This post was originally written in March 2014, but was updated in November 2015 to reflect the changes in the penalty calculation for 2016, and again in November 2016 to address the penalty for 2017. The penalty in 2017 will remain unchanged from 2016, but it’s considerably higher than it was in 2014 or 2015, and tax returns with the penalty assessment for 2016 have not yet been filed.

I’ll start by noting that nobody can say for sure how healthcare reform will evolve under President-elect Trump. I’ve summed up our best guesses here, but there are a lot of moving parts and unknowns at this point. The individual mandate — and its penalty — might get repealed, or it might be adjusted to a new format. It’s not likely to remain in its current form long-term. But for the time being, we have to assume that a penalty will still apply for people who are uninsured in 2017, since doing otherwise might result in people stuck without health insurance and with an unexpected penalty.

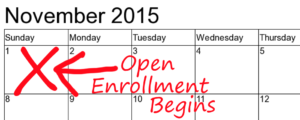

Now that the 2017 open enrollment period is underway, it’s another opportunity for uninsured Americans to get covered by health insurance. If you’re uninsured (or losing your current coverage at the end of 2016) make sure you sign up for new health plan by January 31, 2017. Otherwise, your options will be extremely limited until the 2018 open enrollment begins next fall, unless you have a qualifying life event during the year.

To be clear, you cannot enroll in health insurance either on or off the exchange outside of general open enrollment unless you have a qualifying event (marriage, birth/adoption, loss of other qualified coverage, etc.). The only plans that are available year-round are the plans that generally aren’t recommended as stand-alone coverage: things like critical illness policies, accident supplements, dental/vision plans, and discount plans. Short-term policies are still available year-round, but those are not regulated by the ACA, so they still use medical underwriting, do not cover pre-existing conditions, have caps on benefits, and cannot be renewed. They also don’t count as minimum essential coverage under the ACA, which means that you’re still subject to the individual mandate penalty if you rely on short-term insurance and don’t have an exemption from the penalty.

In short, if you want health insurance for 2017, you’ve got a little over two more months to enroll – and very limited opportunities to do so after that time is up.

How the penalty works

In case you’re planning to just skip health insurance again next year and pay the penalty instead, make sure you’re aware of exactly how the ACA individual mandate penalty works. The penalty increased significantly for 2016, and will continue to remain at that level for 2017. If you were uninsured in 2016, the penalty will take a much bigger chunk out of your IRS refund check when you file your 2016 taxes than it did in previous years.

In case you’re planning to just skip health insurance again next year and pay the penalty instead, make sure you’re aware of exactly how the ACA individual mandate penalty works. The penalty increased significantly for 2016, and will continue to remain at that level for 2017. If you were uninsured in 2016, the penalty will take a much bigger chunk out of your IRS refund check when you file your 2016 taxes than it did in previous years.

For 2017, the penalty will be the same as it was for 2016. There are two penalty options (the IRS assesses whichever one amounts to a larger penalty): A flat rate, or a percentage of your income. The percentage of income penalty is 2.5 percent as of 2016, and will remain unchanged going forward. The flat-rate penalty for 2016 is $695/month for adults (half that amount for children, up to a maximum of $2,085 per family). It’s subject to inflation adjustment starting in 2017, but the IRS has confirmed that there’s no adjustment for 2017. The flat-rate penalty will continue to be $695 per uninsured adult in 2017. If it’s adjusted for 2018, the IRS will publish that info in late 2017.

The penalty is pro-rated for the number of months you’re without coverage (1/12 of the total for each month you don’t have coverage – and “having coverage” means that you’re covered for at least one day of the month in question). You’re allowed one short gap in coverage with no penalty as long as it’s less than three months long.

In addition, the penalty can never exceed the national average cost for a bronze plan. For 2016, the maximum penalty is $2,676 for a single individual, and $13,380 for a family of five or more (details are in Revenue Procedure 2016-43). For 2017, the maximum penalty will likely increase considerably, as premiums are increasing sharply across the nation.

But the maximum penalties don’t apply to many people, as most wealthy households have health insurance (the higher your income, the higher your penalty under the percentage-of-income calculation).

For 2016 and for 2017, your penalty will be determined by the greater of these two calculations:

- $695 per uninsured adult ($347.50 per child), up to a maximum of $2,085 per family OR

- 2.5% of household income above the tax filing threshold, up to national average cost of a bronze plan.

So if you’re a family of four with a relatively low income, your ACA individual mandate penalty for 2016 and 2017 would be $2,085 ($695 + $695 + $347.50 + $347.50). But if that same family has a taxable income of $150,000, the ACA individual mandate penalty would be $3,235 instead:

- $150,000 – $20,600 = $129,400 subject to the penalty (I’ve used the 2015 tax filing threshold – $20,600 – because the 2016 threshold hasn’t been published yet).

- 2.5% of $129,400 is $3,235

- Since $3,235 is larger than $2,085, the percentage of income penalty would apply.

Page 53663 of this Federal Register document has several examples of how the penalty is calculated, based on 2016 numbers.

The IRS reported in January 2016 that the average penalty amount collected on 2014 tax returns was around $210. But the penalty was much higher for 2015 (those returns were filed in early 2016) and even higher still in 2016 (for returns that are filed in early 2017).

And again, this open enrollment period is your only chance to get coverage for 2017. If you change your mind in May and decide you want to be covered after all, it will be too late. And even if you have a qualifying event later in the year, the ACA individual mandate penalty applies — prorated — if you go more than two months without health insurance during the year.

ACA individual mandate penalty calculator

You can use this calculator to see how much your ACA individual mandate penalty would be if you go without coverage next year (you enter adjusted gross income and the calculator accounts for the filing threshold to calculate the correct penalty).

Obviously we don’t recommend going without health insurance — even before there was a penalty involved — simply because it’s impossible to predict if or when you’ll need extensive medical care. But in case you were considering remaining uninsured and just paying the ACA individual mandate penalty, make sure that you know ahead of time what the penalty will actually be. You might find that it makes more sense to purchase health insurance instead, especially if you qualify for subsidies to help pay for it.