HHS Secretary Tom Price was confirmed by the Senate last week, and the agency wasted no time in drafting new proposed regulations under his leadership. The new regulations are intended to stabilize the individual and small group health insurance markets.

The comment period is only three weeks (it closes on March 7, 2017), which is much shorter than the usual 30 – 60 days that HHS allows for public comments. Some have speculated that the Administration simply wants to limit public comments, but there’s also an element of urgency surrounding this whole process. Health insurance rate and plan filing for 2018 starts in April, and continues throughout the spring and early summer, depending on the state. If the intent of the regulations is to stabilize the insurance markets, it’s imperative that final regulations be issued as quickly as possible, so as to give insurers an opportunity to determine whether the stabilizing mechanisms are sufficient to allow them to remain in the market in 2018.

The comment period is only three weeks (it closes on March 7, 2017), which is much shorter than the usual 30 – 60 days that HHS allows for public comments. Some have speculated that the Administration simply wants to limit public comments, but there’s also an element of urgency surrounding this whole process. Health insurance rate and plan filing for 2018 starts in April, and continues throughout the spring and early summer, depending on the state. If the intent of the regulations is to stabilize the insurance markets, it’s imperative that final regulations be issued as quickly as possible, so as to give insurers an opportunity to determine whether the stabilizing mechanisms are sufficient to allow them to remain in the market in 2018.

What do the regulations propose?

1. A shorter open enrollment for 2018.

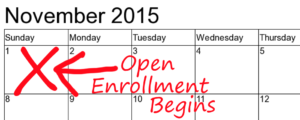

Under current regulations that HHS finalized in early 2016, open enrollment for 2018 was scheduled to follow the same time frame that was used for 2016 and 2017, beginning on November 1 and ending on January 31. For the following year (2019 coverage), HHS had finalized a shorter duration, with open enrollment starting November 1 and ending December 15. Under the new proposal, that shorter open enrollment schedule will take effect this fall, rather than in the fall of 2018. If finalized as proposed, enrollment for 2018 will start on November 1, 2017, and will have to be finalized by December 15, 2018.

That would close a potential loophole that currently exists: If the end of the year is approaching and you know you’re going to need an expensive surgery, you can sign up for a high-cost, robust-coverage gold plan in November or early December, for coverage starting January 1. You can then schedule surgery and follow-up treatment for January and February, and then switch to a low-cost health plan in the second half of January, with an effective date of March 1. This is not the way health insurance is supposed to work, but the current schedule allows this. The proposed schedule will make open enrollment an even busier, crazier time, but it will eliminate that particular loophole.

The proposed regulations note that state-based exchanges might not be able to make the switch to a new enrollment schedule for 2018. Open enrollment is only eight months away, and the infrastructure changes might not be ready in time. So although this proposed modification is likely to happen in states that use HealthCare.gov, it’s less certain in states like Colorado that run their own exchange platforms.

2. Pre-enrollment verification for 100 percent of special enrollment period applications

Verification of eligibility for special enrollment periods (SEPs) has been a contentious issue for the last few years. On one hand, there’s a belief that if exchanges aren’t requiring proof of qualifying events, people might be “gaming” the special enrollment period provisions, and signing up for coverage once they’re sick, without actually having a qualifying event. On the other hand, there’s a concern that if we make it more challenging for people to sign up for health insurance, only sick people will jump through those hoops, and healthy people (who are vital for a stable risk pool) will just skip the enrollment process altogether, leading to a risk pool that’s more heavily skewed towards sick individuals.

Last summer, HealthCare.gov started verifying eligibility for some SEPs, and found that subsequent total enrollment during the “off season” dropped below what it had been in 2015. For 2017 (starting in June) HHS had scheduled a pilot program to verify eligibility before allowing an applicant to enroll, for 50 percent of applicants. The new regulations propose increasing that to 100 percent of applicants.

That would mean that anybody applying through HealthCare.gov outside of open enrollment will have a pended application until they submit proof of their qualifying event. The application will only be fully processed (allowing the coverage to become effective) once the proof is submitted. This will completely eliminate the possibility that people can enroll without actually having a qualifying event, but it might also make healthy people more likely to just skip the process altogether and go uninsured.

Colorado, however, has its own health insurance exchange. And so far, they have chosen to not require proof of qualifying events when people enroll during special enrollment periods (health insurance carriers can request proof, if applicants enroll outside the exchange). Changes to the eligibility verification process through Connect for Health Colorado will be up to the exchange, and changes in the way the process works via HealthCare.gov will not impact people in Colorado. Having more control over these issues is a benefit of having our own state run exchange.

3. It changes the metal level requirements slightly, which could mean smaller subsidies

If finalized as proposed, this rule change could impact people in Colorado, as premium subsidies are a federal program and are applied the same way in every state.

Your premium subsidies are based on the price of the second-lowest-cost silver plan (benchmark plan) in your area, and your own income. The ACA sets a percentage of your income that you’re expected to pay for the benchmark plan, and provides a subsidy to make up the difference between that amount and what the benchmark plan actually costs.

You can buy any metal-level plan you like though; and apply your subsidy to its premium. Subsidies are bigger when benchmark premiums are higher, and lower when benchmark premiums are lower.

Under the ACA’s rules, silver plans have to cover an average of 70 percent of enrollees’ costs (it will vary considerably from one person to another however; a very sick patient who uses a million dollars worth of care will have virtually all of it paid for by insurance, while a healthy patient who only has a couple doctor visits during the year might pay for all or virtually all of her own care). This percentage is called actuarial value (AV). Bronze plans have an AV of 60, and gold plans have an AV of 80. But since it’s tricky to design a plan that covers exactly a certain percentage of enrollees’ average costs, HHS regulations (promulgated shortly after the ACA was enacted) allow insurance companies to have a +/-2 range. That means a silver plan can have an AV between 68 and 72.

Under the regulations HHS proposed today, that range would be widened to +2/-4, allowing silver plans to be in an AV range of 66 to 72.

If a health insurer offers a plan with an AV of 66, premiums will be lower, but out-of-pocket costs will be higher, since the insurance company will be paying a smaller percentage of enrollees’ average costs. If that plan ends up being the benchmark plan in your area, subsidies will be lower, since the premium of the benchmark plan will be lower. So not only will out-of-pocket costs increase for plans with reduced AV, subsidies for everyone in the area would decrease, regardless of which plan they select.

On the upside, however, this change would give insurers a little more flexibility in terms of plan design, and could serve to lower premiums a bit, which is beneficial to people who have to pay full price for their coverage.