Over the last several weeks, much has been said about the need to tighten up enforcement of the ACA’s special enrollment period eligibility. And CMS has said they will conduct audits this year to ensure that people enrolling through Healthcare.gov for the remainder of this year have a valid qualifying event. There is concern that people enrolling outside of the annual open enrollment period tend to have higher healthcare costs than people who enroll during general open enrollment, and there’s also concern that some of them might be “gaming” the system and finding ways to enroll in coverage after they’re already sick.

These issues are part of the reason some health insurance carriers are making it clear they want to limit sales outside of open enrollment (by cutting broker commissions for plans sold during the remainder of the year). This is understandable – if there’s any chance that people are gaming the system, carriers obviously don’t want any part of that.

But maybe we also need to look at the structure of the system that makes it relatively easy for people to go without health insurance for all or part of the year. A few thoughts come to mind:

- The penalty for going without coverage is too small. If a healthy person can opt to go without health insurance and pay a penalty that’s significantly lower than the cost of health insurance, the risk pools won’t be as robust as they would be if the penalty were essentially similar to what people would pay to have health insurance (keeping in mind that there are already numerous exemptions from the penalty, including – most importantly – an exemption for anyone for whom the least expensive plan available would cost more than 8.13% of household income. This means people in the family glitch and people in places where health insurance is extremely expensive are already given a pass – the penalty only applies if coverage is considered affordable).

- The penalty is somewhat optional for people who don’t receive a tax refund, since the IRS can’t use its normal collection enforcement methods for the ACA penalty.

- There’s no penalty for a gap in health insurance coverage of less than three months.

For now, I want to focus on the third point – the provision that allows people to have a penalty-free gap in coverage as long as it’s less than three months. This exemption from the penalty applies even if there were affordable plans available, and it applies regardless of the reason the person was without coverage.

For now, I want to focus on the third point – the provision that allows people to have a penalty-free gap in coverage as long as it’s less than three months. This exemption from the penalty applies even if there were affordable plans available, and it applies regardless of the reason the person was without coverage.

From the perspective of maintaining the stability of the risk pools, allowing people a gap in coverage is clearly counter-productive. People who are sick and undergoing medical treatment will obviously not opt to go without health insurance for two months. But people who are healthy might very well do so in an effort to save money on premiums.

Take for example, the people who lost coverage in Colorado when Colorado HealthOP shut down at the end of December. There were about 82,000 people who lost coverage, and 64,000 of them had their plans through the exchange. By early January, just 25,000 of them had re-enrolled in other health plans through the exchange. The other 39,000 had not. Of course, some of them may have opted to go outside the exchange, or might have had an opportunity to join an employer-sponsored plan instead. But some of them were undoubtedly waiting until the end of open enrollment (and the special enrollment period that runs until the end of February for people who lost coverage on December 31) to enroll in a new plan.

That would mean being uninsured for January and February. But it also means not having to pay premiums for January and February, which might seem pretty appealing to someone who’s healthy. It’s a gamble for sure, since an emergency could arise during the gap in coverage. But it’s a calculated gamble. And the penalty exemption for a short gap in coverage implicitly suggests that it’s ok to go without coverage for a couple months.

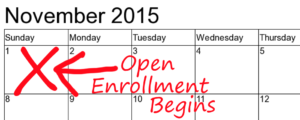

The individual mandate and its associated tax penalty are becoming better-understood by the general public. But so is the fact that people can have a short gap in coverage with no penalty. It’s well within reason to assume that people might start to cut corners on their health insurance premiums by cancelling their coverage towards the end of the year and then re-enrolling during open enrollment.

People who are in the premium grace period at the end of the year must pay all past-due premiums before renewing the same coverage for the coming year, but there’s no rule against cancelling coverage for November and December and signing up again for the coming year. And people who don’t pay their premiums in December are technically in a grace period for the whole month, but if they’re switching to a different carrier for January, they can just skip the December payment altogether, and their coverage will lapse – but they’ll have a new plan in place by that point anyway. The tax form they get from their insurer or exchange will show that they didn’t have coverage in December – but there’s no penalty for that, since it’s less than three months.

The problem with this is that the penalty exemption for a short gap in coverage is a mechanism for adverse selection. People who are sick are going to make sure that they have continuous coverage. But people who are healthy are going to consider their options, crunch the numbers, and think about skipping a month or two of premiums at the beginning or end of the year, or mid-year if they experience a loss of coverage.

And in order to stabilize premiums, we need to make sure that healthy people are in the risk pools, paying premiums for all 12 months of the year. So maybe we should revisit the penalty exemptions, and think about eliminating the exemption for a short gap in coverage?

Of course, that might also involve changing the way effective dates work when people lose coverage outside of open enrollment. The way it’s set up now, you can enroll in a new plan in the 60 days before your plan is ending, and you’ve also got 60 days after the plan ends. People who enroll in the 60 days prior to the loss of coverage will have coverage effective the first of the month following the loss of coverage, which generally means there will be no gap in coverage, since the old plan typically ends on the last day of the month. But people who wait to enroll until the 60 days following the loss of coverage are guaranteed a gap in coverage of at least one month, since there’s no provision to back-date coverage.

For the most part, people know when they’re going to be losing coverage, and can enroll in a new plan prior to the loss of coverage, so that there’s no gap. But it’s conceivable that there could be circumstances where a person isn’t aware that their plan is terminating until it’s actually happened, which is why the special enrollment period continues for 60 days after the loss of coverage. In those scenarios, maybe we need to make a provision to allow people to have their new plan backdated to the day after their old plan ended, to ensure no gap in coverage. And for those who don’t opt for backdated coverage, the penalty for being uninsured would apply if there was no longer an exemption for a short gap in coverage (which might make people less likely to opt for a gap in coverage).

To stabilize health insurance premiums, we have to get as many people as possible into the risk pool. Sick people make sure they get themselves in. But sometimes healthy people need a little extra motivation. The ACA provides carrots in the form of premium subsidies and cost-sharing subsidies. And it also provides a stick, in the form of the penalty and the limited open enrollment windows. But the penalty exemption for a short gap in coverage seems to be inviting people to take a short gap in coverage, tacitly approved by the powers that be.