A recent article published by the Colorado Center on Law and Policy (CCLP) caught my attention on Twitter today. One part of the article stood out, and I wanted to address it here. The article states that

“Anyone who purchases insurance on Connect for Health Colorado would be wise to check eligibility for assistance and, if found eligible for cost-sharing reductions, should always purchase a silver plan.”

I respectfully disagree with this one-size-fits-all advice. It’s true that plans with built-in cost-sharing subsidies offer a tremendous value to consumers, and are often the right choice. But not always. There are very valid reasons for opting to buy a different plan — in most cases a bronze plan — that doesn’t include cost-sharing subsidies.

The 5 cheapest Bronze plans all have $0 premium

I come from the perspective of a family that’s very healthy and always purchases one of the lowest-cost plans available in the individual market. We’ve been doing that since 2002 when we first started having to buy our own health insurance, and we’ve switched plans many times over the years to keep chasing the lowest premium. Since we’re healthy and (knock on wood) don’t use our coverage, we only have it as a just-in-case, since you never know what could happen tomorrow. But because we hope to go many years without using it, we opt for the lowest premiums we can get.

So in our situation, it wouldn’t make sense to pay extra for a silver plan, just to get the cost-sharing subsidies. We have two kids, so running quotes for plans with cost-sharing subsidies gets a bit complicated, since our kids would be eligible for CHP+ if we had an income that made us eligible for cost-sharing subsidies.

So instead, let’s consider a couple with no kids, who are ages 56 and 58. Let’s say their income is $32,000/year, which puts them just under 200 percent of poverty level and in the “sweet spot” for great cost-sharing subsidies. Let’s also assume that these folks actually earn more than $32,000/year, but get their MAGI down to that level thanks to the contributions they make to their IRAs and HSA each year. If they live in 80246 (Denver) there are five plans available through Connect for Health Colorado for 2017 that would have no premium at all — their coverage would be free after the premium subsidy is applied. Those are all bronze plans, including two that are HSA-qualified. Our hypothetical couple wants an HSA-qualified plan, because otherwise they won’t be able to contribute to their HSA in 2017, and their MAGI will end up higher, making them owe more in taxes and eligible for a smaller premium subsidy.

The two cheapest Silver plans

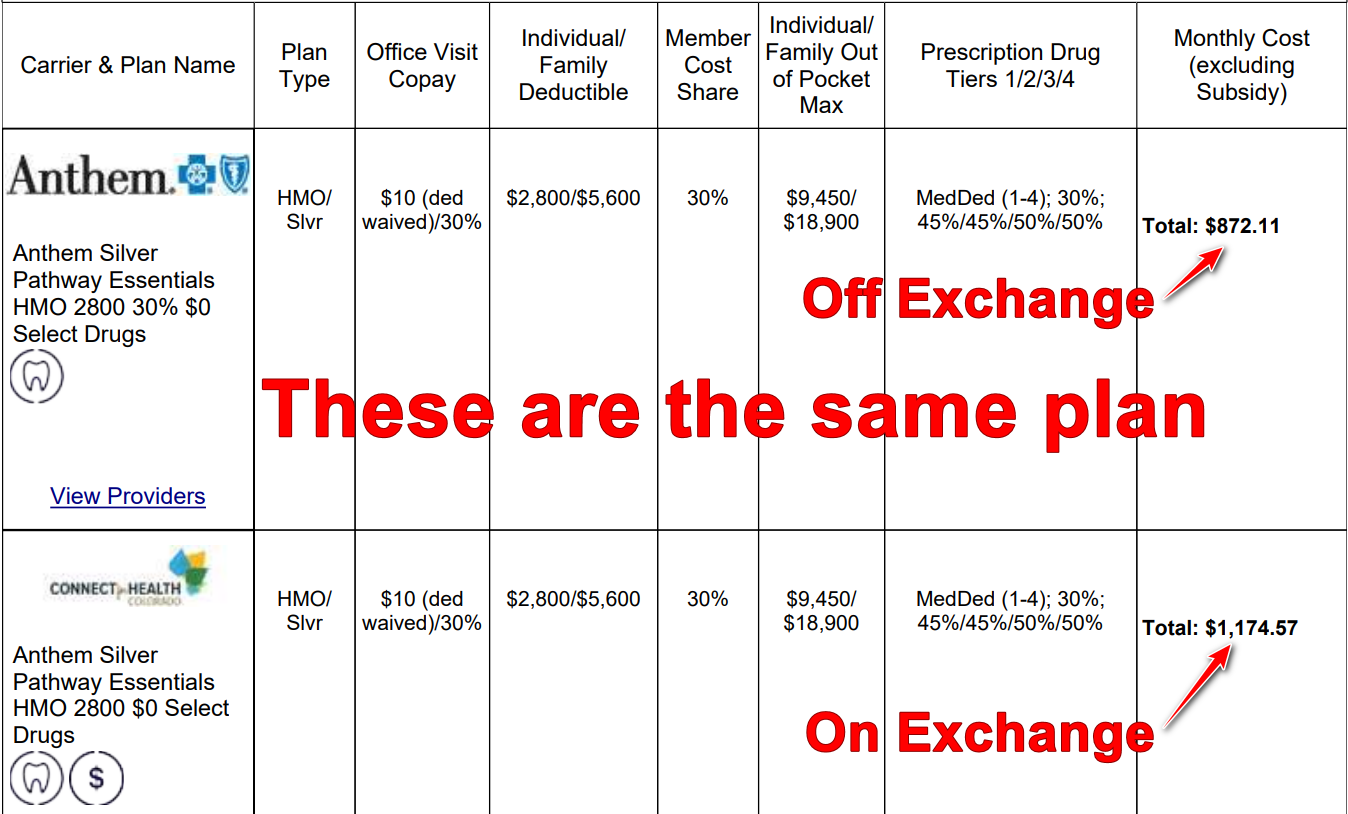

But this couple also has access to silver plans, all of which come with built-in cost-sharing subsidies based on their income. By any measure, these plans are a terrific bargain, since the premium subsidies make them dramatically cheaper than they would otherwise be, and the cost-sharing subsidies make the coverage much more robust. But the cheapest silver plan is $140.33/month for this couple (the price range goes up considerably from there as the next option jumps to $171.91/month, but $140 is the minimum amount they’d have to pay in premiums in order to get the cost-sharing subsidies).

And none of the silver plans with cost-sharing reductions would be HSA-qualified, since the cost-sharing reductions at that income level result in coverage that doesn’t meet the IRS definition of HSA-qualified (the IRS addressed this issue back in 2013; see question 8). As a result, if they picked a silver plan, they wouldn’t be able to contribute to their HSA at all in 2017.

In this scenario, despite the better coverage offered by the silver plans, the couple might decide to go with the bronze, HSA-qualified plan that doesn’t have a premium at all. And their choice would not be unwise, since it’s tailored for their specific situation. They would end up, at a minimum, with an extra $1,683 they didn’t pay to the insurance company in premiums and instead invested into their HSA. Obviously, if they end up needing a significant amount of healthcare during the year, those premium savings might be eaten up in higher out-of-pocket costs. But healthy enrollees often feel comfortable with that trade-off.

There’s no one-size-fits-all answer when it comes to picking the best health insurance plan. The plan that works best for me is not the plan that will work best for you. Some people will be much better served by a higher-cost plan that has more robust coverage, but other people would prefer the lowest premium they can get, and are willing to accept the higher out-of-pocket exposure that comes with that. As long as they make the decision with all the facts in front of them, we shouldn’t expect the choice to be the same for everyone.