefit and payment parameters for 2017, and if so, whether Connect for Health Colorado will choose to align with the FFE on this issue.

It’s worth noting that although the standardized plan options are being proposed to “simplify the consumer plan selection process,” it would only likely do so for healthy enrollees who aren’t taking medications or being treated by specific doctors whom they wish to continue using. For healthy enrollees, the plan selection process is already pretty simple. They tend to gravitate to simple plan designs and relatively low premiums. Provider networks are an issue for some, but others simply opt for the lowest-cost plan and accept whatever provider network it offers – not a big deal if you only see the doctor occasionally for preventive care.

It’s worth noting that although the standardized plan options are being proposed to “simplify the consumer plan selection process,” it would only likely do so for healthy enrollees who aren’t taking medications or being treated by specific doctors whom they wish to continue using. For healthy enrollees, the plan selection process is already pretty simple. They tend to gravitate to simple plan designs and relatively low premiums. Provider networks are an issue for some, but others simply opt for the lowest-cost plan and accept whatever provider network it offers – not a big deal if you only see the doctor occasionally for preventive care.

But when insureds are being treated for ongoing health conditions, picking a plan is never going to be a simple process, even if there are standardized plan designs (honestly, this would be the case even if the only plans available were all standardized plan designs, and it will certainly be the case as long as carriers also have the option to offer non-standardized plans). Product differentiation is a key factor in any competitive industry, and health insurance is no different. Carriers must differentiate their products, and they will always find ways to do so.

The proposed regulations mention a single provider tier, which means the standardized plans wouldn’t have different copays and deductibles depending on what hospital an insured uses. But the provider networks themselves would still differ greatly from one carrier to another.

Presumably prescription drugs would be included in the “key set of EHB that comprise a large percentage of the total allowable costs for an average enrollee.” So it’s possible that standardized plans might have to all have the same prescription copays (or count all prescriptions towards the deductible and then cover them with a standardized coinsurance, as might be the case for Bronze plans). But the drug formularies (covered drug list) would still vary greatly from one carrier to another, as would the tier designations for specific drugs.

While cost-sharing structure is certainly part of the plan-selection process for people with chronic health conditions, it’s by no means the only factor, or even the most important factor for some enrollees. Imagine you’re looking at plans, and you’re taking a specific prescription medication. Let’s say Kaiser has the lowest premium, then Anthem, then Cigna, but your medication is tier 1 with Anthem, tier 2 with Cigna, and tier 4 with Kaiser. Suddenly you have another level of complexity added to your decision-making process.

Now imagine that your doctors are only in-network with Cigna. But Cigna is more expensive than Anthem and your medication will also cost more with Cigna (this is all hypothetical – the actual premiums and the impact of the formularies and provider networks are unique to each applicant).

At this point, you’ve got some decisions to make. How important is it to keep seeing your current doctors? Is it important enough to pay an extra $x each month in premiums? How important is it to stay on your current medication as opposed to switching to another medication within the same class that’s covered on a different carrier’s formulary? These questions are part of the plan selection process, and standardized plans don’t make them any easier to answer as long as we retain our current system of multiple private health insurance carriers that all have their own specific provider networks and drug formularies.

If exchanges switch to having standardized plan designs, it will be essential that they go along with the HHS proposal to also allow for non-standardized plan designs too. Otherwise, the exchanges could end up with a competitive disadvantage when compared with the off-exchange market, where carriers would retain the freedom to offer additional product differentiation. People who qualify for premium subsidies shop on the exchange (or at least they should, since subsidies aren’t available outside the exchange). But people who don’t qualify for premium subsidies can shop on or off the exchange – it’s up to them, since they’ll pay full price either way. In Colorado, there are two fees that fund the exchange. One applies to both on and off-exchange plans, while the other applies only to plans sold through the exchange. Clearly, it’s better for the exchange’s revenue stream if they can get non-subsidy-eligible applicants to enroll through the exchange. Maintaining a robust suite of plan offerings on the exchange is a way to attract enrollees who also have the option to shop off-exchange. Colorado already has more than twice as many plans available off-exchange as on-exchange (including both individual and small group). It would seem that we don’t want to further skew that ratio.

If you’d like to comment on any of the proposed changes HHS has made, you have until December 21 to do so. See page 2 of the proposed benefit and payment parameters for instructions on submitting comments.