Edit: This post was originally written in 2014, but was updated in May 2016.

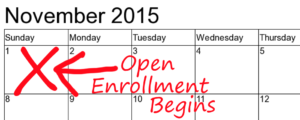

Open enrollment for 2017 will begin on November 1, 2016, and will end on January 31, 2017. If you didn’t get coverage during the open enrollment period for 2016, and you haven’t had a qualifying event that allows you to buy coverage between open enrollment periods, you’ll have another chance to enroll starting in November. Know how to avoid frustration with some of our best open enrollment tips.

The best first step is to find a broker. There’s no charge for a broker’s services, and the premium you pay is the same whether you have assistance or do everything on your own. There are no downsides to using a broker; they’re just an extra resource. You can still call the exchange or the insurance company if there are situations you prefer to handle on your own. There are more than a thousand brokers in Colorado who are certified by Connect for Health Colorado, and are very familiar with the enrollment process and available plan options, both on and off-exchange. You can find a local broker in your area if you prefer to meet in-person and get to know them. You can also find brokers with convenient online tools. Talk to a few brokers to make sure you’re getting the type of service you need. Brokers are aware of the pitfalls and problems that can arise, and will help you navigate around them.

Connect for Health Colorado has been touted as one of the more successful state-run exchanges in the country.

Colorado had the fifth largest drop in uninsured rate following ACA implementation – going from 17% uninsured last year, to 11 percent by mid-2014. The exchange staff have been working closely with carriers, consumers, brokers, and navigators for nearly 3 years now, fine-tuning their process and learning as they go. There is no doubt that open enrollment this year will get out of the gates a lot faster than it did last year – the glitches that held things up in previous years have been addressed.

But if you’re planning to apply for coverage, we have some open enrollment tips to make the process smoother and help you set realistic expectations.

Trying to enroll through @C4HCO & getting an error message? Keep hitting back and trying again. A lot of them resolve after a few minutes.

— Louise Norris (@LouiseNorris) November 15, 2014

Should I purchase through the exchange or directly through the carrier?

One of the questions you’ll have is whether to shop for a policy through the exchange (Connect for Health Colorado) or off-exchange. We can help you with the whole process, regardless of which path you choose. A lot of the same policies are available in both places, but there are some plans that are only available through the exchange, and others that are only available outside the exchange. If you qualify for subsidies, you’ll definitely want to apply through the exchange – that’s the only place the subsidies are available. But people who don’t qualify for subsidies should still consider the exchange, for a couple reasons:

- Even if your income is currently too high to qualify for subsidies, that might not be the case six months into the year. If you lose your job or your income drops, you can notify the exchange and start receiving subsidies, but ONLY if you enrolled through the exchange when you purchased your plan. Losing your job or having a reduction in income are not qualifying events – they don’t allow you to start a new enrollment through the exchange (if your income drops below the Medicaid threshold however, you can enroll in Medicaid year-round). So for people who don’t qualify for a subsidy during open enrollment, applying for coverage through the exchange is a good way to hedge your bets. If you end up having a lower income later in the year, you can inform the exchange of your changed circumstances and start receiving a subsidy at that point.

- If there are no children on your policy and you want to be able to buy a plan without having to purchase pediatric dental, going through the exchange is your best option.

But going through the exchange has its drawbacks too. We’ve found that as long as we set clients up with realistic expectations, things work out well. So here are a few open enrollment tips we’ve learned over the last 11 months:

- Technically, you have to apply by the 15th of the month in order to get a 1st of the following month effective date. But if you qualify for subsidies, we recommend getting your application in earlier than that. We recommend that you aim for the 10th of the month at the latest, if you want your effective date the be the first of the next month. This is because enrollment is a multi-step process if you’re getting subsidies, and it takes a while. You start with PEAK (where they determine whether or not you qualify for Medicaid), and if you don’t qualify for Medicaid, they use the financial data in that system to verify your subsidy eligibility when you enroll in a private plan. But it’s not an instantaneous process – it can take several days (or more, if there are problems) for the PEAK application to be finalized. Your private plan enrollment has to be submitted by the 15th, but the whole process works better if your PEAK application is finished by the time you’re submitting your plan enrollment. If you start before the 10th, everything will hopefully be good to go for an enrollment that’s entirely finished by the 15th of the month.

- Make sure you have all of your ducks in a row before you enroll. Have things like social security numbers, prior coverage info, tax returns or pay stubs, etc. on hand when you begin. Also, try to be certain about the effective date you want. You can change things after the enrollment is complete, but it’s far from simple. In most cases, any changes you make to your policy will result in Connect for Health Colorado sending a cancellation notice to the carrier and then re-enrolling you. It’s not the end of the world, but it can be very frustrating if you’re not expecting it. So the more you can get right the first time around, the better.

- On that note, be prepared for a bit of bumpy road if you do need to make changes once your policy is in force. Adding or removing a dependent, or even adding a social security number, can be a very long process. The exchange uses the aforementioned process of cancelling and then re-enrolling members whenever any sort of change is made to the policy. This is an odd protocol, and it certainly adds a layer of complexity that catches many insureds by surprise.

If the requested change affects your plan or premium, there is a good chance the carrier will receive the effective date of the change as if it happened on 1/1 of the current year. You may need to have Connect for Health work with the carrier to fix the effective date of the change to avoid billing or accrued deductible problems. We really hope they’ll switch to a different procedure as time goes on, but for now, it’s good to be aware that requested changes will likely result in frustration. - If you’re enrolled through the exchange, virtually any change or update needs to be made through the exchange – you can’t just call the carrier and request that they make changes for you. If you’re not able to make the change in your online account, hold times can be long during open enrollment (over an hour in some cases). Try to call earlier in the morning if possible. Patience will stand you in good stead here, and having realistic expectations is key.

If you enrolled this year in a plan with a subsidy, be aware that the benchmark plan in your area might be changing for 2017. Subsidies are based on the second-lowest cost silver plan in each area, but you can apply your subsidy to any “metal” level policy. That means you may be paying more or less than the percentage of income designated under the ACA for the benchmark plan. But although you can let your current plan renew in 2015, you may find that your subsidy amount is different in 2015 because a new plan has moved into the benchmark spot for your area. Premium changes vary considerably from one plan to another, so the plan that was the second lowest-cost silver plan this year may not snag that same spot next year. It’s worth your time to reconsider your options for 2017. A broker can help with that, and there’s never any cost for the services of a broker.